jokal's Profile

jokal's Posts

Stars aligning

Assays anticipated from $1-million drill program

Andrew Topf

The old mining adage "grade is king" is often used to differentiate a mediocre exploration property from one that has excellent potential for being developed into a mine.

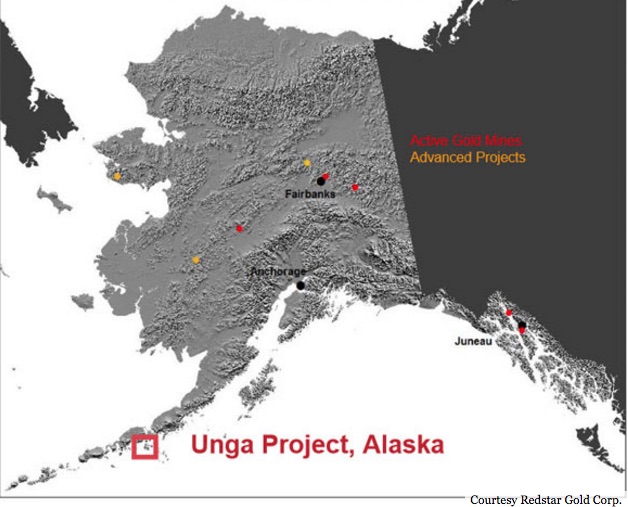

One project with a lot of eyes on it right now, not only for the grade, but other factors working in its favour, is the Unga gold project in Alaska. The property is the focus of Redstar Gold Corp (TSXV:RGC), which recently completed a 1,500-metre drill program at the 2-kilometre-long Shumagin zone. While assays are still pending, Redstar has reason to believe that there is high-grade gold throughout the zone, and along strike and at depth.

An 8-hole drill program at Shumagin in May 2015 yielded several high-grade gold intersections. Assay results included 202 grams per tonne over 1.9 metres and 35.3 g/t over 2 metres. The recently completed program comprised 7 holes, spaced over the 750-metre-long strike. According to Redstar, the program was designed to test the down-dip and along-strike expansion potential of high-grade vein and breccia mineralization at various elevations.

image: http://www.mining.com/wp-content/uploads/2016/11/Redstar2.jpg

The Unga gold project is located at the end of the Aleutian Peninsula, at the site of Alaska's first gold mine, the underground Apollo-Sitka mine.

"We are excited to report that all drill holes intersected the targeted structure, which included the intersection of multi-generational phreatomagmatic breccias, hydrothermal breccias, and late Shumagin-style breccias and veins that has been documented in previously executed drill programs to host high-grade mineralization," said Redstar president and CEO Peter Ball, in a press release announcing the completion of the three-week, $1-million drill program.

Achieving a successful drill program was one of the goals of Ball, a mining industry veteran who joined Redstar in January after working for Columbus Gold (TSV:CGT) as senior vice-president, business and corporate development. The 49-year-old has 25 years of industry experience on his resume including stints with Hudson Bay Mining & Smelting, Echo Bay Mines Ltd., RBC Dominion Securities, Eldorado Gold (TSX:ELD), Adriana Resources (TSXV:ADI) and Argentex Mining (TSXV:ADX).

In an interview with MINING.com, Ball explained how the stars are aligning for Redstar and the Unga project, which despite being early-stage, is attracting interest from institutional investors, including some influential gold funds. But first, a little history.

http://www.mining.com/stars-aligning-redstar-golds-alaska-flagship/

Read more at http://www.stockhouse.com/companies/bullboard?symbol=v.rgc&postid=25459482#cDqIK0FS2m6wrh0U.99

But the market don't like us or other gold producers as long as the US big banks keep the American dollar afloat.

News sounds positive but what bothers me is the number of outstanding shares we have.

Press release from Marketwire

INV Metals Provides Loma Larga Update

Tuesday, October 01, 2013

INV Metals Provides Loma Larga Update

07:00 EDT Tuesday, October 01, 2013

TORONTO, ONTARIO--(Marketwired - Oct. 1, 2013) - INV Metals Inc. (TSX:INV) ("INV Metals" or "Company") is pleased to announce the results of the Company's recent drill program and provide an update on the Company's 100% owned Loma Larga project ("Loma Larga", "Project" or "Property"), located in Ecuador.

Loma Larga Update

The Company's previously announced re-evaluation of the Loma Larga Project has resulted in management's determination that the Project warrants a full and detailed evaluation as a high-grade underground gold mine, which under new Ecuadorian laws may be categorized as a "medium sized" project permitted to produce up to 1,000 tonnes of ore per day.

In July, the Ecuadorian government amended its mining laws and created a new "medium sized" mining category. The regulations for the medium sized mining category have not yet been finalized by the government. However, the information released to-date indicates that underground production classified in this category would be limited to 1,000 tonnes per day or less and subject to corporate income taxes, a 4% gold and by-product royalty, value added taxes, 5% employee profit sharing, and 10% state profit sharing for social development projects. As a medium-sized mining project, the Project would not be subject to the same requirements as the large scale mining category, which include negotiating an exploitation agreement, a minimum 5-8% gold and by-product royalty, advanced royalties and windfall taxes.

The Company recently drilled two boreholes to obtain core samples for metallurgical test work. This work is on-going and is designed to test gold recoveries at various higher cut-off grades to determine the most effective cut-off grade to produce economic recoveries and a saleable concentrate. The cut-off grades contemplated by the Company are up to twice the grade previously considered. If the metallurgical test results are positive, the Company will complete a Preliminary Economic Assessment ("PEA") in order to determine whether the Project will qualify under the new medium sized mine category. A new, higher-grade resource estimate will also be prepared pending the results of the metallurgical test work.

Upon the completion of a positive PEA, the Company plans to conclude discussions with the Ecuador government to obtain approval for the classification of the Project as a medium sized mine and, pending receipt of such approval, will proceed to advance the Project.

Robert Bell, CEO of the Company, stated, "We are very pleased with this new smaller, higher-grade approach to making Loma Larga an economically robust project and working with the Ecuadorian government to move the project forward for the benefit of its stakeholders and the people of Ecuador."

The Company has and is continuing to scale back expenditures in Ecuador until such time that the Company completes a positive PEA and receives approval for the qualification of the Loma Larga project under the new medium sized mining category.

INV Metals' unaudited cash balance as of September 30, 2013, was approximately $20.7 million.

Exploration Update and Drill Results

The Company has completed the first phase of the Loma Larga drill program, which consisted of 12 diamond drill holes totalling 3,684.7 metres including two holes drilled for metallurgical test work, three holes to further define the high-grade zone and seven holes to test step-out targets to extend the deposit. No further drilling is planned on the Property until clarification is received on the medium sized mining category.

Drilling in High-Grade Zone (see Table 1)

Holes LLD-371 and 372 were drilled to obtain material for metallurgical test work. The metallurgical drilling in the high-grade zone clearly demonstrates that the Loma Larga gold deposit contains a high-grade core surrounded by a lower grade halo. For example, hole LLD-371 intersected 77 metres grading 13.7 g/t gold, including 20 metres grading 34 g/t gold and LLD-372 intersected 36.5 metres grading 11.8 g/t gold including 6.3 metres grading 47.7 g/t gold. This drilling not only provided samples for metallurgical testing but also confirmed management's view that Loma Larga warrants detailed evaluation as a lower tonnage, higher grade mining operation.

Holes LLD-373 to 375 were drilled to better define the margins of the high-grade zone.

Step-out Drilling (see Table 2)

The objective of the step-out drill program was to expand the gold resource in areas where the deposit is open and untested, including a regional target referred to as Loma Larga West, and deeper holes to test for stacked lenses at depth beneath the main zone. The areas for expansion were identified by the Company during a comprehensive and detailed geological review. The results of the step-out drilling indicate that the prospectivity of the regional area within the Property remains encouraging.

The first hole, LLD-364, was drilled as an 85 metre step-out north of the resource and 40 metres north of a significant gold intersection from a historic drill hole. The hole intersected 15.5 metres grading 3.1 g/t gold, 148.4 g/t silver, and 0.98% copper.

Four drill holes, LLD-365 to 368, tested the Loma Larga West target, a 1.2 kilometre long north-northwest trending zone parallel to and west of the known resource. The target has a magnetically low signature similar to that of the Loma Larga deposit with positive drill results in historic drilling at both ends of the magnetic anomaly, with no drilling in the intervening 1.2 kilometre target. The most significant zone of mineralization was intersected in hole LLD-367 which contained 4.9 g/t gold, 48.7 g/t silver, and 0.51% copper over a core length of 25.1 metres, including 11.9 g/t gold, 78.7 g/t silver and 0.33% copper over 6.2 metres. This intersection is located approximately 165 metres north of the northern limits of the resource and additional drilling is required to determine if the mineralization is a continuous extension of the main resource. Hole LLD-365 intersected 13.6 metres grading 3.8 g/t gold, 19.6 g/t silver, and 0.14% copper while hole LLD-368 intersected 6.0 metres grading 3.7 g/t gold, 33.2 g/t silver and 0.33% copper.

Hole LLD-369 was drilled to 422.1 metres on the eastern side of the deposit, 75 metres outside of the resource, to test a northwest-southeast trending structure, and to follow up a significant, historic drill hole intersection excluded from the resource. The best intersection in LLD-369 was 3.0 metres grading 2.3 g/t gold, 3.0 g/t silver, and 0.19% copper.

LLD-370 was drilled to 402.3 metres to test for potential stacked lenses below the two main lenses within the resource, in a 350 metre long gap with no drilling between two historic drill holes with gold mineralized intersections. Above the target horizon, two main zones were intersected containing 46.5 metres grading 2.8 g/t gold, 8.0 g/t silver and 0.06% copper, which included 14.0 metres grading 4.3 g/t gold, 13.8 g/t silver, and 0.11% copper, and 22.7 metres grading 5.3 g/t gold, 19.4 g/t silver, and 0.23% copper. The deeper target horizon returned 4.3 metres grading 2.4 g/t gold, 4.6 g/t silver and 0.28% copper, and 2.0 metres grading 4.3 g/t gold, 14.5 g/t silver, and 1.3% copper.

Table 1 - Metallurgical and High Grade Drill Results

True

Hole

From

To

Width

Width*

Au

Ag

Cu

(m)

(m)

(m)

(m)

(g/t)

(g/t)

(%)

LLD-371

105.00

182.00

77.00

77.00

13.65

40.15

0.52

including

132.00

152.00

20.00

20.00

33.95

98.84

1.23

and

158.00

163.00

5.00

5.00

12.21

24.96

0.36

LLD-372

142.50

179.00

36.50

36.50

11.80

79.57

0.93

including

170.00

176.30

6.30

6.30

47.72

217.32

3.32

LLD-373

48.50

54.86

6.36

6.36

1.66

8.54

0.12

166.50

171.00

4.50

4.50

10.36

57.30

2.90

including

167.50

168.60

1.10

1.10

38.20

214.90

11.21

LLD-374

53.40

69.00

15.60

15.60

2.73

15.69

0.77

including

56.40

60.40

4.00

4.00

4.65

30.48

1.29

and

65.00

69.00

4.00

4.00

4.46

5.59

1.00

133.50

146.00

12.50

12.50

2.81

15.58

0.24

including

133.50

137.00

3.50

3.50

5.14

34.00

0.50

and

143.80

146.00

2.20

2.20

5.01

14.44

0.43

LLD-375

124.00

162.00

38.00

37.90

3.27

55.65

0.23

including

155.00

162.00

7.00

7.00

6.83

131.21

0.19

and

128.00

131.00

3.00

3.00

6.60

48.10

0.14

*True Width is an estimation taking into account both the dip of the borehole and the interpreted dip of the mineralized zone of 10° to the west.

Table 2 - Regional Drill Results

True

Hole

From

To

Width

Width*

Au

Ag

Cu

(m)

(m)

(m)

(m)

(g/t)

(g/t)

(%)

LLD-364

158.25

173.73

15.48

13.80

3.12

148.40

0.98

including

158.25

163.00

4.75

4.20

6.42

319.60

2.34

including

158.25

160.00

1.75

1.60

10.95

535.70

4.49

LLD-365

293.40

307.00

13.60

12.10

3.81

19.62

0.14

including

297.05

306.00

8.95

8.00

4.57

20.95

0.18

LLD-366

249.10

249.93

0.83

0.70

6.47

2.10

0.01

LLD-367

218.70

243.84

25.14

23.90

4.87

48.70

0.51

including

221.85

228.00

6.15

5.90

11.90

78.70

0.33

LLD-368

251.00

257.00

6.00

5.80

3.72

33.23

0.33

including

252.00

255.00

3.00

2.90

4.46

30.23

0.33

LLD-369

260.00

262.55

2.55

**

1.16

3.70

0.42

299.00

302.00

3.00

**

2.28

3.00

0.19

LLD-370

86.00

132.50

46.50

44.65

2.77

8.00

0.06

including

87.00

92.00

5.00

4.80

5.89

9.22

0.08

and

112.00

126.00

14.00

13.40

4.33

13.83

0.11

including

113.00

117.00

4.00

3.80

5.32

22.88

0.16

137.00

159.70

22.70

21.80

5.28

19.40

0.23

including

138.00

142.00

4.00

3.80

12.64

23.93

0.42

341.75

353.00

11.25

**

1.68

5.48

0.19

including

341.75

346.00

4.25

**

2.42

4.59

0.28

377.00

379.00

2.00

**

4.28

14.50

1.32

*True Width is an estimation taking into account both the dip of the borehole and the interpreted dip of the mineralized zone of 10° to the west.

**For these intersections true width cannot currently be estimated as the mineralized intercepts are possibly along structural feeders of unknown inclination.

An updated corporate presentation is available on the Company's website at www.invmetals.com which provides graphics for the drill program.

Loma Larga

The Loma Larga deposit is a high sulphidation epithermal gold-copper-silver deposit with an Indicated Mineral Resource containing a high grade core of 2.1 million ounces grading 6.3 g/t gold, surrounded by a lower grade shell hosted by volcanic flows and volcaniclastics for a total Indicated Mineral Resource estimated at 3.3 million ounces gold within 32.6 million tonnes grading 3.2 g/t gold, 22 g/t silver and 0.20% copper, with an Inferred Mineral Resource estimated at 0.2 million ounces gold within 2.3 million tonnes grading 2.2 g/t gold, 27 g/t silver and 0.22% copper, both at an NSR cut-off value of US$22/tonne, equivalent to approximately a 0.4 g/t gold cut-off. The deposit is a flat lying, north-south striking, cigar shaped body, which is considered to be amenable to both open pit and underground mining scenarios. The mineralized zone hosting the resource has a strike length of approximately 1,600 m north-south by 120 m to 400 m east-west and up to 60 m thick beginning approximately 120 m below surface. (See the Company's Technical Report titled "Technical Report on the Quimsacocha Project, Azuay Province, Ecuador", dated July 18, 2012, prepared in accordance with National Instrument 43-101 ("NI 43-101") by Wayne W. Valiant, Katharine M. Masun, and John T. Postle, all Qualified Persons as defined under NI 43-101, which is available on the Company's website at www.invmetals.com and the Company's profile on www.sedar.com).

Dr. Matthew Gray, a Certified Professional Geologist with the American Institute of Professional Geologists and an independent consultant to INV Metals, is a "qualified person" as such term is defined in NI 43-101 and has reviewed and approved the technical information and data related to the Project included above. Sample preparation was carried out by Inspectorate Del Ecuador at their laboratory in Quito, Ecuador, and analyses were completed at Inspectorate's analytical laboratory in Lima, Peru. For further information on the Company's Quality Control - Quality Assurance program, please see the Company's second quarter 2013 Management's Discussion and Analysis available on its website at www.invmetals.com and on its profile at www.sedar.com.

About INV ™ Metals

INV™ Metals is an international mineral resource company focused on the acquisition, exploration and development of base and precious metal projects in Ecuador, Namibia, and Brazil. Currently, INV™ Metals' primary assets are: (1) its 100% interest in the Loma Larga (formerly Quimsacocha) gold property in Ecuador, (2) its 35% interest in the Kaoko property, located in Namibia and (3) its 50% interest in the Rio Novo southern claims, located in Brazil.

I enjoyed reading Portee's shannigans, he will sorrowly be missed by many as he was the one that kept most people glued to the sites to see what he was going to say next. Gone but not forgotten. Everytime I hear the word Ripple I will think of you. Bye for now.

Joe (Jokal)

We're told the American economy is booming again, American banks making money, US house prices on the rise so why not get involved in another loss-loss situation, Syrian government probably purchased the poison from an American company in the first place. Soon it will be time for Obama to purchase another printing machine, and print more money, China can't say anything as they hold a whack of greenbacks and can't afford the dollar to collapse or they loss too. Come on AR lets go...my rant LOL

Gold can't stay down? Sure it can, as long as big investors/banks want us to beleive the US economy is rosie, doomsday for the Euro, China having inflation troubles, leaving the US dollar as the currency of flavour, we may even see gold test the $1200-1300 range. Once the big boys filled their pockets up then we will see a jump, till then we're screwed.