solyomtwo's Profile

solyomtwo's Posts

Since I can't post pro Falcon opinon any longer without being censored, let's find out what is allowed:

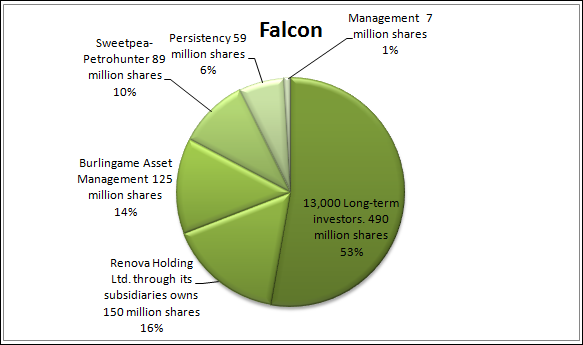

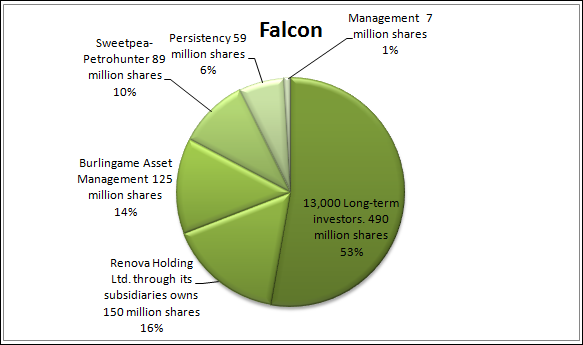

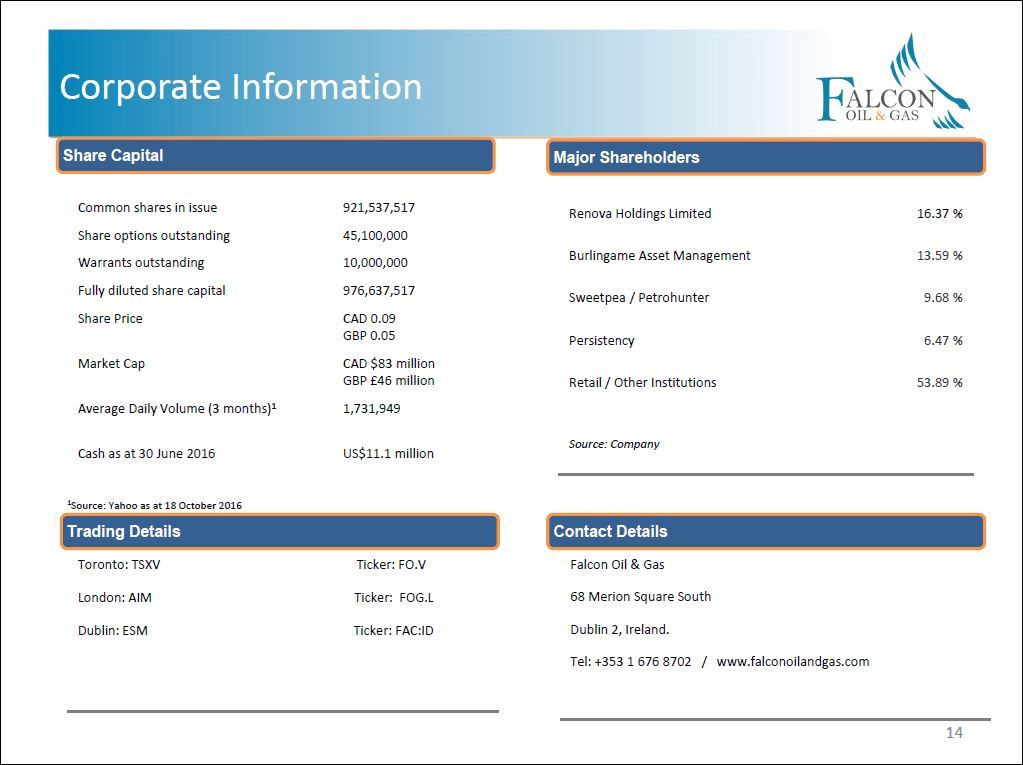

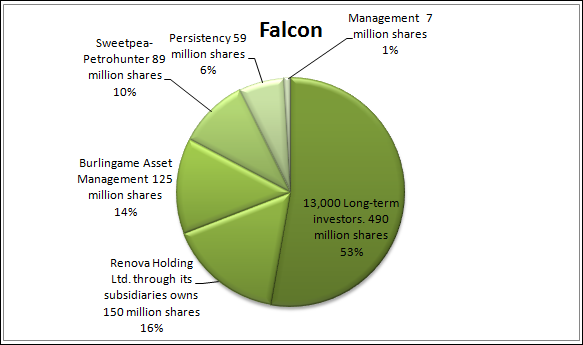

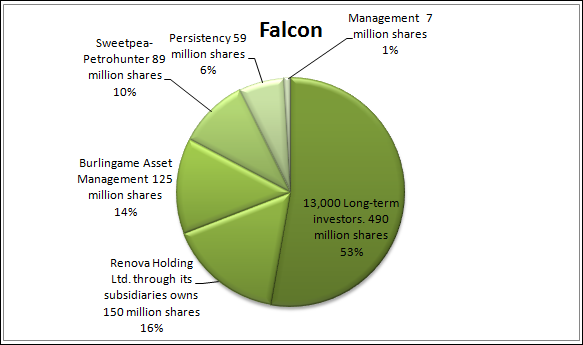

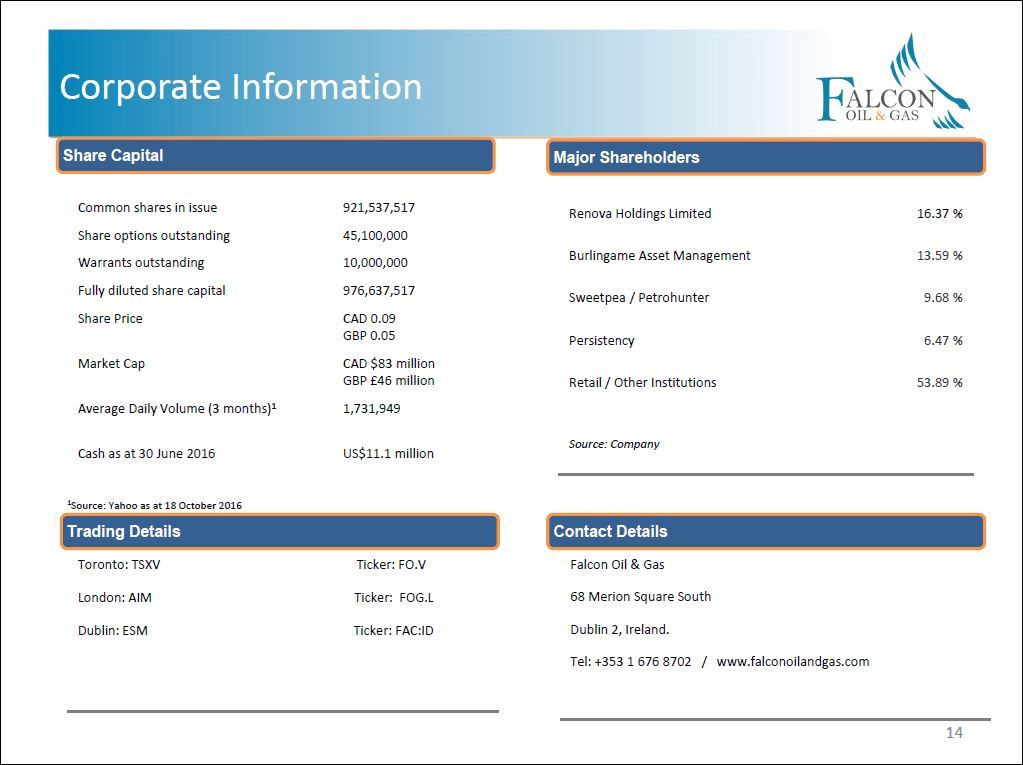

We, the 13,000 long-term investors holding strong. Like Renova..like Burlingame...like Persistency.. like Sweetpea...

You can find me on this chart, I'm one of the 13,000.

You are also looking at a $6.00 per share pool.

Japan Liquefied Natural Gas Import Price: 7.15USD/MMBtu for Nov 2016

Huge churning from very deep left pocket into very deep right pocket then into very deep rear pocket.

Meanwhile in London:

The deplorable, double talking backroomboys trying to bamboozle the investors. BS on steroids.

Trades for C:FO on 20170125 - 10 trades displayed

Backroom Trades

Time ET

Ex

Price

Change

Volume

Buyer

Seller

15:58:33

V

0.105

2,000

1 Anonymous

99 Jitney

15:12:56

V

0.105

30,000

39 Merrill Lynch

99 Jitney

13:48:27

V

0.10

-0.005

100

59 PI

7 TD Sec

13:48:27

V

0.10

-0.005

8,000

7 TD Sec

7 TD Sec

10:53:33

V

0.105

5,000

143 Pershing

99 Jitney

10:32:52

V

0.10

300

7 TD Sec

7 TD Sec

09:30:00

V

0.105

37,500

79 CIBC

99 Jitney

09:30:00

V

0.105

5,000

79 CIBC

1 Anonymous

09:30:00

V

0.105

4,500

79 CIBC

1 Anonymous

09:30:00

V

0.105

3,000

79 CIBC

1 Anonymous

and

the

beat

day

after

day

House Positions for C:FO from 20170125 to 20170125

House

Bought

$Val

Ave

Sold

$Val

Ave

Net

$Net

50,000

5,249

0.105

0

50,000

-5,249

30,000

3,150

0.105

0

30,000

-3,150

5,000

525

0.105

0

5,000

-525

100

10

0.10

0

100

-10

8,300

830

0.10

8,400

840

0.10

-100

10

2,000

210

0.105

12,500

1,312

0.105

-10,500

1,102

0

74,500

7,822

0.105

-74,500

7,822

TOTAL

95,400

9,974

0.105

95,400

9,974

0.105

0

0

Rule to long-term investing:

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

In 2011 Burlingame increased their holding to 125 million shares.

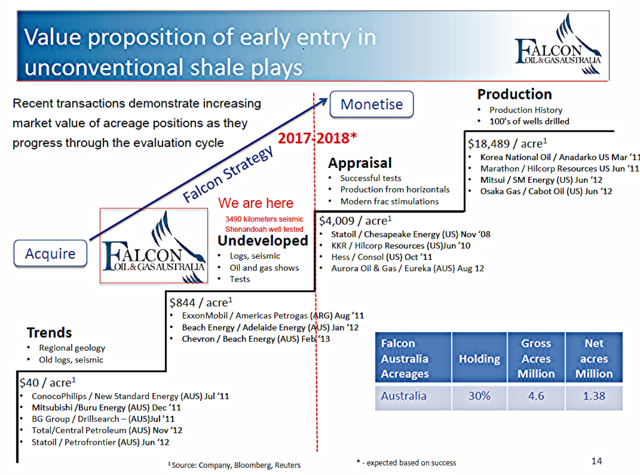

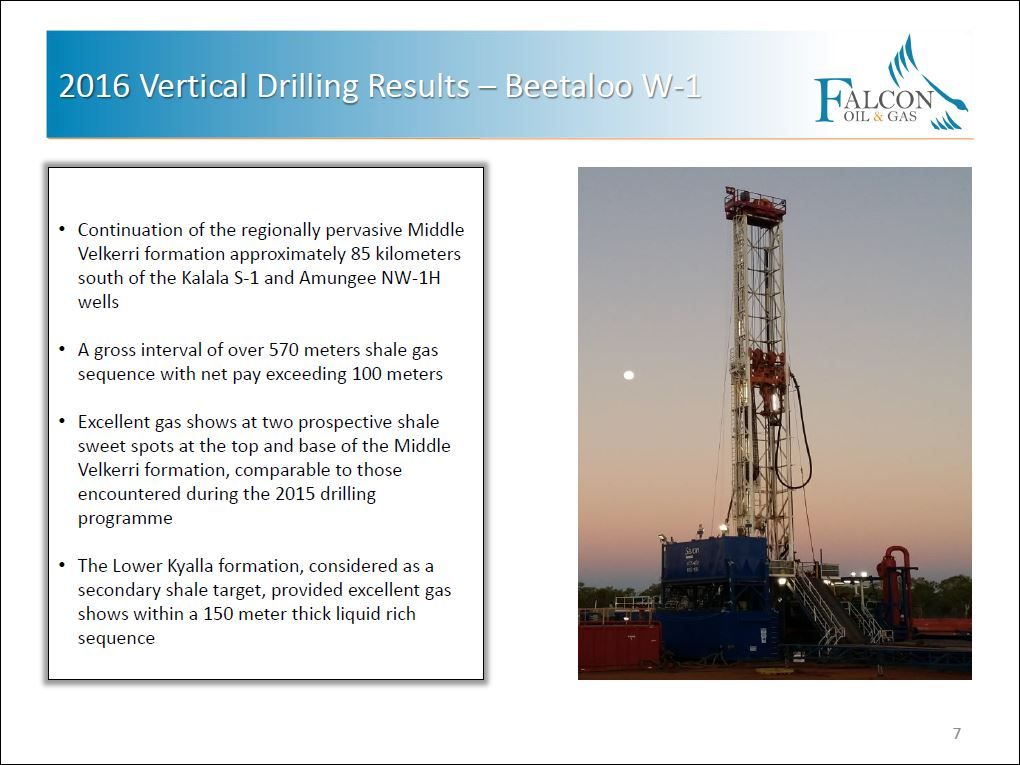

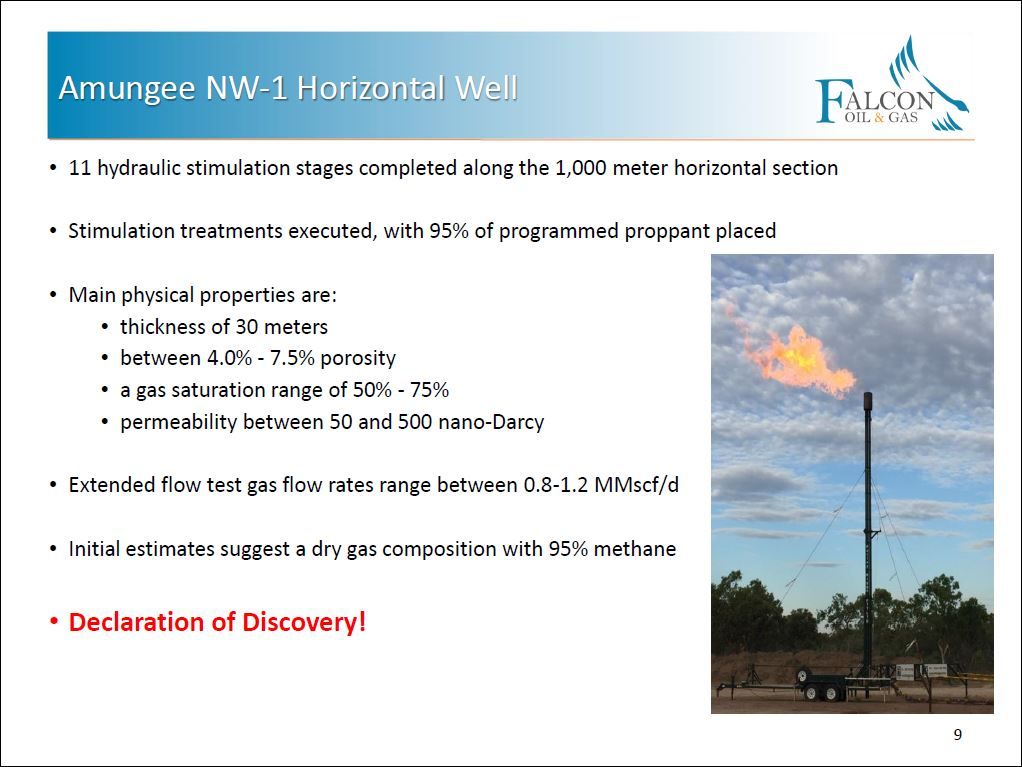

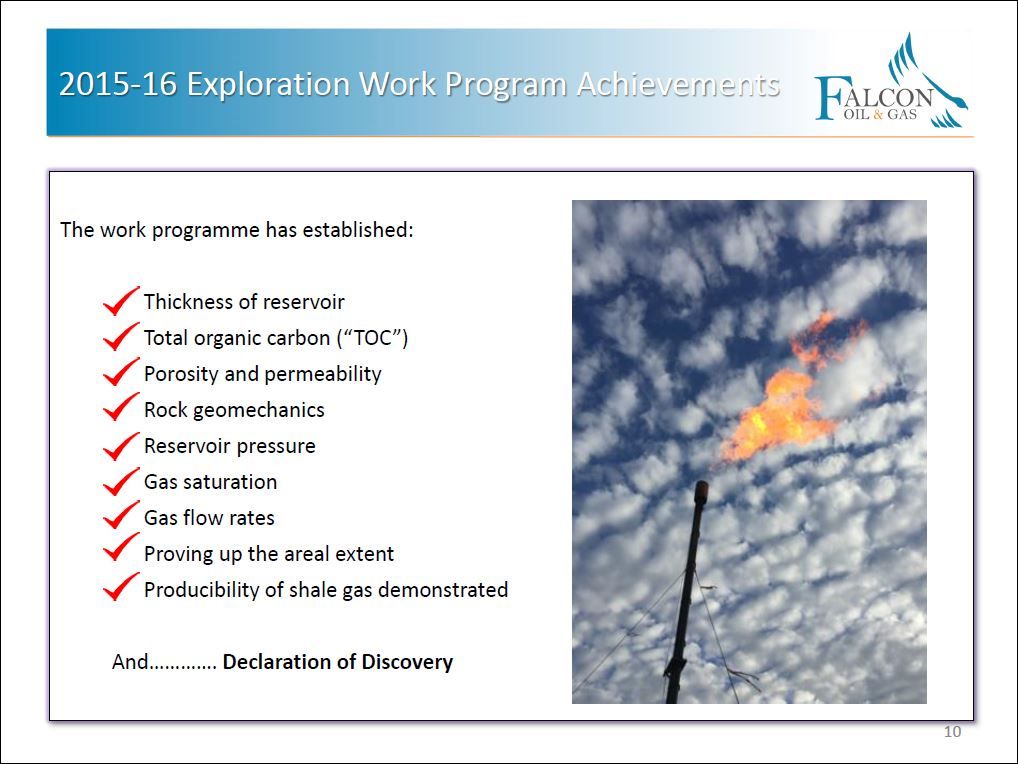

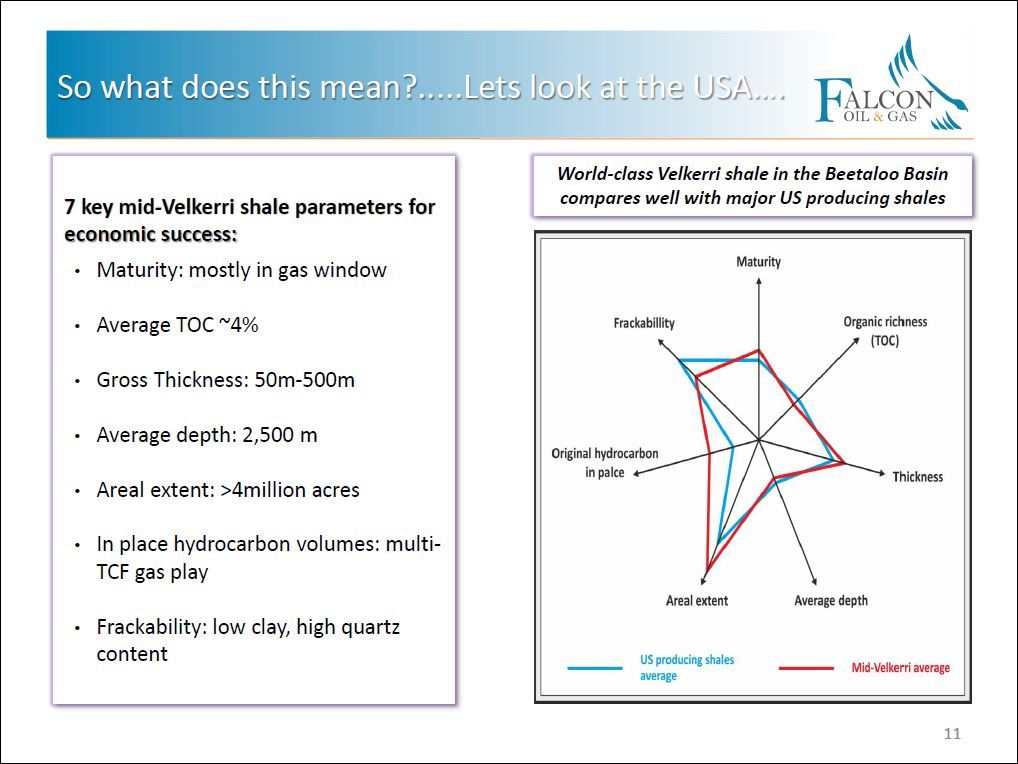

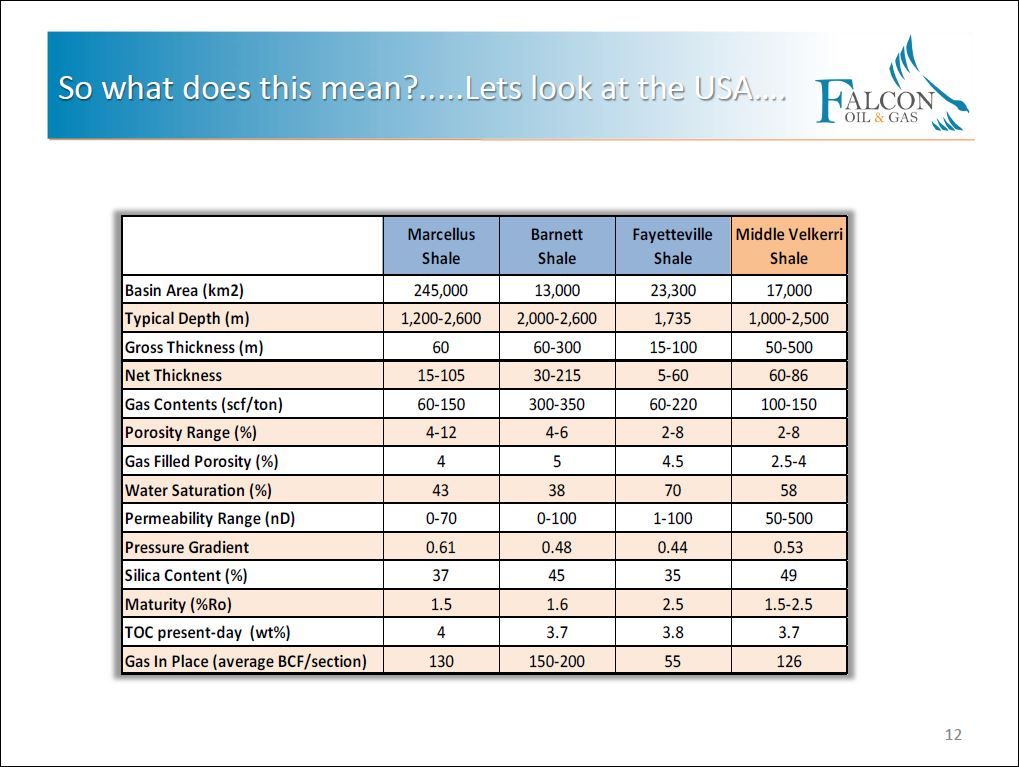

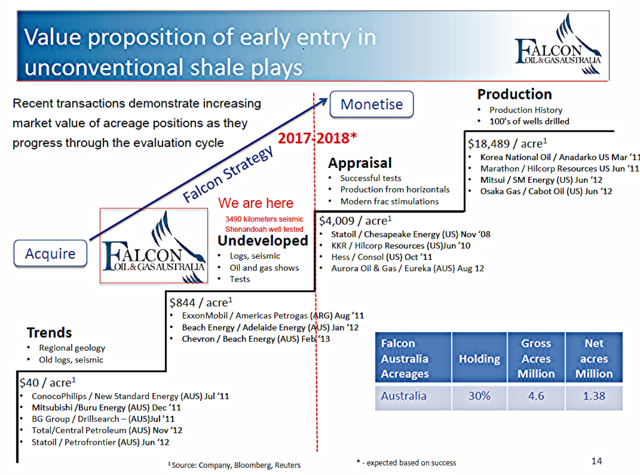

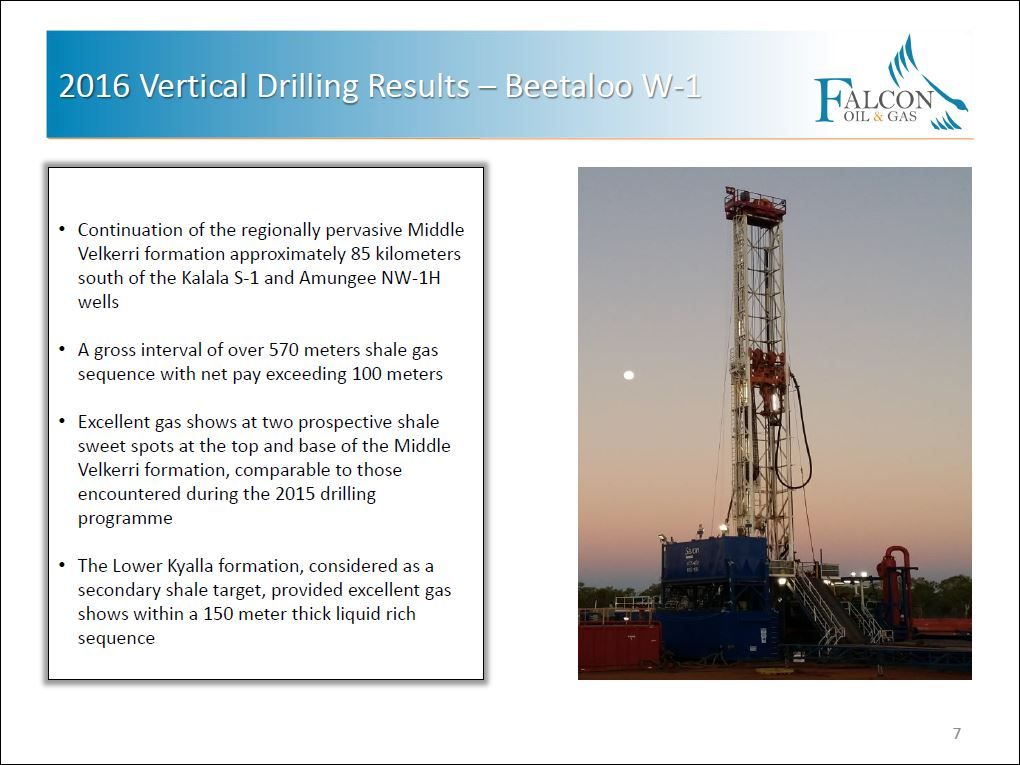

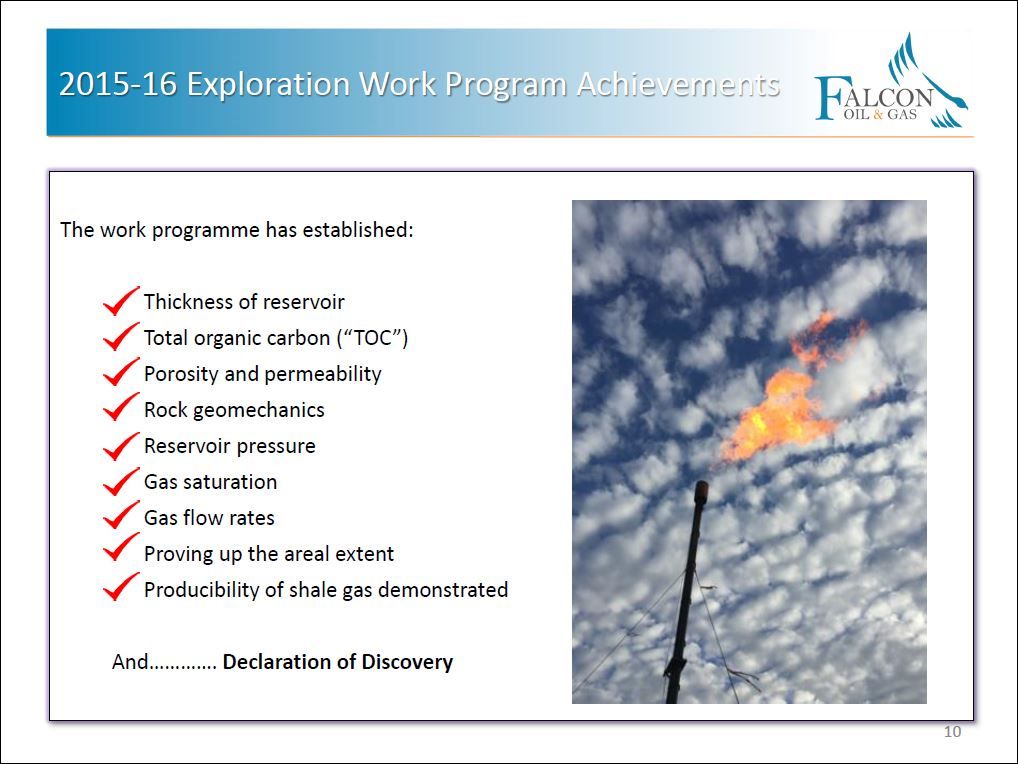

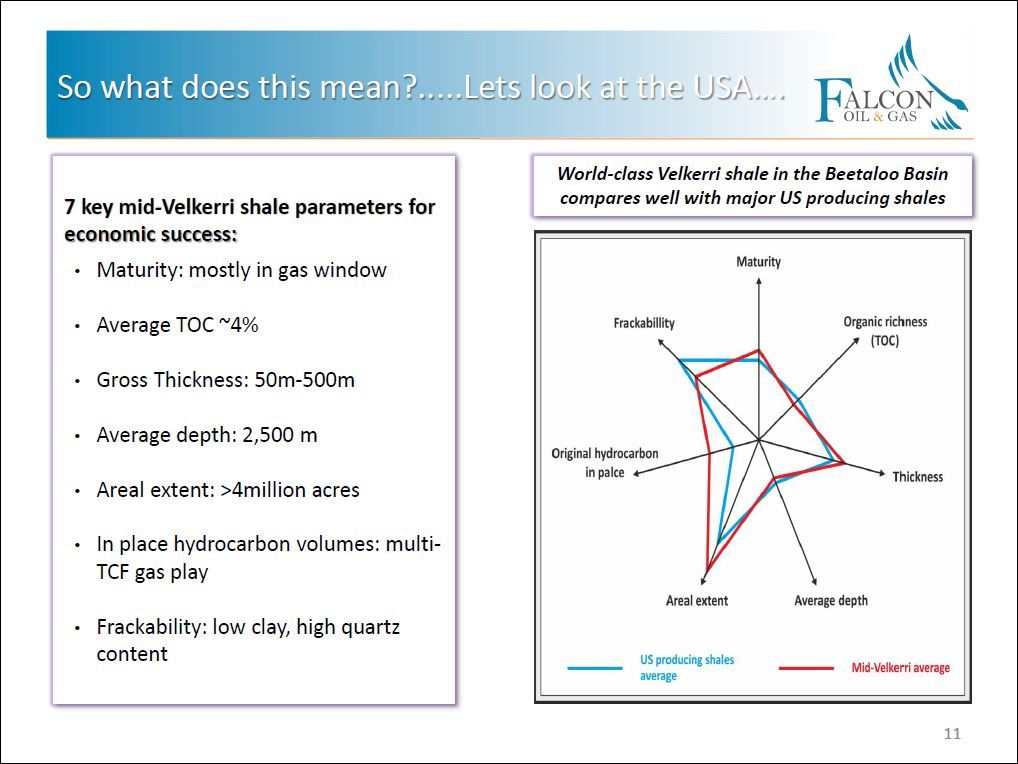

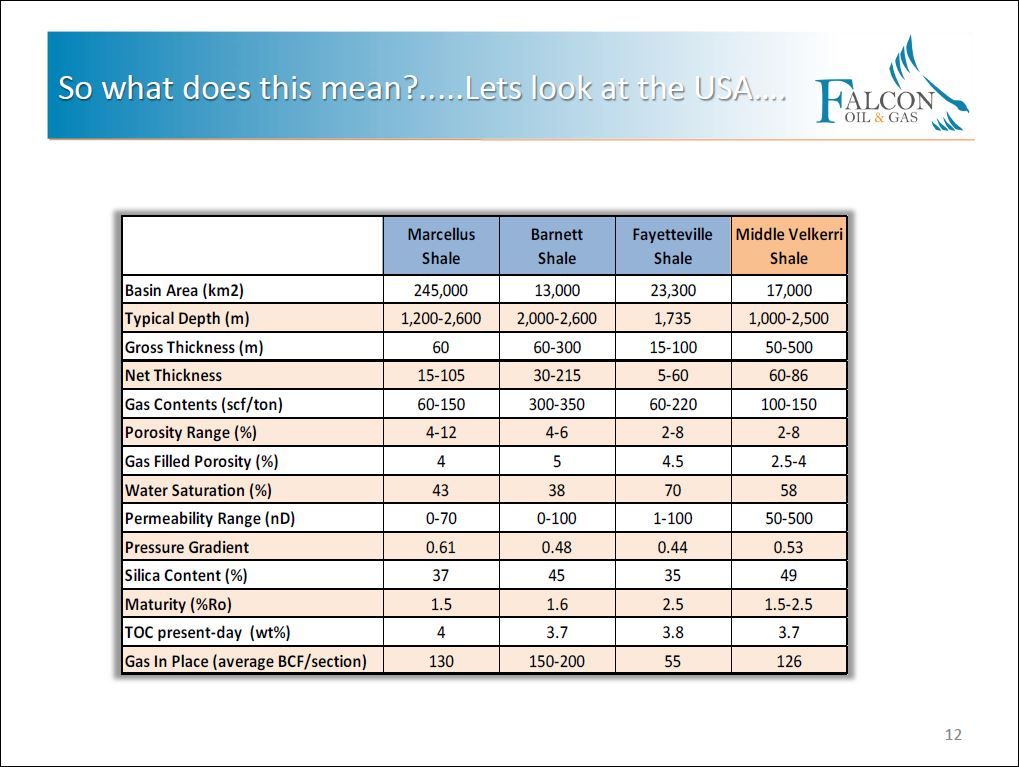

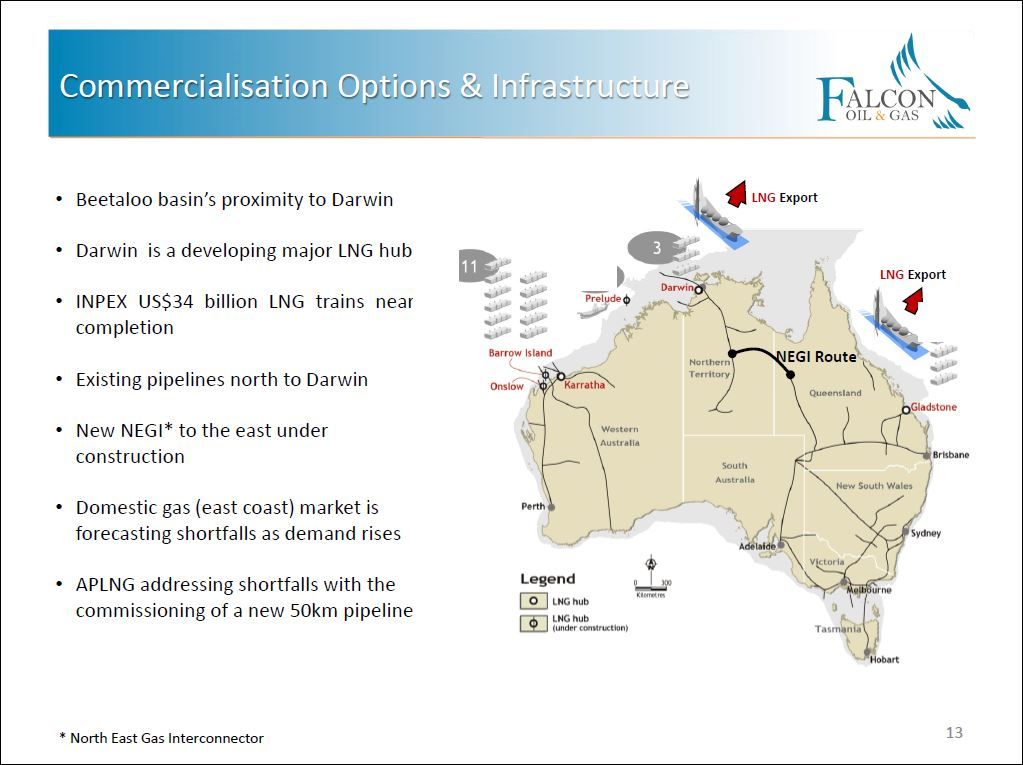

Shale Oil and Gas. America has done it.

Now it's Australia's turn.

Index

Close

Change

DJ Industrial

20068.51

+155.80

Nasdaq

5656.34

+55.38

TSX

15643.84

+33.15

TSX-V

799.52

-7.22

TSX-Gold

211.16

-4.29

$Cad/Usd

0.7658

+0.0012

Gold

1201.90

+1.40

Crude Oil

53.05

+0.30

Natural Gas

3.358

+0.026

“Shareholders don’t want to wait 20 years for a payback. We’re setting ourselves up to sell. Ultimately, that’s what we want to do. Shareholders want a big return and they want a quick return.” -Philip O’Quigley, chief executive, Falcon Oil & Gas –

Just who are these shareholders?

Well, all of us, the 13,445 long-term investors.

But, Philip O’Quigley really talking about his bosses. You know, the guys who hired him in the first place. Burlingame, Soliter, Persistency, Sweetpea, the folks on left side on this chart.

Of course they'll wait for the conclusion of the 9 well program. And so are we, on the right side of the chart.

The 13,000 holds the balance of power.

The folks on the left side eyeing the shares of those on the right side.

Since I can't post pro Falcon opinon any longer without being censored, let's find out what is allowed:

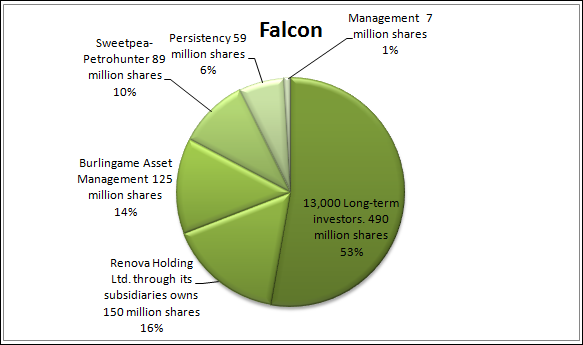

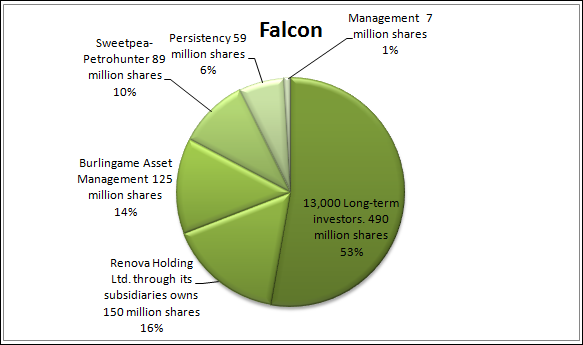

We, the 13,000 long-term investors holding strong. Like Renova..like Burlingame...like Persistency.. like Sweetpea...

You can find me on this chart, I'm one of the 13,000.

You are also looking at a $6.00 per share pool.

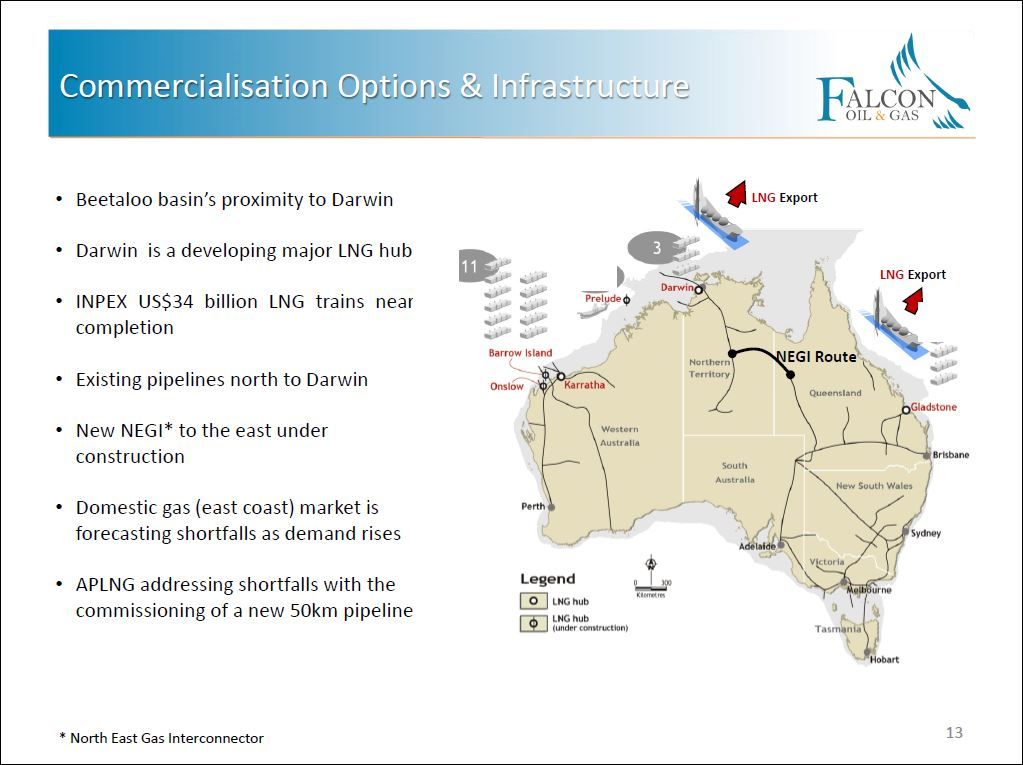

Japan Liquefied Natural Gas Import Price: 7.15USD/MMBtu for Nov 2016

Huge churning from very deep left pocket into very deep right pocket then into very deep rear pocket.

Meanwhile in London:

The deplorable, double talking backroomboys trying to bamboozle the investors. BS on steroids.

Trades for C:FO on 20170124 - 22 trades displayed

Backroom Trades

Time ET

Ex

Price

Change

Volume

Buyer

Seller

15:14:31

V

0.105

0.005

22,500

85 Scotia

1 Anonymous

12:29:53

V

0.10

1,500

39 Merrill Lynch

2 RBC

12:06:13

V

0.10

1,000

39 Merrill Lynch

19 Desjardins

11:55:44

V

0.105

0.005

5,000

88 Credential

1 Anonymous

10:58:29

V

0.105

0.005

1,000

89 Raymond James

1 Anonymous

10:57:56

V

0.105

0.005

1,000

89 Raymond James

1 Anonymous

10:52:07

V

0.105

0.005

10,000

89 Raymond James

1 Anonymous

10:19:13

V

0.105

0.005

6,000

79 CIBC

1 Anonymous

10:13:02

V

0.10

19,000

39 Merrill Lynch

2 RBC

10:12:53

V

0.105

0.005

2,000

88 Credential

1 Anonymous

10:12:39

V

0.10

30,000

39 Merrill Lynch

2 RBC

10:12:39

V

0.105

0.005

400

89 Raymond James

85 Scotia

10:12:39

V

0.105

0.005

4,000

89 Raymond James

1 Anonymous

10:08:40

V

0.105

0.005

4,000

89 Raymond James

1 Anonymous

09:54:31

V

0.105

0.005

15,000

79 CIBC

1 Anonymous

09:54:31

V

0.105

0.005

1,500

79 CIBC

7 TD Sec

09:54:31

V

0.105

0.005

13,500

79 CIBC

85 Scotia

09:33:56

V

0.10

5,500

85 Scotia

9 BMO Nesbitt

and

09:33:56

V

0.10

3,500

85 Scotia

1 Anonymous

the

09:30:00

V

0.095

-0.005

1,000

88 Credential

14 ITG

beat

09:30:00

V

0.095

-0.005

2,000

88 Credential

14 ITG

09:30:00

V

0.095

-0.005

1,500

7 TD Sec

7 TD Sec

day

after

day

House Positions for C:FO from 20170124 to 20170124

House

Bought

$Val

Ave

Sold

$Val

Ave

Net

$Net

51,500

5,150

0.10

0

51,500

-5,150

36,000

3,779

0.105

0

36,000

-3,779

20,400

2,142

0.105

0

20,400

-2,142

31,500

3,262

0.104

13,900

1,459

0.105

17,600

-1,803

10,000

1,020

0.102

0

10,000

-1,020

0

1,000

100

0.10

-1,000

100

1,500

142

0.095

3,000

299

0.10

-1,500

157

0

3,000

285

0.095

-3,000

285

0

5,500

550

0.10

-5,500

550

0

50,500

5,050

0.10

-50,500

5,050

0

74,000

7,752

0.105

-74,000

7,752

TOTAL

150,900

15,495

0.103

150,900

15,495

0.103

0

0

Rule to long-term investing:

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

In 2011 Burlingame increased their holding to 125 million shares.

Shale Oil and Gas. America has done it.

Now it's Australia's turn.

Index

Close

Change

DJ Industrial

19912.71

+112.86

Nasdaq

5600.96

+48.02

TSX

15610.69

+130.56

TSX-V

806.74

+1.66

TSX-Gold

215.45

-1.36

$Cad/Usd

0.7617

+0.0015

Gold

1208.00

-5.60

Crude Oil

53.02

-0.15

Natural Gas

3.267

-0.012

“Shareholders don’t want to wait 20 years for a payback. We’re setting ourselves up to sell. Ultimately, that’s what we want to do. Shareholders want a big return and they want a quick return.” -Philip O’Quigley, chief executive, Falcon Oil & Gas –

Just who are these shareholders?

Well, all of us, the 13,445 long-term investors.

But, Philip O’Quigley really talking about his bosses. You know, the guys who hired him in the first place. Burlingame, Soliter, Persistency, Sweetpea, the folks on left side on this chart.

Of course they'll wait for the conclusion of the 9 well program. And so are we, on the right side of the chart.

The 13,000 holds the balance of power.

The folks on the left side eyeing the shares of those on the right side.