AUH2O's Profile

AUH2O's Posts

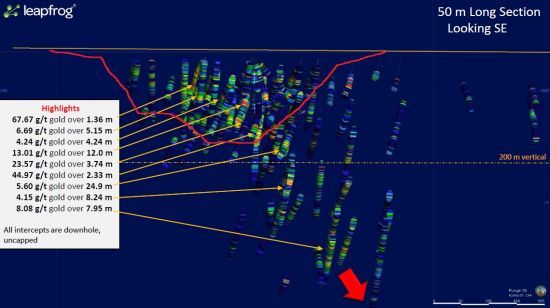

VANCOUVER, BC--(Marketwired - January 23, 2017) - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSX: BAR)(OTCQX: BALMF) today reported that the Bug South gold deposit on its Martiniere Property in Quebec continues to return broad intersection of high grade gold mineralization and show good continuity between sections. Results were released from seven holes testing Bug South completed during the fall program and were highlighted by:

41.95m grading 3.24 g/t gold, including 11.58m grading 6.30 g/t gold from the Upper Bug Zone -- hole MDE-16-246B

13.93m grading 4.07 g/t gold from the Upper Bug Zone -- hole MDE-16-250

10.13m grading 7.34 g/t gold, including 5.34m grading 13.54 g/t gold from the Hanging Wall Zone -- hole MDE-16-247

13.79m grading 2.80 g/t gold, including 2.22m grading 16.33 g/t gold from the 221 Zone -- hole MDE-16-247

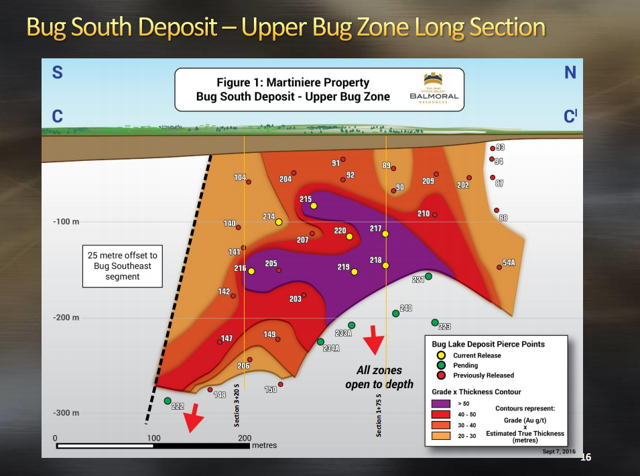

The Upper Bug Zone of the Bug South deposit continues to exhibit excellent continuity ranging in down-hole thickness in the holes released today from 5.83 to 88.36 metres. The Upper Bug Zone continues to exhibit a well-defined, south-southeast plunging area of enhanced thickness and grade. Updated cross-sections for the Bug South deposit featuring the results of the holes released today are available at http://www.balmoralresources.com. Strong gold values also continue to be intersected throughout the deposit area in the Hanging Wall Porphyry ("HWP"), Hanging Wall and recently discovered 221 Zones.

Hole Northing Easting Dip From To Interval* Gold Zone

Number (Degrees) (Metres) (Metres) (Metres) (g/t)

MDE-16-244 2+20S 1+40W -51 98.08 102.64 4.56 0.34 HWP

206.04 226.83 20.79 2.16 Hanging Wall

including 206.04 211.51 5.47 5.63 "

which includes 210.32 211.51 1.19 16.65 "

297.92 303.75 5.83 1.27 Upper Bug

including 299.17 300.50 1.33 3.53 "

346.47 354.18 7.71 0.68 Lower Bug

MDE-16-245 1+75S 2+40W -48 52.64 62.33 9.69 0.18 Zn-Pb Zone

88.05 176.41 88.36 1.07 Upper Bug

including 127.83 128.38 0.55 6.70 "

and 156.64 164.41 7.77 2.99 "

210.90 220.68 9.78 1.20 Lower Bug

including 213.31 214.12 0.81 6.06 "

MDE-16-246B 2+55S 1+20W -51 256.05 334.35 78.30 1.94 Upper Bug

includes 281.68 282.35 0.67 6.41 "

and 292.40 334.35 41.95 3.24 "

which includes 313.07 324.65 11.58 6.30 "

which includes 316.50 317.08 0.58 19.40 "

and 318.95 319.69 0.74 11.60

and 323.57 324.65 1.08 33.91

and 331.58 332.43 0.85 62.30

345.42 348.95 3.53 4.37 Lower Bug

including 347.59 348.26 0.67 18.05 "

MDE-16-247 1+75S 1+35W -51 137.28 151.07 13.79 2.80 221 Zone

including 144.74 146.96 2.22 16.33 "

190.83 200.96 10.13 7.34 Hanging Wall

including 192.71 198.05 5.34 13.54 "

which includes 192.71 194.00 1.29 47.50 "

311.87 338.00 26.13 0.64 Upper Bug

including 337.00 338.00 1.00 4.66 "

MDE-16-248 1+20S 2+40W -51 103.96 150.19 46.23 0.98 Upper Bug

including 122.75 143.37 20.62 1.88 "

which includes 122.75 124.20 1.45 5.39 "

and 129.48 130.80 1.32 7.77 "

161.31 172.79 11.48 0.37 Upper Bug

198.50 206.02 7.52 0.48 Lower Bug

MDE-16-249 1+25S 1+95W -51 230.60 244.98 14.38 0.72 Upper Bug

MDE-16-250 2+65S 2+20W -51 114.21 132.96 18.75 0.95 HWP

including 122.28 123.76 1.48 9.73 "

172.27 201.20 28.93 2.15 Upper Bug

including 174.14 188.07 13.93 4.07 "

which includes 177.44 184.69 7.25 5.40 Upper Bug

which includes 183.95 184.69 0.74 14.40 "

* Reported drill intercepts are not true widths. At this time there is insufficient data with respect to the shape of the mineralization to calculate true orientations in space although they are estimated to range between approximately 70 and 77% of true thickness. All values presented uncapped.

The Company also intersected a new zone of zinc-lead-silver-gold veining at shallow depth in hole MDE-16-245. The 5.36 metre wide interval between 54.79 and 60.15 metres down-hole returned an average grade of 2.80% zinc, 2.67% lead, 99.11 g/t silver and 0.19 g/t gold. This is the first time that mineralization of this nature (Zn-Pb-Ag-Au) has been intersected on the Martiniere Property, although high-grade silver mineralization is known from the Martiniere East area. This new discovery appears to cross-cut the local stratigraphy. Its origin and relationship to the Bug Lake gold deposits and/or the VMS system in the Martiniere East area is currently unknown.

Additional results from the fall drill program on the Martiniere Property and on Balmoral's Detour East Property remain pending. Work on the winter road into the Martiniere camp continues and, weather conditions permitting, drilling is expected to commence on the property in early February.

Balmoral will have drill core from the Bug South gold deposit on display in the core shack, booth 820, at the 2017 Mineral Exploration Round-Up in Vancouver, B.C. on January 23rd and 24th, and at the Prospectors and Developers Association convention in Toronto, Ontario on March 5 and 6.

Quality Control

Mr. Darin Wagner (P.Geo.), President and CEO of the Company, is the non-independent qualified person for the technical disclosure contained in this news release. Mr. Wagner has supervised the Quebec based work programs on the Martiniere Property since inception, visited the property on multiple occasions, examined the drill core from the holes summarized in this release, discussed, reviewed the results with senior on-site geological staff and reviewed the available analytical and quality control results.

Balmoral has implemented a quality control program for all of its drill programs, to ensure best practice in the sampling and analysis of the drill core, which includes the insertion of blind blanks, duplicates and certified standards into sample stream. NQ sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization and alteration. The remaining half of the core is stored on-site at the Company's Martiniere field camp in Central Quebec. Drill core samples are transported in sealed bags to ALS Minerals' Val d'Or, Quebec analytical facilities. Gold analyses are obtained via industry standard fire assay with atomic absorption finish using 30 g aliquots. For samples returning greater than 5.00 g/t gold follow-up fire assay analysis with a gravimetric finish is completed. The Company has also requested that any samples returning greater than 10.00 g/t gold undergo screen metallic fire assay. Following receipt of assays, visual analysis of mineralized intercepts is conducted and additional analysis may be requested. ALS Minerals is ISO 9001:2008 certified and the Val d'Or facilities are ISO 17025 certified for gold analysis.

Balmoral Resources: Flagship Asset Martiniere Definitely Looks Like It's Heading In The Right Direction

Summary

Balmoral Resources is advancing two interesting discoveries, the Martiniere gold project and the Grasset nickel/copper/PGE deposit.

Grasset is one of very few nickel deposits available in safe jurisdictions, decent grade but small.

Martiniere is the flagship project, and continuing high grade drill results seem to define a collection of several interesting mineralized envelopes, all starting near surface.

The company was too optimistic in the recent past about timelines of the maiden resource estimate, but I believe Q3 2017 to be my own realistic estimate this time around.

Martiniere could very well top 2M ounces of high grade gold, partly open pittable which could generate very interesting economics, making it a premier exploration play in the Abitibi.

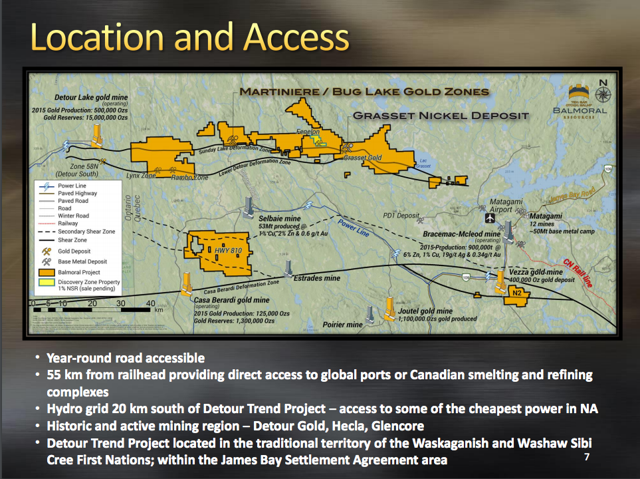

Martiniere location

This article was first published on www.criticalinvestor.eu, a comprehensive platform with a free newsletter service for junior mining investors

1. Introduction

After exploring and advancing the Martiniere gold project and the Grasset project for 5 years now, one could think Balmoral Resources (OTCQX:BALMF) still has a bit of an image issue, at least in my view. The Grasset maiden resource estimate in March this year disappointed the markets for size, and the Martiniere maiden resource estimate was expected in Q1 of 2016 as well. However, this last one still didn't materialize, and management didn't bother to timely explain to investors why it got delayed substantially, raising doubts because of this. Fortunately, this didn't prove to be decisive for the stock for this year, the excellent drill results kept piling in, and gold, nickel, copper and many other commodity prices surged to unexpected highs in 2016, bringing Balmoral's share price up to new highs since the beginning of 2015.

After gold started to come down since the summer of this year, the Balmoral share price has come down with it too. I have watched it for many years since the first high grade results came out at Martiniere, sometimes owned it, and I am curious to see if Balmoral could be interesting again as an investment, as gold seems to be near a bottom, the Grasset deposit could grow further and Martiniere does seem to be on a clear path to be derisked into a maiden resource estimate at last.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Balmoral Resources is a Canadian exploration and development company focused on creating shareholder value through the discovery, aggressive exploration and development of high-grade gold and base metal assets in the major mining districts of Canada and in particular the province of Quebec. The company follows a time tested and proven model of aggressive, drill focused exploration driven by the latest geophysical techniques, geochemical methods and geological models. Balmoral's activities along the Sunday Lake-Detour Trend in central Quebec have led to the identification of two developing assets. The high-grade Martiniere gold system and to a lesser extent the H3 (Grasset) nickel-copper-PGE discovery are the current focus of the Company's activities.

The company is headed by President and CEO Darin Wagner. Wagner is a geologist by profession and has plenty of experience after working for Noranda, Cominco and Platinum Group Metals, before taking up the CEO role of West Timmins Mining which was later sold for $424M. He and the Balmoral exploration team won awards for both the Martiniere and Grasset discoveries, and he was awarded for the Seagull discovery when he was with Platinum Group Metals before this. Wagner is among other things also a co-founder of Falco Resources (FPC.V). Needless to say he is very experienced both on the ground and in the board room. Another skilled representative of Balmoral is John Foulkes, who is both a successful geologist (leading the teams that discovered the Jericho and Gahcho Kué diamond mines) and VP Corporate Development/IR at companies like West Timmins Mining, MAG Silver, Candente Copper and Platinum Group Metals.

Notable names in the Board of Directors are Daniel McInnis, retired President and CEO of MAG Silver, who as a former geologist is a lead director for exploration programs at Balmoral, and Graeme Currie, former Director Investment Banking at Canaccord who is invaluable when arranging financings.

Balmoral Resources has its main listing on the main board of the Toronto Stock Exchange, where it's trading with BAR.TO as its ticker symbol. With an average volume of in excess of 150,000 shares per day, the company's trading pattern is quite liquid, which makes it easier for investors to get in or out, and reduces the aggressive volatile share price moves you sometimes see with less liquid companies.

Balmoral currently has 125.5M shares outstanding (fully diluted 134.0M, no warrants and several option series, ranging from C$0.60 to C$0.90 expiring from January 2019 to March 21, and one priced at C$1.05 expiring at February 2018), which gives it a market capitalization of C$94.13M based on yesterday's share price of C$0.75. At the end of the third quarter, Balmoral had a working capital position of just over C$10M, and in excess of C$11M in cash in the treasury, making the company well-capitalized.

Share price; 1 year time frame

After seeing its share price triple since the start of this year, Balmoral Resources (BAR.TO) lost approximately 50% of its market cap again since the summer. The recent weakness in its share price was very likely caused by the weak gold markets, although the market seems to be conveniently ignoring the Grasset nickel project which has become more appealing after the recent momentum on the nickel markets, but still is likely not economic as I will explain later on. The downfall in the share price was probably accelerated by the tax loss selling season, which has ended now, so with gold riding on a bit of positive sentiment again, the sub C$0.65 levels might prove to be a bottom for the Balmoral share price.

3. The projects

Balmoral Resources has an extensive portfolio of exploration projects, but the two most advanced projects are clearly the Martiniere Gold project and the Grasset Ni-Cu-Co-PGE project, so I will focus on these two.

A. Martiniere

Balmoral's Martiniere Gold project is the company's flagship asset which currently enjoys the most focus and attention. The land package consists of almost 62 square kilometer approximately 100 kilometers towards the west from Matagami , which has the nearest airport and railway connection. Infrastructure isn't that far away, but additional investments are warranted, as cheap hydroelectric power is located 20km to the south, and at least about 35-40km of new road starting from the Selbaie Mine needs to be constructed to access the projects for construction and trucking concentrates to refineries/smelters in the region. When it would be more efficient to truck concentrate directly to the Railroad at Matagami, about 60-70km of new road needs to be constructed. To give an indication: a very global indication based on other projects in often more mountainous terrain would be $12.5M for connecting to the power grid (including substation) and $0.5M per km year round road, assuming use of waste rock from pre-stripping eventual open pits/starter pits (more on this later), resulting in a $20-35M estimate.

Grasset Nickel Deposit location, claims Balmoral Resources

The property has been an area of interest for more than 50 years as the previous operators of the project were looking for orogenic gold and VMS deposits. No gold has been found during the first 40 years of exploration activities at Martiniere, as the thick layer of overburden prevented any outcrop from being found through old fashioned reconnaissance (early stage exploration) programs like sampling, trenching etc.

Balmoral acquired the property in 2010, and this actually was just the first time Martiniere was properly explored, as Balmoral immediately drilled several hundred holes for a total of over 70,000 meters of drilling in the first four years. This was followed by another drill program in 2015, and a significant exploration program in 2016, with about 30,000 meters of drilling completed in 2016.

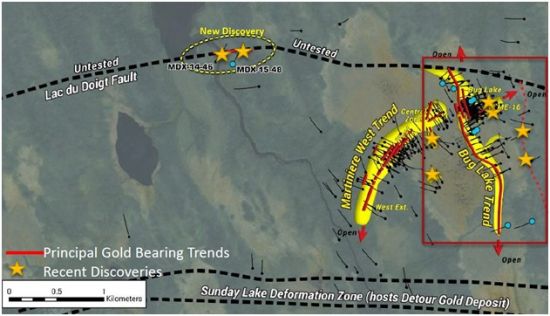

Martiniere project

As mentioned, there is still, despite earlier provided timelines indicating Q1 2016, no existing resource estimate on the Martiniere property, which generated a lot of raised eyebrows on for example size or continuity. However, based on the ongoing drill results, Martiniere might progress slower than anticipated, but it probably has a good reason for it as Martiniere appears to be more and more a complex assembly of separate mineralized subzones instead of one big mineralized envelope, which just take longer to delineate properly. On top of this, considering the probable additional capex for infrastructure as mentioned, management likely made some back of the envelope calculations themselves and probably concluded it needed more ounces first to at least indicate an economic deposit towards investors. However, this is pure speculation on my behalf. In my view the company would be following the right track by establishing this carefully, the only thing is it could have been more forthcoming with information on why they would be missing their timelines by that much.

By talking to management it seemed they were aware of this, so hopefully this could be something of the past. Nonetheless I will monitor their timelines carefully from now on, as I like management to be structurally transparent overall whenever possible, and so should you as an investor. Besides this, I got the impression that with the additional drilling in the 2015 and 2016 exploration seasons (the last program will be completed in Q1 2017 after a winter road is completed) and assays done in 6-8 weeks after this, management feels confident that it will have a sufficient amount of data by then to commence the NI43-101 resource estimate work, and my guess is they could release a maiden resource estimate 3-4 months after this, which would be in Q3 2017.

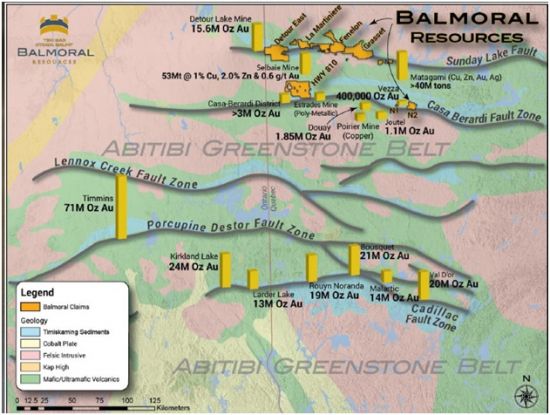

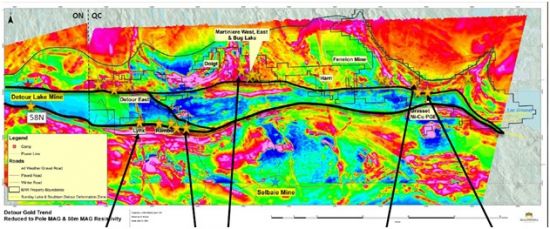

The location of Martiniere is interesting, as it's located right on the Sunday Lake fault trend which is where Detour Gold's (DGC.TO) Detour Lake gold mine is located as well, just 75 kilometers to the west of the Martiniere claims. Basically, most of Balmoral's properties are located right on this Sunday Lake Fault which looks like a strategic land package in my view.

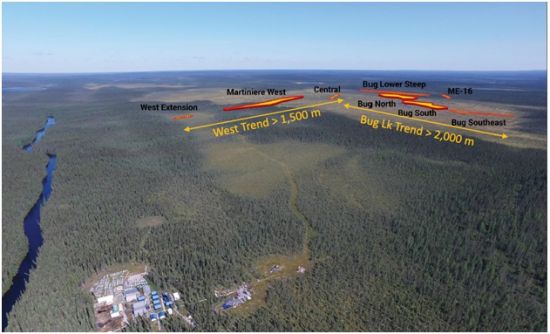

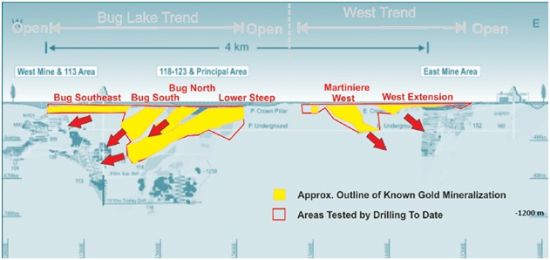

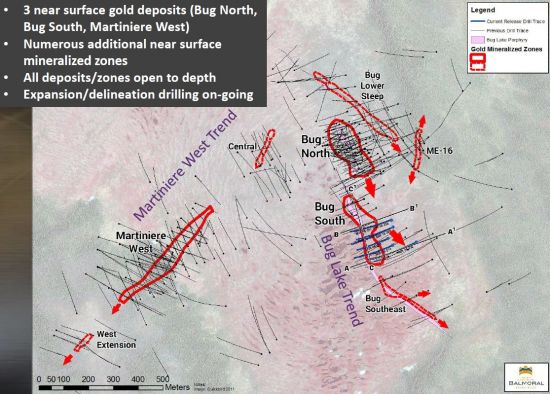

The Martiniere project can be sub-divided in different zones; Martiniere West, Bug Lake South and the Bug Lake North zone. It's not because these zones and trend have different names they are located far away from each other. In fact, as you can see on the next image, all zones are pretty much adjacent to each other.

Aerial view; Martiniere West, Bug Lake

When the property is discussed into more detail later in this article, the distinction will be made between both the Martiniere West zone and the two Bug zones (even though they are called Bug North and Bug South, both zones are just 100 meters apart.

B. Grasset

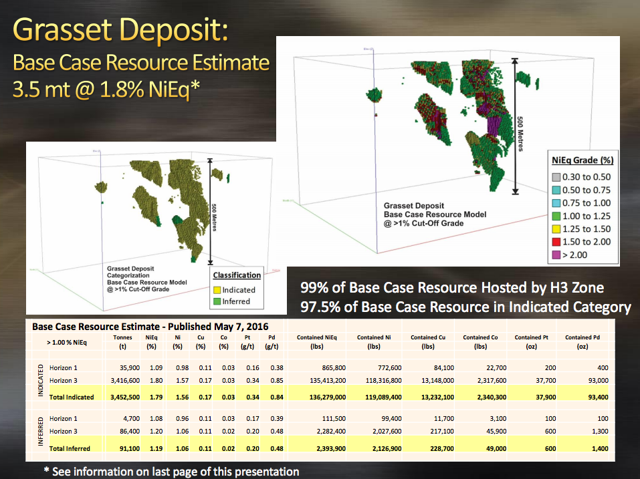

Even though the Martiniere project is Balmoral's flagship asset, it's the Grasset project which is the most advanced as this is the only property owned by the company with a recent NI43-101 compliant resource estimate.

Balmoral claims

Grasset is located approximately 50 kilometers towards the east of the Martiniere project, and just 50 kilometers from the city of Matagami. The deposit is hosted in the prolific Abitibi Greenstone Belt and is located on the Sunday Lake Fault, just like Detour Lake and the Martiniere project.

Grasset is by far Balmoral's largest property, and just like Martiniere, it took several decades and multiple operators before real progress was made. The property was relinquished by the previous operator in the late nineties, and remained freely available until Balmoral staked the claims in 2010. In the first two years after acquiring the property, Balmoral focused on soil sampling to determine the high priority drill targets. Just like at the Martiniere project, there's a pretty thick overburden (50-100 meters) and there are very few outcrops on the property, but at least there were some.

Even though the first few intercepts contained more gold than anything else (33 m@1.66 g/t Au including 4 m@6 g/t Au is really good for a first few results), as time passed by, Balmoral's exploration team realized they were sitting on something pretty unique. Not only was Grasset part of a gold-rich zone, but a follow-up drill program revealed it also hosted a komatite/associated nickel/copper/PGE (= platinum group element) deposit, and this is just the second Ni-Cu-PGE discovery above the Porcupine-Destor Deformation zone.

C. The Northshore joint venture

A third asset that deserves to be highlighted is the Northshore property which his located on the northern shore of Lake Superior in Ontario. High-grade gold was discovered at the end of the 19th century, and this property has always been a zone of interest, so it was interesting to see that Balmoral was able to secure the rights to this past-producing project in 2010.

There was only so much Balmoral Resources could do on its own, so just one year after acquiring the property, Balmoral already entered into a joint venture agreement with TSXV-listed GTA Resources and Mining (GTA.V), which could earn up to 70% of the property. GTA currently owns 51.4% of the property, and continues to explore for more gold to increase the historic resource estimate of 135,000 ounces.

This summer, an additional 15 shallow holes were drilled and extended the Afric gold zone, with 21.5 m@2.24 g/t Au, 10.5m@ 0.92 g/t Au and 12.5m@ 1.58 g/t Au. This summer program was a follow-up based on impressive results from the Phase 1 program which included intercepts of 9m@23.73 g/t g Au and 4.06 g/t gold over 23.00 metres from the Audney and Caly veins system located in the core of the Afric Gold Zone.

It looks like GTA Resources will complete its requirements to earn its 70% stake shortly, and it will be interesting to see how GTA will move forward. It might be too early for an updated resource estimate and another round of drilling might be required, but the recent exploration programs and metallurgical test results (with gold recoveries of in excess of 95%) are encouraging.

D. Other projects

Balmoral has several other properties, but according to management the current focus is on Martiniere, and the earlier stage exploration projects (Detour East being the most prominent one) are on the backburner at the moment. However, this doesn't mean the other exploration properties aren't worth any attention, and the sale of the Fenelon project shows Balmoral has the connections to monetize its non-core assets at a really good price.

Balmoral projects along the Detour Gold Trend; Pole MAG & 50m MAG Resistivity

To be more specific on this: early in the fourth quarter, Balmoral completed the sale of the Fenelon property to TSX-listed Wallbridge Mining Company for a total consideration of C$3.5M in cash, almost 2.4 million shares and a 1% Net Smelter Royalty.

This is actually a good price for a property which hasn't been subject to any exploration activities since 2011, and it allowed Balmoral to top up its treasury, as well as retaining some of the upside potential through its position in Wallbridge Mining (albeit small) and the 1% NSR.

So, even though the scope of this article is predominantly focused on Martiniere and to a lesser extent Grasset, the other properties in Balmoral's portfolio definitely have potential.

4. Martiniere: a closer look

Balmoral has completed a substantial drill program at Martiniere this summer and even though the company has been releasing drill results since September, the assay results from an additional 42 holes are still pending.

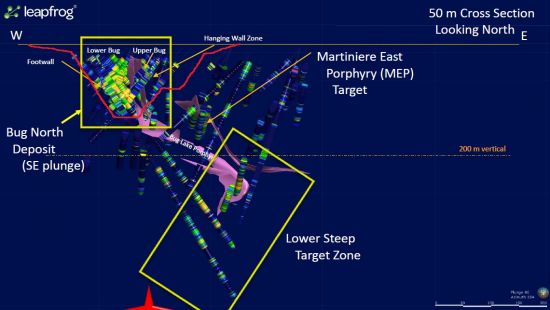

In this summer's drill program, Balmoral successfully expanded the Bug Lake gold trend, and has now been able to confirm the existence of gold mineralization all the way until a depth of 550 meters, which is approximately 140 meters deeper compared to the previous drill programs. The importance of extending the Bug Lake zone at depth should not be underestimated, as it really helps to quickly increase the tonnage of the deposit.

Martiniere project; schematic mineralization

This year's drill program was also very important to prove up the continuity of the gold mineralization at Bug Lake, which is now the main focus of the Martiniere project (as it does look like Bug Lake could be mined through a simple open pit, whereas expanding Martiniere West at depth can be quite expensive). It's all about getting the biggest bang for your buck, and right now, it's easier to build tonnage and ounces at Bug Lake and hopefully release a substantial maiden resource estimate in Q3 2017, as mentioned earlier.

Martiniere, deposit outlines

Balmoral has been postponing a maiden resource estimate for years as, as mentioned earlier and according to my point of view, it probably wanted to make sure it understood the mineralized zones well, its first resource estimate likely wouldn't go unnoticed by the market, and even more important likely wouldn't disappoint, especially after Grasset. Nonetheless, it's not easy to make a first educated guess for this resource estimate as the mineralization is divided across several envelopes.

Let's have a look first at those mineralized envelopes themselves. As mineralization starts near surface right under the overburden at all envelopes, sometimes at high grade, and continues at depth at decent grade, it is likely in my view that a combination of open (starter) pits and underground mining could be the most economic concept. To get a very global idea about strip ratio and therefore an important factor of economic viability, I estimated rough pit outlines in various sections, ranging from -100 to -150m depth as I figured it to be most economic this way (please note I'm no mining engineer), based on slopes of 45-55 degrees, and less at overburden (maybe this can be stabilized more efficiently):

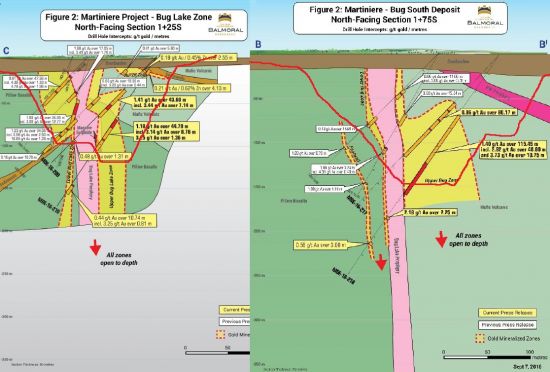

Bug South - cross sections

Bug North- cross section

Bug North - Long section

When looking at these sections and very global pit outlines, I would assume an average strip ratio of about 6-7:1 for the open pittable mineralized zones. This should be doable, as the estimated average grade seems to come in at or higher than 5g/t Au (which would be extremely high for open pit projects) for the high grade zones, and 1.2g/t Au for the low grade zones in my view. After studying the drill results and sections I estimated (for the parts eligible for open pit mining) these numbers: 150koz Au @5g/t for Martiniere West, 350koz Au @7g/t for Bug North, and 300koz Au @1.2g/t for Bug South, so 0.8Moz in total, averaging about 3.2g/t Au, which can deal quite easily with a 6-7:1 strip ratio, which is doable with 1.5-1.8g/t open pit projects at current gold prices in my view.

I even believe, after doing some quick back of the envelope estimates, that there is a decent chance for 0.8Moz Au to pay back initial capex for a combined open pit/underground operation within the first 2.5-3 years if front loaded for annual production/grade. As almost all mineralized envelopes extend to depth, and grade increases with depth in some cases like Bug South, I would like to estimate underground mineralization to the tune of 800koz Au @2g/t for Bug South, 300koz Au @ 4g/t for Bug North, 100koz Au@ 4g/t for Martiniere West, and 100koz Au @ 3g/t for all other satellite zones so far, totaling 1.3Moz Au @2.6g/t. This would bring the estimated total amount of ounces to 2.1Moz Au @ 2.8g/t. The underground part isn't the most compelling of this operation as the average estimated grade probably isn't economic in itself, but keep in mind that likely the high grade open pittable parts could make the difference for this proposed combined operation.

As my estimate is just a global attempt, applying some margin would provide some safety, and therefore I would like to estimate a range for the Martiniere resource of 1.8-2.4Moz Au.

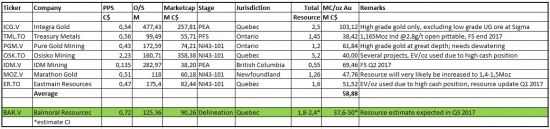

In the next table, you can find a comparison between the different valuations of other open pit/underground projects in North America. All of the properties are located in Canada, in pro-mining jurisdictions to allow me to make a more fair comparison.

Integra Gold (ICG.V) is obviously skewing averages here, without it the average MC/oz Au figure would come in at C$44.14M/oz. But as Integra has risen to the ranks of prominent Quebec developers, it should be part of the peer comparison lineup anyway, and therefore an average figure of C$58.88M/oz Au is used. This can be compared to the First Majestic (FR.TO) situation, where this company got singled out as an outlier to peers by flawed analysis (which I analyzed in-depth here), but as this company is very much a go-to silver producer, it is simply a integral part of a group of silver producers and cannot be left out.

Besides this, it shows you more than anything that such a peer comparison is just an indication and not all-determining for valuation, as each and every company has very specific reasons why it is valued like it is. To normalize all these reasons towards a level playing field (what actually should be done for a peer comparison to be really effective as a valuation tool) would require a full analysis for each featuring company. Therefore, always be careful with peer comparisons and make sure you understand what makes up the different metrics and ratios.

The aforementioned projects are in different phases of the development curve of course, but this peer comparison should be able to give a decent indication of the value of delineation/development ounces in Québec. Should Balmoral's resource estimate indeed be able to come in at 2.1 million ounces, a market capitalization of C$110-120M could definitely be warranted for Martiniere alone, depending on the resulting average grade and the additional exploration potential of course.

Martiniere is special as high grade mineralization starts from surface at several sub deposits. Assuming about 35-40% of the deposit could be open pittable and the balance could be mined by underground mining, economics of this project should come in above average. This is despite the moderately remote location without much infrastructure, which undoubtedly will increase initial capex numbers to above average numbers as mentioned in the beginning of this analysis.

Right now, the market is valuing Martiniere as if the project contains 1.6 million ounces of gold (again without taking any additional value into consideration for the other projects), and this threshold should be easy to reach for Balmoral Resources according to my estimates.

5. Grasset: a closer look

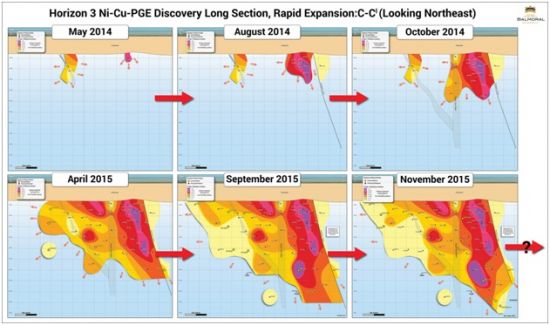

The Grasset Ni-Cu-PGE discovery was made in 2012, and was followed up by a larger drill program in 2014 which consisted of in excess of 50 diamond drill holes for a total of almost 17,000 meters. This was the first drill program fully focusing on the nickel-rich zones of Grasset. This approach most definitely was the right one, and with assay results of 58 meters at 1.85% nickel and 0.21% copper, including 1.5 meter of ultra high grade material with almost 15% Nickel and in excess of 3 g/t Platinum and 5.61 g/t Palladium, Balmoral knew it made an interesting discovery.

Grasset deposit expansion timeline

2015 was the year of confirming the discovery, and an additional 10,000 meters were drilled in 25 holes consisting of both infill and step out drilling. This was sufficient for a maiden resource estimate, of which the majority of the tonnage was already part of the indicated resource category.

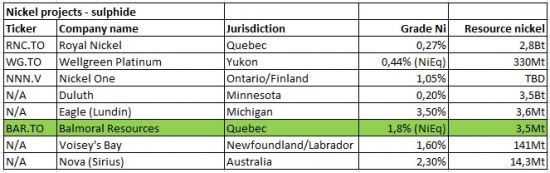

Using a cutoff grade of 1% Nickel-equivalent, the Grasset project contains almost 3.5 million tonnes at 1.56% nickel, 0.17% copper, 0.34 g/t platinum and 0.84 g/t palladium. The total nickel content is approximately 119.1 million pounds, with 13 million pounds of copper as a by-product. The value of the cobalt and platinum is almost negligible as Grasset contains just 2.34 million pounds of cobalt and less than 40,000 ounces of platinum. The almost 95,000 ounces of palladium could be interesting as an economic driver as the in situ value of the palladium is twice as high as the value of the copper, so palladium looks like Grasset's most important by-product (depending on the recovery rates and payability of the copper and the palladium of course). A negative of this nickel sulphide deposit is its size. Some sell side analysts would at least like to see a resource double the current one in order for it to be of interest, and when the usually positive sell siders have this opinion, I guess there is something to it. I'm not a nickel expert, so I collected some figures on nickel deposits to get a bit of a big picture on nickel sulphide deposits:

It is clear to me that Grasset isn't exactly a Tier I asset for size, although the average grade looks solid. The small Eagle Mine (first commercial production at the end of Q4, 2014) owned by Lundin is an example of very high grade nickel being economic, albeit small as well. Again can be seen why Voisey's Bay is such a remarkable deposit, it is relatively high grade but also large.

At a current nickel price of $4.55/lb Ni, the rock value of Grasset's deposit would be $180.2/t assuming 100% payability/recovery rates, which would be the equivalent of 4.86g/t Au. However, these rates are less in (engineered) reality, as the technical report on Grasset reveals (p. 17 and p. 113):

- Payability: Payable of 70% for Nickel, 75% for Copper, 75% for Cobalt (minimum deduction of 0.20%), 45% for Platinum, and 45% for Palladium applied on expected concentrate based on analysis of available smelting and refining cost parameters

- Recovery: Concentrates grading between 13.4% and 13.8% nickel were produced with nickel recoveries ranging between 86% and 87%

When roughly using 80% recovery and 70% payability for nickelequivalent, the rock value goes down to $101/t, which in turn would be the equivalent of 2.73g/t Au. At current metal prices, underground gold operations with this grade are not economic at all, so Grasset as a relatively small base metal project does indeed seem to be in need for more economies of scale or find interesting near surface mineralization, in order to be convincing.

On a side note: I found it to be remarkable to see the large variation in grade of nickel sulphide deposits. When looking at this nickel laterite (the other main nickel deposit type besides sulphide, I don't believe awaruite nickel deposits are anywhere as frequent) deposit graph, grades seem to be a bit more consistent:

Let's look a bit further into by-products here. According to the first resource estimate report, and as mentioned earlier, the Grasset project could produce a consistently graded nickel concentrate (13.4-13.8% nickel) at a recovery rate in the high 80% figures. The average recovery rate of the copper is also pretty good at 94%. That is important as the higher the value of the by-products, the lower the cash cost per produced pound of nickel will be, so metallurgy seems to be ok here.

Grasset 3D

It's not easy to estimate the operating expenses at Grasset as it does look like at first sight that the project could be amendable to open pit mining in the first few years of its mine life, followed by underground operations in order to mine the high-grade zones (a part of the block model has an average grade of in excess of 2% nickel). However I assume the average grade near surface not to be interesting enough like Martiniere's in this case.

If I would assume payability (after recovery) of 90% for the copper, and 70% (which is a bit optimistic) for the three other metals (cobalt, platinum and palladium), the total value of the by-products would be approximately C$44/t of processed rock. As you can see in the next table, relatively conservative commodity prices are used to calculate the by-product revenue:

In the maiden resource estimate, the company's consultants used an expected production cost of C$86 per tonne (C$48/t mining expenses, a C$22/t processing cost and C$16/t in G&A and maintenance expenses). If I would now deduct the value of the by-product credits, the net cost to process a tonne of ore would be roughly C$86 - C$44.2 = C$42, resulting in a cash cost of US$1.5 per recovered pound of nickel (using a recovery rate of 83% to remain conservative).

This is not too bad, but as I indicated earlier, I do believe that Grasset needs much more tonnes to counter the undoubtedly equally above average initial capex with economies of scale, just as could probably be the case with Martiniere (therefore the long wait). Fortunately, the Grasset deposit is open to depth and NW, and management believes there is district scale exploration potential, so ending up with 7-8Mt doesn't seem too unrealistic in my view.

6. Nickel

As I implied earlier, this article is my first foray into nickel, so by no means I'm pretending to be an expert about this metal. Fortunately, there are sites like ceo.ca, where #nickel ( the "nickel channel") provides some useful quotes on the state of the nickel market, here are some meaningful ones, taken directly from #nickel:

Nov 25 2016: Metal movements into and out of Shanghai and LME warehouses: Nickel stocks fell 281t in Shanghai with LME stocks down just 6t. This barely dents the mountain of nickel out there - Source: SP Angel - Morning View - Friday 25 11 1

Dec 2 2016: Philippines Expected to Close More Nickel Mines: The Philippines is expected to announce closure of a further 20 more mines as early as next week in its bid to fight environmental degradation, Reuters reported on Friday, December 2nd

Dec 10 2016: Andy Home: "Interest in the London nickel options market has cranked up several gears over recent weeks. Outstanding open interest in call options totals 14,406 lots across Q1 2017. That dwarfs the 6,545 lots of open interest on put options. The Q1 2017 time frame coincides with the seasonal drop-off in Philippine ore exports and the period of maximum stress in China's long nickel supply chain. That call option open interest is a heat map of bullish bets that the supply chain is not going to withstand the coming test without a price reaction."

Dec 12 2016: #Nickel US$ 11,290/t vs US$11,380/t yesterday - Hellenic Shipping News report on the potential suspension of more NPI mines in the Philippines. The government has closed eight mines with a further 14 put on notice accounting for around half the nation's nickel pig iron ore exports. The wet season is slowing exports out of the Philippines but the question is how many mines will be able to reopen and ramp up next year. Low inventories in China, estimated to be at around 13.4mt by Mysteel may cause the processing of nickel pig iron to fall further also reducing the availability of pig iron from this source and helping iron ore prices higher.

Dec 12 2016: Goldman Sachs yesterday on #nickel "We continue to anticipate an announcement of large-scale Filipino mine suspensions and resulting ore stocks drawdowns to low levels. We now expect this will drive nickel prices up to $12,500/t over the next three months, relative to current pricing of c.$10,800/t. The potential for nickel prices to rise more than our base case 3-mo target of $12,500/t is high in our view, with upside in the bull case of larger and/or more permanent than expected Philippines mine suspensions potentially driving prices up to $15-16,000/t."

Dec 14 2016: New Caledonia's nickel ore miners have applied to increase shipments to #China after an environmental crackdown on Philippine mine supply this year has caused prices to spike, four sources familiar with the matter said this week.

Dec 15 2016: "The Philippines has cancelled the environmental permits of three nickel mines and warned that three more producers were at risk of losing theirs. This comes on the heels of a separate environmental audit of the country's 41 mines completed in August, full results of which will be released in January."

Dec 19 2016: Blow Up Of This World-Leading Nickel Miner Could Lift Prices Higher

According to insiders I contacted, the Philippines are closing 55% of production capacity, New Caledonia mines in most cases are cash bleeders, and there are secret stocks which fuel imports of China. On the other hand, LME stocks are dwindling, but Shanghai stocks are rising, stock levels stay the same:

Nickel inventories; RBC Capital Markets

In my view after digesting all this, it seems that nickel prices are on a plateau at the moment, and seem to be stuck in a trading range for now, despite all "positive" catalysts. I don't see the steel market (China dominated) supply/demand dynamics change a great deal soon, which is the ultimate driver in my opinion for nickel.

Because I don't see nickel trending (much) higher very soon, I wouldn't consider it a bad thing for Balmoral to divest Grasset, and use the proceedings to develop Martiniere much further, as it looks like this gold project could deploy a big budget to its vast prospective properties for the good. It could easily become some sort of second Probe Mines, acquired in 2015 for C$526M by Goldcorp based on the high grade underground resource of 2Moz @5g/t Au. Although I must say this was pretty generous as I commented at the time. Nonetheless, with Kaminak taken out (also by Goldcorp), such deposits, if economic, are becoming increasingly rare, and therefore sought after.

Update: the company delivered another good set of drill results on January 11, both near surface (intercept of 5.8m @10.51 g/t Au) and at depth (11.71m @6.06 g/t Au), so I'm still contemplating but getting more convinced to take a position again at this point.

7. Conclusion

Balmoral Resources is dedicated to advance its two major projects in Québec, although progress varied at Martiniere and Grasset. After all, these properties were acquired six years ago, drilling started very soon afterwards at Martiniere, and the quest for nickel at Grasset started in 2012. Grasset saw its maiden resource estimate this year although small, whereas Martiniere's maiden resource estimate is expected by me in Q3 2017. It is believed that Grasset has to grow substantially before becoming economic.

Martiniere could have an estimated resource containing anywhere between 1.8 and 2.4Moz Au, at an estimated average grade of 2.8 g/t, with still lots of exploration potential as new mineralization is found at many locations. The combination of high grade near surface mineralization which could most likely be open pittable, and decent grade underground mineralization will most likely provide a substantial, economic operation. Especially since all deposits are open at depth, and the style of mineralization in this area is of deep trending zones, I don't rule out the possibility that Martiniere could become significantly bigger, maybe even to the tune of 4-5Moz Au.

The maiden estimate for flagship Martiniere, if successful according to my estimates, will probably put Balmoral firmly on the radar of many investors and analysts as economic 2Moz+ Au deposits in safe jurisdictions are very rare. Its two-pronged approach could pay off in the near future as having exposure to both precious metals and base metals, but my cards would be on developing Martiniere to the biggest deposit possible if I were management of Balmoral. I'm curious about the potential, and so should you.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has no position in this stock, but might initiate one soon. All facts are to be checked by the reader. For more information go to balmoralresources.com and read the company's profile and official documents on sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 4, 2017) - Peregrine Diamonds Ltd. ("Peregrine Diamonds" or "the Company") (TSX:PGD) is pleased to announce the appointment of Chantal Gosselin to its board and updates to its senior management team.

Ms. Gosselin has more than 24 years of combined experience in the mining industry and capital markets. She most recently held the position of Vice President and Portfolio Manager at Goodman Investment Counsel. Previously, she served as a senior mining analyst at Sun Valley Gold LLP, a precious metals focused hedge fund, the senior mining analyst and partner of Genuity Capital Markets and held positions with Haywood Securities and Dundee Securities. Previously, she held various mine-site management positions in Canada, Peru and Nicaragua.

Ms. Gosselin received her Bachelor of Science degree (Mining Engineering) from Laval University and completed a Master of Business Administration at Concordia University. She has completed the Director Education Program offered by the Institute of Corporate Directors. Ms. Gosselin also serves as a Director of Silver Wheaton Corp.

"Chantal is a well-respected mining executive with in-depth experience in both the mining and capital markets," said Eric Friedland, Peregrine's Executive Chairman. "As a Director of Peregrine Metals Ltd, a base-metal exploration and development company spun out of Peregrine Diamonds Ltd in 2005, Chantal played a key role in the 2011 sale of Peregrine Metals to Stillwater Mining Company in a transaction valued at US$487 million. Chantal built her career in increasingly senior roles with several of Canada's leading mining investment banks and she is a welcome addition to our team of directors as we advance our Chidliak Diamond Project toward development."

Since Peregrine Diamonds announced its positive Preliminary Economic Assessment ("PEA") for the Chidliak Diamond Project, Nunavut, Canada on July 7, 2016, the Company has been in discussions with a number of diamond producers and capital funds concerning the on-going development of this very valuable diamond asset. The Company is continuing discussions with various entities regarding options to finance future work programs and advance Chidliak towards commercial production. There can be no assurance that these discussions will be successful.

Starting at the end of 2015, Management has undertaken certain reorganizational initiatives that have resulted in decreased administrative costs through the balance of 2016. As part of this focus on cost reduction, effective January 4, 2017, Peregrine's President and CEO, Mr. Tom Peregoodoff, has also been appointed President and CEO of Kaizen Discovery Inc. Mr. Peregoodoff's duties in his role as President and CEO of Peregrine Diamonds will continue unaffected by this appointment to Kaizen's management team and Mr. Peregoodoff will share his time and costs between the two companies. Kaizen Discovery is a TSX-V listed company controlled indirectly by Robert Friedland, a major shareholder of Peregrine Diamonds.

Great primer on Balmoral...AUH2O

--------------------------------------------------------

Balmoral Resources, An Undervalued Gold/Nickel Opportunity For 2017

Summary

Balmoral Resources has one of the highest-grade gold deposits in the world, Martiniere, located in Quebec, Canada.

Balmoral owns a second asset, Grasset, a 100%-owned high-grade nickel-copper-PGE deposit.

First 43-101 on Martiniere due in 2017. Drill results ongoing.

Balmoral is the ideal company for prudent gold bulls.

Balmoral Resources (OTCQX:BALMF) is a gold-focused project generator that had a lot of investor interest in 2014 when its market cap went from $38 million to $128 million due to solid drill results. Now it is back to $80 million, but seems poised to go higher. It owns an 82 kilometer trend in a high-grade gold bearing zone (175,000 acres in total) in the Abitibi gold district in Quebec that has produced over 120 million oz.

Balmoral's history began in late 2010 with 1 million ounces of historic resources on its property. The company now has $10 million in cash and is exploring several gold discoveries. The Martiniere property (Bug North and Bug South) appears to be at least 2 million oz. Drill results in 2015 and 2016 were very impressive and high-grade. The CEO thinks the entire trend could have 5-10 million oz. It will release its first 43-101 resource in 2017.

The company is focused on two projects: the high-grade Martiniere gold system and the large H3 (Grasset) nickel-copper-cobalt-PGE discovery. Additionally, it has a 48% JV for a gold project in Ontario and some minor exploratory-stage assets.

In this article, we will first analyze the Martiniere property, after which we will move to the second important Balmoral asset, the Ni-Cu-Co-PGE Grasset deposit. This will be followed by a short analysis of the company's other additional assets, such as the above-mentioned gold project in Ontario. After these initial analyses, the rest of the article will focus on management, share structure and downside risk, which will show why this company is indeed a buy recommendation.

The Martiniere Discovery

Balmoral's flagship Detour Gold Trend Project is located in the Abitibi Region of Quebec, which is not only a safe jurisdiction, but also actually counts as the eighth best worldwide according to the Fraser's Survey of Mining Companies 2015.

The gold deposits within the Abitibi occur along major, regional scale faults like the Sunday Lake Deformation Zone underlying Balmoral's holdings. These deposits are known for their high average gold grades and vertical continuity. Balmoral controls over 1,000 km2 of mineral rights in this region.

Figure 1 shows the location of all Balmoral's main assets in the Abitibi: Martiniere, Grasset, Fenelon. Notice how close and on strike they are from the Detour Lake Gold mine.

Balmoral owns 100% (no royalties) of the Martiniere Gold System, which consists of three known near-surface deposits (Bug North, Bug South, Martiniere West) within a system spanning 4 x 2 kilometers. Moreover, there has been limited regional exploration, which showed the presence of numerous additional near-surface mineralized zones. The Project is located 45 km east of the Detour Lake gold mine and is located at similar distance from the Casa Berardi gold mine.

95% of drilling was made above 250 vertical meters (as it is possible to observe in figure 2 below); it means that all zones are open to depth.

The company is engaged in an ongoing work expansion/delineation drill program at the Bug Gold Deposits with a $4.0 million budget; there are hole results pending and more are being drilled with new discoveries made in every program to date. The last three releases consisted:

November 22nd, 2016

6.43 Metres Grading 4.36 g/t Gold within 48 Metre Wide Gold Zone in Deepest Hole to Date at Bug Lake

October 17th, 2016

September 7th, 2016

Martiniere has some of the highest intercepts of the whole Detour Trend. These holes showed nice thickness and length, which, if confirmed by further drill results, bodes well for the general size of the resource and the economics of it when all this data will be integrated in a Preliminary Economic Assessment.

Figure 2 is a cross-section of one of the three main zones at Martiniere. As we can see it is open to depth while it already has a large zone with very good grades near surface.

Grasset Ni-Cu-Co-Pt-Pd deposit

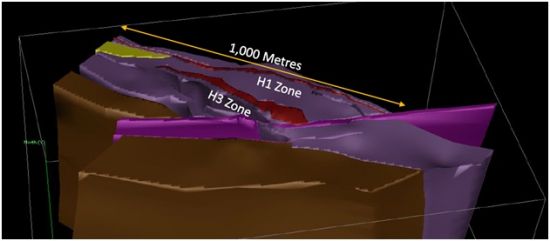

The Grasset deposit is the second most important asset that Balmoral possesses. It is 100% owned by the company, with no royalties. The deposit is composed of the H1 and H3 zone; two sub-parallel zones of disseminated to locally semi-massive sulfide mineralization. Both zones are near vertically dipping, an important positive in light of modern mining techniques. The H3 Zone extends for 500 meters along strike and to vertical depths of 550 vertical meters, still open at depth. The H1 Zone has been less explored. It intersects for over 1,000 meters along strike and to a vertical depth of approximately 450 meters however, showing good potential. It remains open along strike to the northwest and to depth.

Initial Resource Estimate

In March 2016, Balmoral published the initial resource estimate for the Grasset deposit. The Maiden resource estimate for the Grasset deposit is 3.5mT @ 1.56% Ni, 0.17% Cu, 0.03% Co, 0.34 g/t Pt and 0.84 g/t Pd, from which 97.5% are already in the indicated category (released March 2016).

Figure 3 shows the Grasset deposit ore body and the base case resource estimate.

Although Balmoral is more focused on its gold assets right now, the Grasset deposit is a valuable asset to have. It has a high grade core, it is located at a shallow depth (starting from surface), it has a simple metallurgy with high recoveries (always good for the bottom line and for the environment) and there is still untapped exploration potential. Infrastructure is excellent as everywhere else in the Abitibi, with highway, power and skilled workforce all located in the 40km around the deposit.

An interesting aspect of Grasset is that in 2011, gold was found before the delineation of the Nickel-Cu-PGE deposit. Hole FAB 11-44 intersected a 33.00 meter interval grading 1.66 g/t gold including two higher-grade intervals grading 6.15 g/t gold over 4.04 meters and 4.18 g/t gold over 5.00 meters (press release here). There is also untested copper-zinc VMS potential on the property. If Balmoral decides to invest in further exploration and metallurgy studies, the value of Grasset could increase quite substantially.

The value of Grasset can be enhanced by joint venturing it or by producing relatively cheap engineering studies (giving us some preliminary NPVs). In any case, it represents a valuable second asset for Balmoral.

Other Assets

Balmoral has multiple early-stage exploration assets including N2, Detour East, Jeremie, Hwy 810, Harry, East Doigt, a royalty on the Fenelon Gold Mine property and a JV with GTA Resources & Mining (OTC:GTARF). All assets are in Canada. These assets can be joint ventured, sold for royalties and shares and/or further enhanced funding more exploration.

The two most important of these assets are the Fenelon Gold Mine Property and Northshore.

Northshore

This property is now JV with GTA, of which Balmoral now holds a 7.8% interest. It is an advanced gold exploration play in the Hemlo-Schreiber Belt in Ontario. GTA can earn up to a 70% interest in the Northshore property by spending $5.5 million on the property over five years, issuing 3.5 million shares to Balmoral and making cash payments totaling $150,000. A historic near-surface geological resource of 2.0mT grading 2.20g/t gold for an in-situ resource of 135,000 ounces of gold is the starting point of the partnership. GTA is currently successfully exploring the property. In August 2016, results from standard bottle roll tests from two samples, one from the core of the Afric Zone and one from the high-grade Audney vein system, returned peak gold recoveries of 96.3% and 99.5%, respectively. These are preliminary but excellent results. GTA made quite the buzz in march 2016 when it made the first flow-through crowd funded capital raise in Canada, taking advantage of the new amendments to the Securities Act made by the Ontario Securities Commission in January (interview with CEO can be found here)

Fenelon

On Oct. 19th, 2016 Balmoral sold the Fenelon Gold Mine Property to Wallbridge Mining (OTC:WLBMF) for 2.4M Wallbridge shares, $3.5 million cash (boosting even more the cash balance) and 1% NSR on the property. This was a smart move from the management that gives Balmoral continued exposition to these assets via shares and royalties while raising cash for the continued advancement of the main project, Martiniere. This property is also between Martiniere and the Detour Gold mine in the Abitibi.

Management Team

Management is always one of the most important aspects of a company. Balmoral has an experienced team that successfully found and developed deposits before selling or joint venturing them for a profit. The core of the management comes from West Timmins Gold after it was bought out by Lake Shore Gold (NYSEMKT:LSG) for $424 million. It knows the area and what it is doing.

Darin Wagner (full bio here), the president, CEO and director, is the founder of Balmoral and was the co-founder, president and CEO of West Timmins Mining. He is a well respected geologist with 25 years of international experience with major and junior companies including Noranda (OTCPK:NORNQ), Cominco and MAG Silver Corp. (NYSEMKT:MVG).

Dan MacInnis, (full bio here) is the lead director with over 40 years worldwide exploration experience including a leading one of the industry's most successful explorers, MAG Silver.

Other directors include Richard Mann, Graeme Currie and Bryan Disher all highly respected and well experienced managers.

Share Structure

One of the common problems that small-cap miner shareholders encounter while investing is the constant dilution that the management inflicts upon them. How to blame management however? Raking up debt could be a dead sentence for firms that have virtually no assets lest the potential of building a mine on a deposit that has still to be delineated.

Fortunately, Balmoral is in a different situation. It has no debt, $10m in the chest, royalties on different properties, shares of other small caps and multiple non-core assets that could be sold.

Management and insiders own about 5% of the company, and the share structure is relatively clean with only 7.5m options outstanding compared to 125.5m issued shares. With a 5% insider ownership, I am confident that shareholders and management interests are aligned here.

The whole share structure can be found at the company website. It is always a positive when the management is transparent about corporate matters, and Balmoral is.

Issued & Outstanding: 125,499,167

Stock Options Outstanding:

- 175,000 @ $0.90 expiry November 7, 2021

- 1,900,000 @ $0.60 expiry March 14, 2021

- 360,000 @ $0.77 expiry June 18, 2020

- 150,000 @ $0.90 expiry December 23, 2019

- 300,000 @ $0.61 expiry February 5, 2019

- 2,855,000 @ $0.60 expiry January 23, 2019

- 1,807,700 @ $1.05 expiry February 6, 2018

Total Stock Options Outstanding: 7,547,700

Fully Diluted: 133,046,867

Many of these options are not in the money, meaning that dilution going forward will be minimal.

Downside risks

Investing in Balmoral comes with market risks and company-specific risks. The value of Balmoral's shares are highly leveraged to the price of gold and nickel. The main company-specific risks are exploration risks (the company does not find more metals in its deposits). Properties are promising however, and Balmoral does not have all its eggs in one basket, which adds a positive diversification aspect to this investment vehicle.

As the major stock indexes (NASDAQ, S&P, DJIA) are at or near all-time highs, more general market risk have to be considered, if there is a broad market correction, Balmoral would probably also go south, and financial records show that small caps perform worse than blue chips in case of crash. It is important to note here that Balmoral has a Beta of 0.95 i.e. it is highly correlated to the broad market (Google Finance Data below) and it should not be considered as a diversification vehicle from the broad market per se, but more as a vehicle to gain exposure to gold and nickel.

I would exclude political risks here as all properties are in excellent jurisdictions. There are no known First Nations (local natives) issues, and the Abitibi has seen plenty of mines permitted.

Figure 4 shows Balmoral's price chart since inception. Market cap is $75m and Beta (a volatility measure) is 0.95.

Conclusion

Balmoral represents a high risk/high reward proposition. On one side, the value of the company depends heavily on the price of gold (and nickel). It always relies on, although promising, uncertain exploration success.

On the other side, there are multiple company-specific success factors. Grades on Martiniere and Grasset are high; good for the economics of the project. Location is excellent as it is in the Abitibi region of Quebec, Canada. Management is experienced, coming from the MAG Silver and West Timmins. The company has sufficient cash on hand to continue exploration and engineering studies beyond 2017.

Balmoral offers a solid balance sheet, exposure to third-party-funded exploration successes, and a high grade nickel deposit.

The hybrid nature of Balmoral makes it resilient in today markets. I would hence recommend a buy around (or below) $0.60 for those that believe in a stable or upper trending gold price in 2017 and are comfortable with a company with less than $100m.

Disclosure:I am/we are long BALMF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Falco Announces Election of Directors, Approval of the Amended and Restated Shareholder Rights Plan and Approval of the Long Term Incentive Plan Amendment

MONTREAL, QC --(Marketwired - November 23, 2016) - Falco Resources Ltd. (TSX VENTURE: FPC) ("Falco" or the "Corporation") announces that the seven (7) nominees listed in the management information circular dated October 20, 2016, were elected as directors of Falco.

Detailed results of the vote for the election of directors held at the annual and special meeting of shareholders on November 22, 2016 are set out below:----------------------------------------------------------------------------

Votes % Votes %

Nominee For For Withheld Withheld

----------------------------------------------------------------------------

Mario Caron 37,882,586 94.21% 2,326,200 5.79%

----------------------------------------------------------------------------

Hélène Cartier 37,873,586 94.19% 2,335,200 5.87%

----------------------------------------------------------------------------

Paola Farnesi 40,149,286 99.85% 59,500 0.15%

----------------------------------------------------------------------------

Claude Ferron 37,861,586 94.16% 2,347,200 5.84%

----------------------------------------------------------------------------

Paul-Henri Girard 40,206,786 99.99% 2,000 0.01%

----------------------------------------------------------------------------

Luc Lessard 40,206,786 99.99% 2,000 0.01%

----------------------------------------------------------------------------

Sean Roosen 40,189,786 99.95% 19,000 0.05%

----------------------------------------------------------------------------

The appointment of PricewaterhouseCoopers LLP as auditors of the Corporation, as provided for in the management information circular was also approved.

AMENDED AND RESTATED SHAREHOLDER RIGHTS PLAN

The Corporation's amended and restated shareholder rights plan agreement (the "Rights Plan") which amends and restates the Corporation's original shareholder rights plan agreement dated November 28, 2013 between the Corporation and Equity Financial Trust Company has been approved by the Corporation's shareholders at the meeting.

The Rights Plan is not being adopted in response to any proposal to acquire control of the Corporation and the Corporation is not aware of any such efforts at this time. Shareholders may access the Rights Plan through the Internet on the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. Reference should be made to the full text of the Rights Plan for the details of its provisions.

FALCO ADOPTS A ROLLING PROVISION UNDER ITS LONG TERM INCENTIVE PLAN

During the annual and special meeting of shareholders, the shareholders also approved the reinstatement of Falco's rolling stock option provision under its Long Term Incentive Plan ("LTIP"). Pursuant to the rolling stock option provision, options shall not exceed 10% of the issued and outstanding shares of the Corporation, outstanding at the time of the granting of the Award (on a non diluted basis), which may be granted from time to time to directors, senior officers, employees and other persons eligible to be granted options. The rolling stock option provision contained in the Corporation's LTIP is subject to the approval of the TSX Venture Exchange.

Falco Announces Closing of $36.5 Million Bought Deal Financing

MONTREAL, QC --(Marketwired - November 22, 2016) - Falco Resources Ltd. (TSX VENTURE: FPC)

Not for distribution to U.S. newswire services or dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. securities laws.

Falco Resources Ltd. ("Falco" or the "Company") (TSX VENTURE: FPC) is pleased to announce it has closed its previously announced bought deal prospectus offering (the "Offering") of 24,183,350 units (the "Units") at a price of $1.07 per Unit, and 8,260,475 flow-through common shares (the "Flow-Through Shares") at a price of $1.28 per Flow-Through Share for aggregate gross proceeds of approximately $36.5 million including 3,154,350 Units and 447,975 Flow-Through Shares issued pursuant to the partial exercise by the underwriters of the over-allotment option.

The Offering was conducted by a syndicate of underwriters led by Haywood Securities Inc., and including BMO Nesbitt Burns Inc., Canaccord Genuity Corp., Desjardins Securities Inc., Beacon Securities Limited and M Partners Inc. The net proceeds of the Offering will be used for the continued exploration and development of the Horne 5 Project, for dewatering and rehabilitation of the Quemont 2 Shaft, pre-construction surface installation, and for working capital and general corporate purposes.

The proceeds received by the Company from the sale of the Flow-Through Shares will be used by the Company to incur sufficient Canadian exploration expenses (as defined in the Income Tax Act (Canada) on the Horne 5 Project, on or before December 31, 2017 so as to enable the Company to renounce, effective on or before December 31, 2016, in favour of each purchaser of Flow-Through Shares, an amount equal to the aggregate purchase price for the Flow-Through Shares paid by such purchaser.

Each Unit entitles the holder to acquire, for no additional consideration, one common share in the capital of the Company (a "Common Share") and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Warrant shall be exercisable to acquire one additional common share (a "Warrant Share") of the Company for a period of 18 months from the closing date of the Offering at an exercise price of $1.45 per Warrant Share.

The expiry date of the Warrants may be accelerated by the Company at any time following the six-month anniversary of the closing of the Offering and prior to the expiry date of the Warrants if the volume-weighted average trading price of the Company's common shares is greater than $1.75 for any 20 consecutive trading days, by issuing a press release announcing the reduced warrant term whereupon the Warrants will expire on the 20(th) calendar day after the date of such press release.

The Units and Flow-Through Shares were offered by way of short form prospectus in all of the provinces of Canada and in the United States to qualified institutional buyers pursuant to Rule 144A, and to certain accredited investors pursuant to an exemption under the U.S. Securities Act of 1933. Copies of the final short form prospectus and documents incorporated therein may be obtained on request from the Secretary of the Company by sending a written request to 1100 avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, Canada, H3B 2S2, telephone: 514 905-3162, and are available electronically under Falco's issuer profile on SEDAR at www.sedar.com.

The securities offered have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

Certain officers and directors of Falco and Osisko Gold Royalties Ltd ("Osisko"), an insider of Falco, have participated in the Offering and were issued 661,000 Flow-Through Shares. Osisko also participated in the Offering and was issued 2,343,750 Flow-Through Shares. Such participation in the Offering constitute "related party transactions" as defined in Regulation 61-101 respecting Protection of Minority Security Holders in Special Transactions ("61-101"). The Offering is exempt from the formal valuation and minority shareholder approval requirements of 61-101 as neither the fair market value of the securities issued to insiders nor the consideration for such securities by insiders exceed 25% of the Company's market capitalization. The Company did not file a material change report 21 days prior to closing of the Offering as the participation of insiders of the Company in the Offering had not been confirmed at that time.

Finally, the Company is expected to close the first tranche of the concurrent private placement previously announced on November 2, 2016 in the next few weeks.