Balmoral Resources Ltd

Great primer on Balmoral...AUH2O

--------------------------------------------------------

Balmoral Resources, An Undervalued Gold/Nickel Opportunity For 2017

Summary

Balmoral Resources has one of the highest-grade gold deposits in the world, Martiniere, located in Quebec, Canada.

Balmoral owns a second asset, Grasset, a 100%-owned high-grade nickel-copper-PGE deposit.

First 43-101 on Martiniere due in 2017. Drill results ongoing.

Balmoral is the ideal company for prudent gold bulls.

Balmoral Resources (OTCQX:BALMF) is a gold-focused project generator that had a lot of investor interest in 2014 when its market cap went from $38 million to $128 million due to solid drill results. Now it is back to $80 million, but seems poised to go higher. It owns an 82 kilometer trend in a high-grade gold bearing zone (175,000 acres in total) in the Abitibi gold district in Quebec that has produced over 120 million oz.

Balmoral's history began in late 2010 with 1 million ounces of historic resources on its property. The company now has $10 million in cash and is exploring several gold discoveries. The Martiniere property (Bug North and Bug South) appears to be at least 2 million oz. Drill results in 2015 and 2016 were very impressive and high-grade. The CEO thinks the entire trend could have 5-10 million oz. It will release its first 43-101 resource in 2017.

The company is focused on two projects: the high-grade Martiniere gold system and the large H3 (Grasset) nickel-copper-cobalt-PGE discovery. Additionally, it has a 48% JV for a gold project in Ontario and some minor exploratory-stage assets.

In this article, we will first analyze the Martiniere property, after which we will move to the second important Balmoral asset, the Ni-Cu-Co-PGE Grasset deposit. This will be followed by a short analysis of the company's other additional assets, such as the above-mentioned gold project in Ontario. After these initial analyses, the rest of the article will focus on management, share structure and downside risk, which will show why this company is indeed a buy recommendation.

The Martiniere Discovery

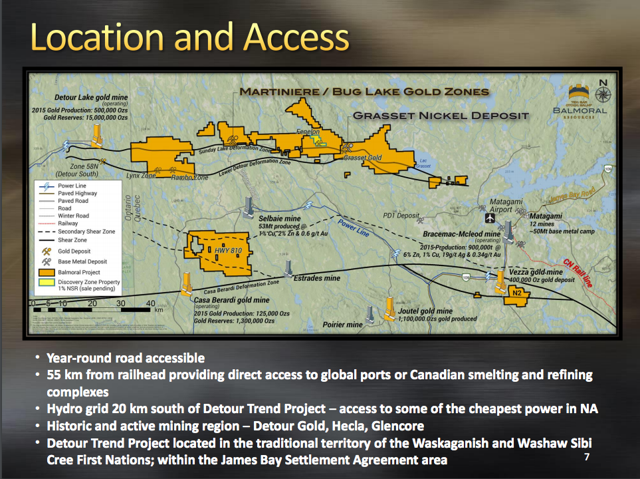

Balmoral's flagship Detour Gold Trend Project is located in the Abitibi Region of Quebec, which is not only a safe jurisdiction, but also actually counts as the eighth best worldwide according to the Fraser's Survey of Mining Companies 2015.

The gold deposits within the Abitibi occur along major, regional scale faults like the Sunday Lake Deformation Zone underlying Balmoral's holdings. These deposits are known for their high average gold grades and vertical continuity. Balmoral controls over 1,000 km2 of mineral rights in this region.

Figure 1 shows the location of all Balmoral's main assets in the Abitibi: Martiniere, Grasset, Fenelon. Notice how close and on strike they are from the Detour Lake Gold mine.

Balmoral owns 100% (no royalties) of the Martiniere Gold System, which consists of three known near-surface deposits (Bug North, Bug South, Martiniere West) within a system spanning 4 x 2 kilometers. Moreover, there has been limited regional exploration, which showed the presence of numerous additional near-surface mineralized zones. The Project is located 45 km east of the Detour Lake gold mine and is located at similar distance from the Casa Berardi gold mine.

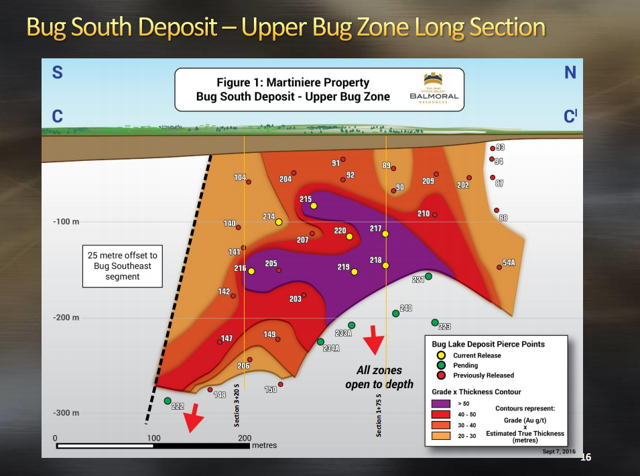

95% of drilling was made above 250 vertical meters (as it is possible to observe in figure 2 below); it means that all zones are open to depth.

The company is engaged in an ongoing work expansion/delineation drill program at the Bug Gold Deposits with a $4.0 million budget; there are hole results pending and more are being drilled with new discoveries made in every program to date. The last three releases consisted:

November 22nd, 2016

6.43 Metres Grading 4.36 g/t Gold within 48 Metre Wide Gold Zone in Deepest Hole to Date at Bug Lake

October 17th, 2016

September 7th, 2016

Martiniere has some of the highest intercepts of the whole Detour Trend. These holes showed nice thickness and length, which, if confirmed by further drill results, bodes well for the general size of the resource and the economics of it when all this data will be integrated in a Preliminary Economic Assessment.

Figure 2 is a cross-section of one of the three main zones at Martiniere. As we can see it is open to depth while it already has a large zone with very good grades near surface.

Grasset Ni-Cu-Co-Pt-Pd deposit

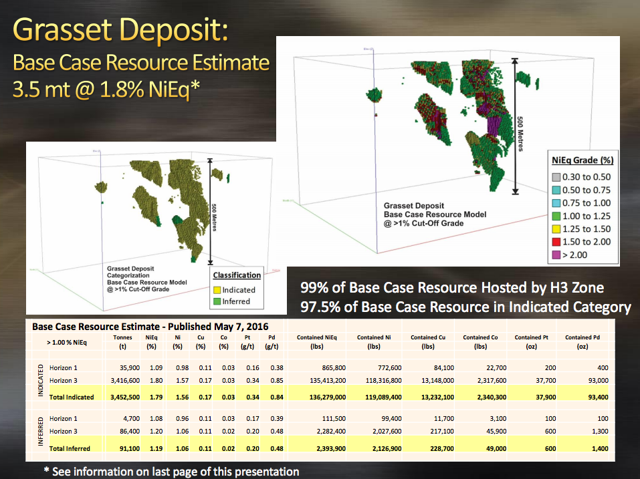

The Grasset deposit is the second most important asset that Balmoral possesses. It is 100% owned by the company, with no royalties. The deposit is composed of the H1 and H3 zone; two sub-parallel zones of disseminated to locally semi-massive sulfide mineralization. Both zones are near vertically dipping, an important positive in light of modern mining techniques. The H3 Zone extends for 500 meters along strike and to vertical depths of 550 vertical meters, still open at depth. The H1 Zone has been less explored. It intersects for over 1,000 meters along strike and to a vertical depth of approximately 450 meters however, showing good potential. It remains open along strike to the northwest and to depth.

Initial Resource Estimate

In March 2016, Balmoral published the initial resource estimate for the Grasset deposit. The Maiden resource estimate for the Grasset deposit is 3.5mT @ 1.56% Ni, 0.17% Cu, 0.03% Co, 0.34 g/t Pt and 0.84 g/t Pd, from which 97.5% are already in the indicated category (released March 2016).

Figure 3 shows the Grasset deposit ore body and the base case resource estimate.

Although Balmoral is more focused on its gold assets right now, the Grasset deposit is a valuable asset to have. It has a high grade core, it is located at a shallow depth (starting from surface), it has a simple metallurgy with high recoveries (always good for the bottom line and for the environment) and there is still untapped exploration potential. Infrastructure is excellent as everywhere else in the Abitibi, with highway, power and skilled workforce all located in the 40km around the deposit.

An interesting aspect of Grasset is that in 2011, gold was found before the delineation of the Nickel-Cu-PGE deposit. Hole FAB 11-44 intersected a 33.00 meter interval grading 1.66 g/t gold including two higher-grade intervals grading 6.15 g/t gold over 4.04 meters and 4.18 g/t gold over 5.00 meters (press release here). There is also untested copper-zinc VMS potential on the property. If Balmoral decides to invest in further exploration and metallurgy studies, the value of Grasset could increase quite substantially.

The value of Grasset can be enhanced by joint venturing it or by producing relatively cheap engineering studies (giving us some preliminary NPVs). In any case, it represents a valuable second asset for Balmoral.

Other Assets

Balmoral has multiple early-stage exploration assets including N2, Detour East, Jeremie, Hwy 810, Harry, East Doigt, a royalty on the Fenelon Gold Mine property and a JV with GTA Resources & Mining (OTC:GTARF). All assets are in Canada. These assets can be joint ventured, sold for royalties and shares and/or further enhanced funding more exploration.

The two most important of these assets are the Fenelon Gold Mine Property and Northshore.

Northshore

This property is now JV with GTA, of which Balmoral now holds a 7.8% interest. It is an advanced gold exploration play in the Hemlo-Schreiber Belt in Ontario. GTA can earn up to a 70% interest in the Northshore property by spending $5.5 million on the property over five years, issuing 3.5 million shares to Balmoral and making cash payments totaling $150,000. A historic near-surface geological resource of 2.0mT grading 2.20g/t gold for an in-situ resource of 135,000 ounces of gold is the starting point of the partnership. GTA is currently successfully exploring the property. In August 2016, results from standard bottle roll tests from two samples, one from the core of the Afric Zone and one from the high-grade Audney vein system, returned peak gold recoveries of 96.3% and 99.5%, respectively. These are preliminary but excellent results. GTA made quite the buzz in march 2016 when it made the first flow-through crowd funded capital raise in Canada, taking advantage of the new amendments to the Securities Act made by the Ontario Securities Commission in January (interview with CEO can be found here)

Fenelon

On Oct. 19th, 2016 Balmoral sold the Fenelon Gold Mine Property to Wallbridge Mining (OTC:WLBMF) for 2.4M Wallbridge shares, $3.5 million cash (boosting even more the cash balance) and 1% NSR on the property. This was a smart move from the management that gives Balmoral continued exposition to these assets via shares and royalties while raising cash for the continued advancement of the main project, Martiniere. This property is also between Martiniere and the Detour Gold mine in the Abitibi.

Management Team

Management is always one of the most important aspects of a company. Balmoral has an experienced team that successfully found and developed deposits before selling or joint venturing them for a profit. The core of the management comes from West Timmins Gold after it was bought out by Lake Shore Gold (NYSEMKT:LSG) for $424 million. It knows the area and what it is doing.

Darin Wagner (full bio here), the president, CEO and director, is the founder of Balmoral and was the co-founder, president and CEO of West Timmins Mining. He is a well respected geologist with 25 years of international experience with major and junior companies including Noranda (OTCPK:NORNQ), Cominco and MAG Silver Corp. (NYSEMKT:MVG).

Dan MacInnis, (full bio here) is the lead director with over 40 years worldwide exploration experience including a leading one of the industry's most successful explorers, MAG Silver.

Other directors include Richard Mann, Graeme Currie and Bryan Disher all highly respected and well experienced managers.

Share Structure

One of the common problems that small-cap miner shareholders encounter while investing is the constant dilution that the management inflicts upon them. How to blame management however? Raking up debt could be a dead sentence for firms that have virtually no assets lest the potential of building a mine on a deposit that has still to be delineated.

Fortunately, Balmoral is in a different situation. It has no debt, $10m in the chest, royalties on different properties, shares of other small caps and multiple non-core assets that could be sold.

Management and insiders own about 5% of the company, and the share structure is relatively clean with only 7.5m options outstanding compared to 125.5m issued shares. With a 5% insider ownership, I am confident that shareholders and management interests are aligned here.

The whole share structure can be found at the company website. It is always a positive when the management is transparent about corporate matters, and Balmoral is.

Issued & Outstanding: 125,499,167

Stock Options Outstanding:

- 175,000 @ $0.90 expiry November 7, 2021

- 1,900,000 @ $0.60 expiry March 14, 2021

- 360,000 @ $0.77 expiry June 18, 2020

- 150,000 @ $0.90 expiry December 23, 2019

- 300,000 @ $0.61 expiry February 5, 2019

- 2,855,000 @ $0.60 expiry January 23, 2019

- 1,807,700 @ $1.05 expiry February 6, 2018

Total Stock Options Outstanding: 7,547,700

Fully Diluted: 133,046,867

Many of these options are not in the money, meaning that dilution going forward will be minimal.

Downside risks

Investing in Balmoral comes with market risks and company-specific risks. The value of Balmoral's shares are highly leveraged to the price of gold and nickel. The main company-specific risks are exploration risks (the company does not find more metals in its deposits). Properties are promising however, and Balmoral does not have all its eggs in one basket, which adds a positive diversification aspect to this investment vehicle.

As the major stock indexes (NASDAQ, S&P, DJIA) are at or near all-time highs, more general market risk have to be considered, if there is a broad market correction, Balmoral would probably also go south, and financial records show that small caps perform worse than blue chips in case of crash. It is important to note here that Balmoral has a Beta of 0.95 i.e. it is highly correlated to the broad market (Google Finance Data below) and it should not be considered as a diversification vehicle from the broad market per se, but more as a vehicle to gain exposure to gold and nickel.

I would exclude political risks here as all properties are in excellent jurisdictions. There are no known First Nations (local natives) issues, and the Abitibi has seen plenty of mines permitted.

Figure 4 shows Balmoral's price chart since inception. Market cap is $75m and Beta (a volatility measure) is 0.95.

Conclusion

Balmoral represents a high risk/high reward proposition. On one side, the value of the company depends heavily on the price of gold (and nickel). It always relies on, although promising, uncertain exploration success.

On the other side, there are multiple company-specific success factors. Grades on Martiniere and Grasset are high; good for the economics of the project. Location is excellent as it is in the Abitibi region of Quebec, Canada. Management is experienced, coming from the MAG Silver and West Timmins. The company has sufficient cash on hand to continue exploration and engineering studies beyond 2017.

Balmoral offers a solid balance sheet, exposure to third-party-funded exploration successes, and a high grade nickel deposit.

The hybrid nature of Balmoral makes it resilient in today markets. I would hence recommend a buy around (or below) $0.60 for those that believe in a stable or upper trending gold price in 2017 and are comfortable with a company with less than $100m.

Disclosure:I am/we are long BALMF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.