Zenyatta Ventures Ltd

* Nothing positive here but thought it should be posted. I'm in the group still holding.

http://seekingalpha.com/article/3531946-zenyatta-ventures-seven-reasons-to-sell

http://seekingalpha.com/analysis/all

Zenyatta Ventures: Seven Reasons To Sell

Summary

An increase in demand for lithium ion batteries is expected to drive growth in demand for high-purity graphite.

Zenyatta Ventures has successfully convinced investors that it has a "unique" graphite deposit in northern Ontario that can be easily purified, and will sell for a substantial premium.

It seems, however, that other producers will be able to make graphite of at least equal purity, at much lower cost.

Because of the high capital and operating costs, it is unlikely that Zenyatta will ever be able to finance and develop its mine.

A surge in graphite prices in 2011 generated a lot of interest amongst junior mining companies, many of which abandoned their search for metals and moved towards exploration of graphite properties around the world.

Graphite is the material of choice for the anode of today's li-ion batteries, and an expected increase in production of lithium ion batteries for electric vehicle is sustaining the drive for exploration and development of graphite properties.

One of the more successful promoters has been Zenyatta Ventures (OTCQX:ZENYF) which managed to convince investors that it had discovered a "unique" hydrothermal graphite deposit in northern Ontario, which could be easily and cheaply processed into a high-purity product that would sell for more than five times the going market price of competing products.

By July of 2013, a series of press releases had generated enough interest to push the share price towards $5/share, an increase of more than 2,000 percent in less than a year. However, some people have questioned the validity of the company's claims and the viability of the Albany graphite deposit.

Zenyatta's share price has now dropped to CAD$1.30, and some investors are still hanging in, sharing a belief in the story that management has spun, and hoping for a return to the good old days when the stock was soaring.

Here are seven reasons why that won't happen, and why Zenyatta's investors should cut their losses and sell.

1. Zenyatta's graphite is not as easy to purify as the company has implied

In April 2013, Zenyatta announced "that all trials using a simple caustic-baking leach process (sodium hydroxide) conclusively demonstrated that an ultra-high-purity graphite product with >99.99% carbon can be produced from the Albany graphite deposit mineralization."

However, after almost two years of laboratory work and process development, culminating in a Preliminary Economic Assessment (PEA) for the Albany graphite project, it appears that the April 2013 statement is not true, and the Albany graphite is not as easy to purify as the company has implied.

The process flow sheet outlined in the PEA for the Albany graphite includes beneficiation by conventional flotation followed by a three-stage chemical purification consisting of two stages of caustic bake and a one-stage acid leach. (Although the company's CEO is on record earlier as stating that no acids are used in the purification process).

The company's graphite appears to be much more difficult to process at the flotation stage when compared to graphite from other sources. There are a number of parameters by which a flotation process can be adjusted to produce a purer concentrate. Among them are a finer grind (which is more costly), extra stages of cleaning, and acceptance of a lower yield.

A look at the parameters outlined in the PEA for Zenyatta's flotation process shows that the graphite has to be ground to a D50 of 25 micron, and goes through a six-step cleaning stage, with a yield of only 84.5%, producing a concentrate of 88.6% carbon.

Compare that with Focus Graphite (OTCQX:FCSMF) which has produced an average 97.8% concentrate without fine grinding and with a 90.9% yield. Or compare with Magnis (OTC:URNXF) which has achieved a 99.2% concentrate with a simple three-stage flotation process. In fact, all of the graphite companies that have so far produced flotation test data have achieved higher-purity concentrates than Zenyatta using less aggressive grinding and achieving higher yields.

It seems therefore, that at the flotation stage, the company's graphite is significantly more difficult to process than most of the world's other potential graphite supplies.

The final stage of Zenyatta's purification process is a standard chemical treatment used in the graphite industry - a caustic bake followed by an acid leach. The acid leach is required because after the caustic leach treatment (where the company initially claimed a 99.99% purity) the graphite purity is only 99.27%. Zenyatta has a marginal advantage over some graphites, which need to be treated with hydrofluoric acid to remove silica whereas the company is able to use a less aggressive and safer hydrochloric acid. But the previous claims of 99.99% purity without use of acids have proven to be false.

The company's final product is a 99.94% graphite powder which could be used in lithium ion batteries after further treatment (spheronization and coating). However, the product is by no means "unique" in the graphite business. Several prospective graphite miners have demonstrated that they can produce a battery grade (>99.95%) graphite, including Syrah (OTCPK:SYAAF), Energizer (OTCQB:ENZR), Northern Graphite (OTCQX:NGPHF), Focus, Kibaran (KNL on the Australian exchange) and others.

The problem for Zenyatta is that all of those companies can make a similar product at much lower cost and with a much lower capital expenditure.

2. ZENYF's operating costs are much too high

In its PEA, ZENYF has estimated operating costs of $2,046 US/tonne for its 25-micron, 99.94%-purity graphite product.

However, sustaining capital is not included in the company's operating cost estimate, and in ZENYF's case, the sustaining capital is exceptionally high - $290 million over the proposed 20-year mine life. When sustaining capital is included, its cost of production will be around $2,500/tonne of product.

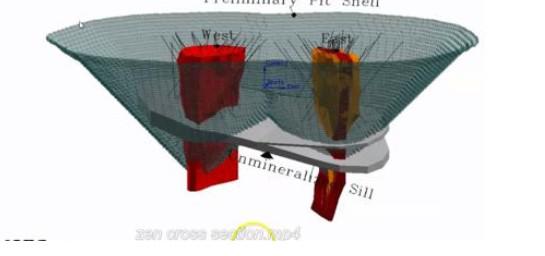

The reason for this high cost is the low head grade and the vast quantity of excavation and rock removal required to continually widen the pit as the mine reaches deeper levels. The picture below, from the company's website, illustrates this problem. Compare the overall size of the excavation with the size of the ore body, and it becomes clear why ZENYF's operating costs are so high.

Comparison with estimated operating costs using data from companies which have completed studies for value added products shows clearly that operating costs of $2,500/tonne to produce a 99.94%-purity graphite are not going to be competitive.

Syrah estimated an operating cost of $3,200/tonne for a spheronized, coated battery grade graphite (not including a credit for sale of waste product from the process). However, that cost included a transfer price of $800/tonne for material purchased from its own Balama mine in Mozambique. Its actual cost of production, using the base cost of the Balama graphite would only be about $2,200/tonne, which includes coating. Making a spheronized, coated product from ZENYF's graphite would likely cost upwards of $4,000/tonne.

Kibaran Resources has completed a study of a graphite upgrading facility which estimates a cost of $1,350/tonne for up to 99.98% product, including a portion of battery grade spheronized (uncoated) material.

It seems therefore that other companies are expecting to produce graphite of 99.95+% purity at a much lower cost than Zenyatta's $2,500/tonne.

3. Zenyatta's CAPEX to develop its mine is much too high

In its PEA, the company has estimated a capital cost of US$411 million to develop the Albany property. On a cost per tonne of annual production basis, that cost is an order of magnitude higher than any of its competitors. Kibaran, for example, has estimated a capital cost of $56 million for a 40,000 tonne per year mine and concentrator, and $35 million for a purification plant for 15,000 tonnes per year of upgraded products, including 6,000 tonnes of battery grade spheronized graphite.

Clearly, ZEN's capital costs are out of line with the rest of the industry.

4. ZENYF's pricing assumptions in the PEA have no factual basis

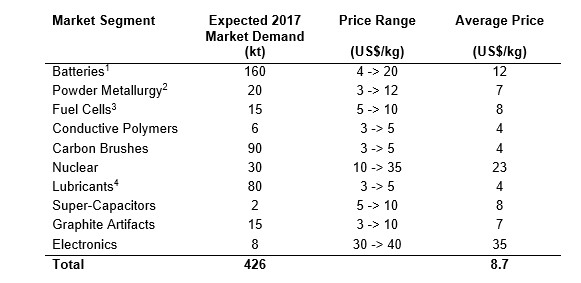

Zenyatta has assumed an average selling price of $7,500/tonne for its Albany graphite product. There is no factual basis for that assumption. Its PEA includes a list of high-purity graphite applications, with a price range for each (see table below).

However, the PEA provides no explanation as to how it has arrived at an average selling price of $7,500/tonne for the company's product. Nor is there any indication as to what specific products are referenced in the quoted price ranges and whether or not the company's 99.94% graphite powder can be sold into the quoted applications, and within the price ranges shown.

In some cases, the price ranges quoted are prices for items which are manufactured from graphite, rather than selling prices of a purified graphite powder. For example, the highly-priced nuclear-grade graphite is sold in the form of blocks which are specially molded to have isotropic properties. Clearly, such pricing cannot be applied to Zenyatta's graphite powder. The company's approach to calculating a selling price is like taking a survey of bread prices in your supermarket, and then using it to calculate the price of flour.

The pricing for battery-grade graphite is perhaps the most obvious example. The low end of the quoted price range ($4,000/tonne) is the selling price of spheronized, uncoated natural graphite, and the high end is the price for a custom manufactured, coated synthetic graphite. Zenyatta's product does not even qualify for the low end of the price range. To be used in batteries, the particle shape has to be modified to round off the edges, typically wasting 30 to 70% of the material - a fact which the company seems to have ignored in developing its selling price assumptions.

Studies by other companies have used much lower prices for a range of value-added, high-purity graphite products. Kibaran has assumed $2,550/tonne for its high-purity, value-added products. Valence Industries (OTC:VLQCF), which is already in production at its Uley mine in South Australia, assumed a selling price of $4,776 in a study of a value-added products facility. Syrah assumed a price of $7,000/tonne for spheronized, coated, battery-grade graphite in its study.

5. There have been no announcements of firm interest from potential buyers

ZENYF has been very active in trying to develop markets for its product, but so far there have been no Letters of Intent, MOUs, or sales agreements of any kind. In fact, although the company is quick to point out that it has been busy sending out samples to dozens of potential buyers, there has been no indication that any potential buyers have made a positive response.

6. If the company were ever to reach production, it would be competing in a market that is oversupplied with high-quality, cheaply produced graphite from Africa

If by some miracle financing were to become available, the company will need at least four years to get its mine into production. There are projects in Tanzania and Mozambique that can supply all of the world's graphite at low cost for the foreseeable future. Those projects have completed their feasibility studies, some are financed and at least one is in the early stages of detailed design and construction.

By 2017, the market will be flooded with cheap, high-quality graphite. Prices will be depressed as new mines compete for market share and there will no room for new entrants.

7. There is no realistic chance of Zenyatta ever financing its project

Funding for mining projects on the TSX has virtually dried up. The graphite companies that have completed feasibility studies for projects in Canada have not been able to raise financing for their projects. It is almost two years since Northern produced a study for its Bissett Creek project, which had an estimated capital cost of only CAD$102 million (US$78 million). Northern has been unable to raise funds for that project. Similarly Focus has reached an impasse in its project development due to lack of financing.

There is no realistic chance of Zenyatta being able to find a lender to provide debt financing to the project. Banks will not lend to industrial minerals projects with dubious economics. To finance the project, the company would have to raise about CAD$600 million to cover the cost of feasibility studies, construction, working capital and company overhead. With a market cap of only $75 million, ZENYF would have to dilute existing shareholders by a factor of 8.

The CAD$2 million raised last August will keep the company alive, and pay management salaries for about a year, with no money left over to advance the project by way of a feasibility study. Clearly, there is no realistic possibility of the company moving forward with the project. The management knows this, which is why it is focused on supporting the share price by announcements of increasingly obscure test work and government funded research rather than by advancing the project.

It is time for the management to come clean with investors, and admit that the Albany project is dead, the $20 million spent so far has been wasted, and the shares are worthless.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Become a contributor »