The 300 Club

These are buoyant times for (some) commodity investors, and (some) commodity producers, but what does it mean in terms of a global recovery?

A common feature among people drawing conclusions about the economy from commodity markets tends to be a sole focus on price, and even then only prices in exchange traded commodities. If buyers outnumber sellers prices rise, so rising prices mean a return of global demand, which in turn means global recovery -- right? Well not quite, despite the enthusiasm displayed in many articles pushing that line. The flaw in this line of thought is that the buyers who are outnumbering sellers in commodity markets need not be end users of the commodity. There can be speculative demand from speculative buyers just as there can be economic demand from industrial buyers. From the point of view of the markets, or the commodity producer, it doesn't matter who the buyer is: more buyers than sellers means rising prices. The problem arises when you use market price -- at face value -- to draw conclusions about the economy. Since most of the people who connect price to economic recovery without digging deeper tend to be economists, I'm assuming economic theories don't allow for speculators.

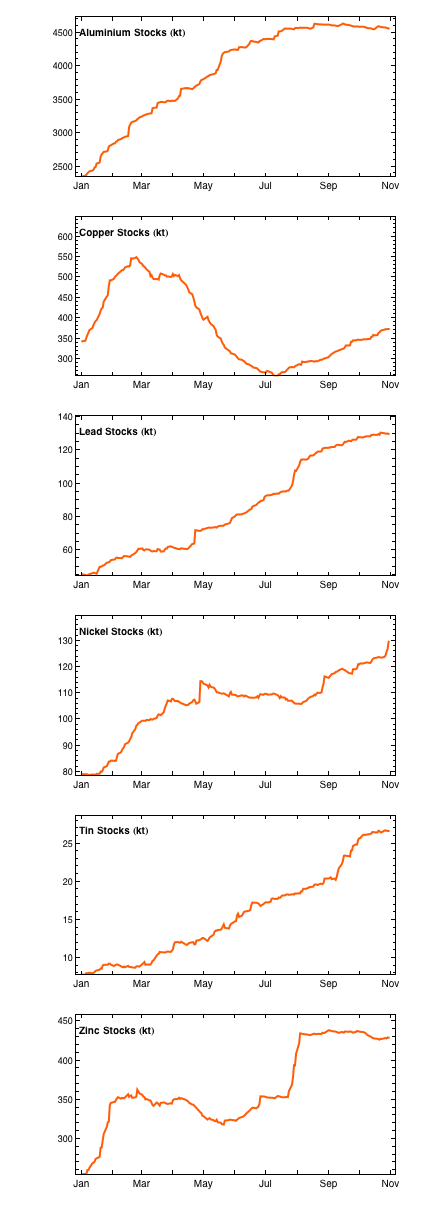

Let me focus on metals and minerals (e.g. iron ore, coal). People don't eat these (unlike food commodities), they are used as inputs for industrial production. As global demand picks up we would expect to see increasing consumption of metals and minerals. When buyers outnumber sellers prices rise. This is clearly what is occurring at the moment, you only need to look at price charts -- which I haven't reproduced here because we're all familiar with them. But what if the majority of buyers are not end users of the commodity and do not take delivery, i.e. speculative buyers? If the buyer doesn't take delivery then you would expect stockpiles to rise. In other words, if speculators are outnumbering industrialists you would expect to see quantities of the commodity that are available, i.e. stockpiled, to increase. In the first chart we have the base metal stockpiles on the London Metals Exchange.

The chart that stands out like dogs' ears among the others is the copper stocks chart. The declining copper stockpile from March through to the end of June coincided with large purchases from China -- verified by Chinese import data. Chinese imports of copper from July dropped off and the copper stockpile has subsequently risen.

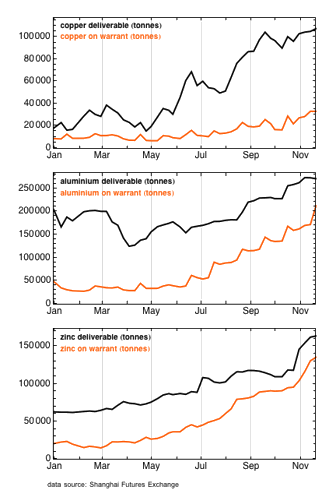

The next chart shows that stockpiles in Shanghai follow the same trend of rising stockpiles seen on the LME. Interestingly, copper stocks have steadily risen all year. From this you could conclude that the Chinese copper purchases on the LME were not for immediate industrial use. This makes sense: copper was trading at a 5 year low, China has lots of US dollars, why not accumulate inventories of copper at prices you're not likely to see again for a long while. (Click charts to enlarge.)

To digress, we also suspect that a lot of the record iron ore imports by China have been stockpiled as well because steel production, while rebounding, doesn't account for all of it, and also Chinese imports of minor components of steel such as manganese are at 2008 levels YOY and chromium is down 16% YOY.

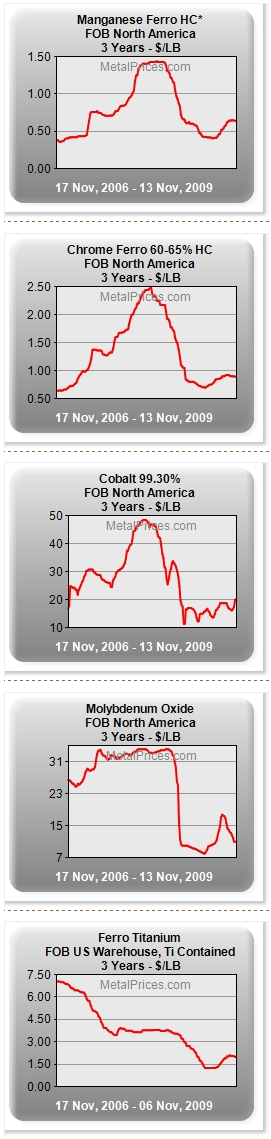

To test the idea that economic demand, as opposed to speculative demand, is weak, the next chart shows a 3 year price history of metals that are not traded on exchanges (these charts come from metalprices.com and minormetals.com). These prices are largely determined between producers and end users. In the absence of speculative buyers we can gauge the relative depth of industrial buyers in the market.

The qualifier is that these metals are mostly used in steel so it could be argued that these charts focus on a single industry. Nevertheless, it demonstrates weak demand in that sector and also demonstrates that strong metals prices pre-crash also existed in non-exchange traded metals. In other words the strong metals prices pre-crash were supported by strong economic demand.

We can conclude from all these charts that economic demand is weak or flat. The world economy may have recovered from the abyss of earlier in the year but we are yet to see a recovery in the sense that we would have used the word pre-crash. It is also worth adding that major miners such as BHP do not expect a recovery in demand until H2 2010.

The next question becomes how to invest in a speculative market. For miners, who cares who is buying your product, you take the cash and book the profits right? Yes, sort of. We are starting to see mothballed projects coming back online but miners would surely have to be cautious about investing capex in a market that is not currently supported by fundamentals.

Among other things commodity prices are rising due to a weak US dollar -- which they must given they are traded in US dollars. Despite the hand wringing among many that is accompanying the fall of the dollar, it seems it is as much to do with interest rate differentials as expansion of money supply (other countries have fiat currencies and printing presses too). So the concern among investors, including miners planning capital expenditure, would/should be what happens when US interest rates eventually rise, relative to other countries, and these speculative positions unwind? That doesn't look like happening anytime soon, and if the USA gets caught in a Japan style rut it may not happen for years.

For now it looks like the party can continue for direct and indirect investors in commodities, but in this sort of market, driven primarily by speculation, you need to know in advance where all the exits are. The panic when someone shouts "fire" could be ugly.