flyers7477's Profile

flyers7477's Posts

What do you think is going on with bto the last 2 weeks shorts having their way maybe

Hey cockerel1 take a pill , life is short ,sure we are living in interesting times but life is what you want to make of it ,you really seem to be on the edge these last couple of years ,I understand you are a senior enjoy whats left man

Senator and CIA Insider Accuse Federal Reserve of Covering Up Secret Bankruptcy

By MONEY MORNING STAFF REPORTS

Is the Federal Reserve covering up a dangerous crisis that threatens to bring down, not just the United States, but the entire global economy?

According to two men, one a high-ranking member of the U.S. Intelligence Community, and the other, a 2016 Presidential hopeful, the answer is yes.

They both believe the world's most powerful central bank is secretly bankrupt and Fed Chairwoman Janet Yellen will do whatever it takes to keep the public in the dark about this startling situation.

If they're correct, every American should fear the unavoidable endgame their evidence is predicting.

Recently, in an emotional speech from the Senate floor, Senator Rand Paul declared that the Federal Reserve is now "insolvent."

Senator Paul has long been an advocate of an official audit of the Fed's books, which polls show 74% of the American people agree with.

And in a separate statement he explained why.

"The Fed's operations under a cloak of secrecy have gone on too long and the American people have a right to know what the Federal Reserve is doing with our nation's money supply," Senator Paul declared.

And an unlikely ally has stepped forward to help him provide the public with the answers they are seeking.

The Secret Fed Gamble

That Could Kill the Dollar

An alarming pattern has caused many in the Intelligence Community to secretly prepare for a "worst-case scenario." Click here to see it....

Unfortunately, they are downright frightening.

Jim Rickards is the CIA's Financial Threat and Asymmetric Warfare Advisor.

In an exclusive interview with Money Morning, Rickards revealed that he and his team have detected a series of dangerous economic signals that predict a fast-approaching $100 trillion meltdown.

And they believe it will lead to an event more severe than the 1930s.

A 25-year Great Depression.

Their estimated date for this catastrophe is March 3, 2015.

Making matters worse, they believe it is impossible to stop.

Rickards shared an alarming collection of charts in the discussion that proved our country has secretly reached, or exceeded, crisis levels in our stock market, with our dollar, and banking system that are more severe than in 1929.

Frightening: This chart reveals which banks could collapse (and how soon). If your life savings is in a major bank, please look at this now.

He examined two charts in particular that specifically place much of the blame for this on the Federal Reserve.

"What you can see from this first chart is that for over a decade the Federal Reserve steadily grew its capital reserves. Even after the recession struck, on the surface at least, they kept strengthening their financial backing," he explained.

"And today they have over $56.2 billion of cash on hand. $56.2 billion sounds like a lot of money, but it's not the full picture."

"You have to compare the cash the Federal Reserve has on hand with the debt they've taken on since the recession. And when you do the picture becomes a lot scarier, because that figure is $4.3 trillion," Rickards continued.

"So you have $56.2 billion propping up $4.3 trillion worth of debt. That means the Fed is leveraged 77-1. Prior to our 2008 meltdown that was only 22-1."

"To folks like me at the CIA that says one thing, the whole thing is unstable and it's ready to explode," he warned.

Editor's Note: Money Morning has released their exclusive interview with Jim Rickards to the public. And it's a must-see for every American who is concerned about our country and their financial security. Click here to view it.

Rickards then cited two private meetings he held with Federal Reserve officials that suggested they know this too.

"I spoke to a member of the Board of Governors of the Federal Reserve, (name withheld), and said to her I think the Fed is insolvent," Rickards revealed.

"She refused to answer the question directly initially, but I pressed her and she said, 'we are but it doesn't matter'."

Rickards' second meeting explained why this high-ranking Fed board member came to that conclusion.

"I was at a recent conclave in the Rocky Mountains with officials from the Federal Reserve and the Bank of England. They'll say things in private that they won't admit publicly," Rickards explained.

"They handed me a copy of Janet Yellen's playbook. And while a lot of Americans have no idea what her big plans are, this playbook revealed everything. It's more of the same. She's going to just keep printing money."

"Don't ever think the Fed knows what they're doing. They can print all the money they want, but if people aren't using it in the economy than it is going to collapse."

What makes Rickards' and Paul's alliance so unusual is that Senator Paul is no fan of the CIA.

Details of Government's

"Day After Plan" Emerge

Warning: Emergency measures have already been put "in play" for this

25-year Great Depression.

Click here to continue....

During a marathon, 13-hour filibuster he successfully halted the appointment of the new director of the Central Intelligence Agency. He cited the public's need to be made aware of the White House and intelligence community's use of drones as the reason for his actions.

However, this has not stopped Rickards and Paul from uniting on what Rickards believes is the greatest threat to our country.

In fact, in a Treasury meeting, Rickards accused both the Fed and Treasury of being more dangerous to the United States' national security than Al-Qaeda or any rival nation.

And Senator Paul has cited Rickards' work in numerous speeches and in his official budget proposal for the year where he warned that our central bank was leading us towards a "Roman Empire-like collapse."

Which is a conclusion that Rickards and many of his colleagues agree with.

A startling report containing the consensus view of all 16 branches of the U.S. Intelligence Committee has revealed that these agencies have begun to estimate the impact of "The fall of the dollar as the global reserve currency."

And our reign as the leading superpower being annihilated in a way "equivalent to the end of the British Empire in the post-World War II period."

The question we should all be asking ourselves now is "what if they're right?"

Editor's Note: For a limited time, you can view Rickards' interview and claim a free copy of his New York Times best selling book, The Death of Money. Click here to continue...

What 10-Baggers (and 100-Baggers) Look Like -

by Clark March 7, 2014

Now that it appears clear the bottom is in for gold,

it’s time to stop fretting about how low prices

will drop and how long the correction will last and

start looking at how high they’ll go and

when they’ll get there.

When viewing the gold market from a historical perspective,

one thing that’s clear is that the junior mining stocks

tend to fluctuate between extreme boom and bust cycles.

As a group, they’ll double in price, then crash by 75%...

then double or triple or even quadruple again, only to

crash 90%. Boom, bust, repeat.

Given that we just completed a major bust cycle and not

just any bust cycle, but one of the harshest on record,

according to many veteran insiders the setup for a major

rally in gold stocks is right in front of us.

This may sound sensationalistic, but based on past

historical patterns and where we think gold prices are

headed, the odds are high that, on average, gold

producers will trade in the $200 per share range

before the next cycle is over.

With most of them currently trading between $20 and

$40, the returns could be stupendous.

And the percentage returns of the typical junior will

be greater by an order of magnitude, providing

life-changing gains to smart investors.

What you’re about to see are historical returns of both

producers and juniors during three separate boom cycles.

These are factual returns; they are not hypothetical.

And if you accept the fact that this market moves in

cycles, you know it’s about to happen again.

Gold had a spectacular climb in 1979-1980, and gold

stocks in general gave a staggering performance at

that time many of them becoming 10-baggers

(1,000% gains and more).

While this is a well-known fact, few researchers have

bothered to identify exact returns from specific

companies during this era.

Digging up hard data from before the mid-1980s,

especially for the junior explorers, is difficult

because the information wasn’t computerized at the time.

So I sent my nephew Grant to the library to view

the Wall Street Journal on microfiche.

We also include information we’ve had from

Scott Hunter of Haywood Securities; Larry Page,

then president of the Manex Resource Group;

and the dusty archives at the Northern Miner.

Note: This means our tables, while accurate, are not

at all comprehensive.

Let’s get started…

The Quintessential Bull Market: 1979-1980

The granddaddy of gold bull cycles occurred during the

1970s, culminating in an unabashed mania in 1979 and 1980.

Gold peaked at $850 an ounce on January 21, 1980, a rise

of 276% from the beginning of 1979.

(Yes, the price of gold on the last trading day of 1978

was a mere $226 an ounce.)

Here’s a sampling of gold producer stock prices from

this era.

What you’ll notice in addition to the amazing returns

is that gold stocks didn’t peak until nine months

after gold did.

Keep in mind, though, that our data measures the exact

top of each company’s price.

Most investors, of course, don’t sell at the very peak.

If we were to able to grab, say, 80% of the climb,

that’s still a return of 231.6%.

Here’s a sampling of how some successful junior gold

stocks performed in the same period, along with the

month each of them peaked.

If you had bought a reasonably diversified portfolio

of top performing gold juniors prior to 1979, your

initial investment could have grown 23 times in just

two years.

If you had managed to grab 80% of that move, your

gains would still have been over 1,850%.

This means a junior priced at $0.50 today that

captured the average gain from this boom would sell

for $12 at the top, or $9.75 at 80%.

If you own ten juniors, imagine just one of them

matching Copper Lake’s better than 100-bagger

performance.

Here’s what returns of this magnitude could mean to you.

Let’s say your portfolio includes $10,000 in gold

juniors that yield spectacular gains such as the above.

If the next boom cycle matches the 1979-1980 pattern,

your portfolio could be worth $241,370 at its peak…

or about $195,000 if you exit at 80% of the top prices.

You have to play the cycle.

Returns from that era have been written about before,

so I can hear some investors saying,

“Yeah, but that only happened once.”

Au contraire. Read on…

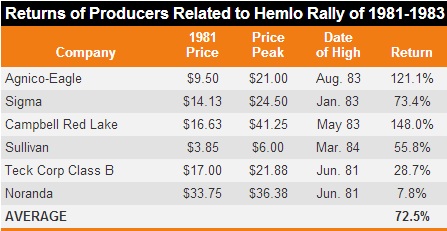

The Hemlo Rally of 1981-1983

Many investors don’t know that there have been several

bull cycles in gold and gold stocks since

the 1979-1980 period.

Ironically, gold was flat during the two years of

the Hemlo rally.

But something else ignited a bull market.Discovery.

Here’s how it happened…

Back in the day, most exploration was done by teams

from the major producers.

But because of lagging gold prices and the resulting

need to cut overhead, they began to slash their

exploration budgets, unleashing a swarm of experienced

geologists armed with the knowledge of high-potential

mineral targets they’d explored while working

for the majors.

Many formed their own companies and

went after these targets.

This led to a series of spectacular discoveries,

the first of which occurred in mid-1982, when

Golden Sceptre and Goliath Gold discovered

the Golden Giant deposit in the Hemlo area of

eastern Canada.

Gold prices rallied that summer, setting off a

mini bull market that lasted until

the following May.

The public got involved, and as you can see,

the results were impressive for such a short

period of time.

Gold producers, on average, returned over 70% on

investors’ money during this period.

While these aren’t the same spectacular gains from

just a few years earlier, keep in mind they occurred

over only about 12 months’ time. This would be akin

to a $20 gold stock soaring to $34.50 by this time

next year, just because it’s located in a

significant discovery area.

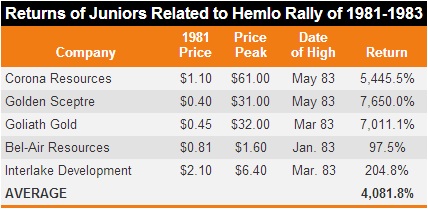

Once again, it was the juniors that brought the

dazzling returns.

The average return for these junior gold stocks that

had a direct interest in the Hemlo area exceeded

a whopping 4,000%.

This is especially impressive when you realize that

it occurred without the gold stock industry as a

whole participating.

This tells us that a big discovery can lead to

enormous gains, even if the industry as

a whole is flat.

In other words, we have historical precedence that

humongous returns are possible without a mania,

by owning stocks with direct exposure to

a discovery area.

By May 1983, roughly a year after it started, gold

prices started back down again, spelling the end

of that cycle—another reminder that one must sell

to realize a profit.

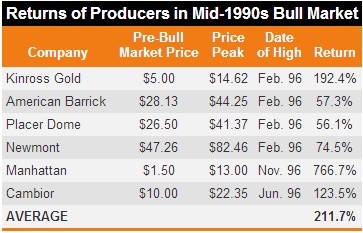

The Roaring ’90s

By the time the ’90s rolled around, many junior

exploration companies had acquired the

“intellectual capital” they needed from the majors.

Another series of gold discoveries in the mid-1990s

set off one of the most stunning bull markets

in the current generation.

By the summer of ’96, these discoveries had sparked

another bull cycle, and companies with little more

than a few drill holes were selling for $20 a share.

The table below, which includes some of the better

known names of the day, is worth the proverbial

thousand words.

The average producer more than tripled investors’

money during this period.

Once again, these gains occurred in a relatively

short period of time, in this case inside

of two years.

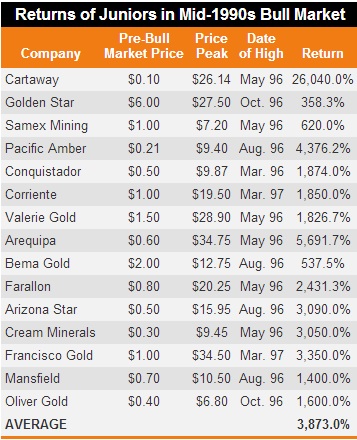

Here’s how some of the juniors performed.

And if you’re the kind of investor with the courage

to buy low and the discipline to sell during a frenzy,

it can be worth a million dollars.

Hold on to your hat.

Many analysts refer to the 1970s bull market as the

granddaddy of them all—and to a certain extent it

was but you’ll notice that the average return of

these stocks during the late ’90s bull exceeds what

the juniors did in the 1979-1980 boom.

This is akin to that $0.50 junior stock today reaching

$19.86… or $16, if you snag 80% of the move.

A $10,000 portfolio with similar returns would grow

to over $397,000 (or over $319,000 on 80%).

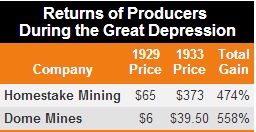

Gold Stocks and Depression

Those of you in the deflation camp may dismiss all

this because you’re convinced the Great Deflation

is ahead.

Fair enough. But you’d be wrong to assume gold stocks

can’t do well in that environment.

Take a look at the returns of the two largest

producers in the US and Canada, respectively,

during the Great Depression of the 1930s,

a period that saw significant price deflation.

During a period of soup lines, crashing stock

markets, and a fixed gold price, large gold

producers handed investors five and six times

their money in four years.

If deflation “wins,” we still think gold equity

investors can, too.

How to Capitalize on This Cycle

History shows that precious metals stocks move

in cycles.

We’ve now completed a major bust cycle and,

we believe, are on the cusp of a tremendous boom.

The only way to make the kind of money outlined

above is to buy before the boom is in full swing.

That’s now. For most readers, this is literally

a once-in-a-lifetime opportunity.

As you can see above, there can be great variation

among the returns of the companies.

That’s why, even if you believe we’re destined for

an “all-boats-rise” scenario, you still want

to own the better companies.

What if you invest in 'Caledonia Mining Corporation

and it become a LION -

ex. in 1975?..

take a look at the past gains in a few juniors:

$GOLD INDX Chart TA TI P&F Alert Bullish Price Objective $2,040.0 / oz

CAL Chart TA TI P&F Alert Bullish Price Objective $3.63 / oz

Caledonia Mining Corp. -

CALVF:NASDAQ - TSE:CAL - CMCL Aim London -

Ex.

Let's focus on what more makes CAL a better buy than almost

any other gold stock out there -

ex...a few...

Caledonia Blanket Gold Mines enjoy Zimland corp. taxes

are 25% and its only

about half of US & Can bolshevistic 50% taxes +

Blanket Gold Mines have much less than half of

the high labour cost in US & Can.

Note.

all producers on the list have higher gold prod. cost than

Caledonia Mining's low prod. cost @ $554/oz -

CAL paying a dividend every quarter to the shareholders -

Fyi. do a dd...for a low cost gold mines producer with

very low labour cost and taxes....

Caledonia Mining Corp. -

CALVF:NASDAQ - TSE:CAL - CMCL Aim London -

CAL Blanket Gold Mines enjoy “Cash costs $554/oz at

the Gold mine are running

at $554/oz - one of the lowest cost -

gold producers in the world -

which positions the CAL company well to keep

generating cash to self-fund expansion and

CAL paying dividends every quarter to shareholders -

CAL has more than $25 million in cash in

Western London banks and NO DEBT -

http://www.commodity-tv.net/c/mid,21943,Mines_und_Money_London_2013/?v=252888

http://www.brrmedia.co.uk/event/119251/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=95869580

CAL / CALVF employ more than 1000 happy miners -

who got 15% ownership in Blanket Gold Mines -

the miners work very good for they work

for them self -

ex...Zimland corp. taxes are 25% and its only

about half of US & Can bolshevistic 50% taxes +

Blanket Gold Mines have less than half of

the high labour cost in US & Can. -

CAL Blanket Gold Mines enjoy the kind best mining

weather and it has produced gold since 2000yrs back -

Kingdoms of Africa - Great Zimbabwe -

http://www.youtube.com/watch?v=AyKrTdv-t4E

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=96263045

The ruins of Great Zimbabwe – the capital of the Queen of Sheba -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67548731

Au-Kingdom -

E.g.,

Hi sinbob ,I too have been here for many years since approx 2006 747flyers was my handle then and on stockhouse before that.I was not happy about the merger and stated my opinion here many times only to have my posts removed and critisized.

My posts were removed because I did not agree with one of the hub leaders and got fed up and closed my account.I joined agoracom a couple months back probably not a good idea,only because I had to say once more that I was wondering how someone could still be defending this company whenever there was a negative comment made about it.

I do apologize to you ,I think you have earned the right to go offside here , everyone's certainly responsible for their own investment decisions.

I thought and still do believe the post should have been removed,only because of the respect and knowledge that you have shown on these boarde over the years ,some here would have taken the advise.

Most here have suffered far too much already ,you could well be correct on the sell aum call, but only time will tell ,it was a very bold call but after reading the posts again I could almost feel the anger and disappontment in what has been going on in these markets for so long ,do not think for a minute that myself and many others do as well.

I just want to mention that I have always enjoyed your posts and agree with most, not sure of your profession but you are a talented writer.

take care and good luck

"Sell all your AUM and buy BG:V (Barisan Gold) tomorrow. Don't wait. You can trust me. This breaks all 'the rules' and goes against all my scruples. History will prove me on this one. I have never done tis before over 14 years of posting except inboxing. I hold shares BG "

This was posted by sinbob January 5 and I reported it as a violation and then since it was not removed I emailed them asking why it was allowed to remain no responce as yet , well January 5 AUM was selling for .60 and Bg was selling for .33 today January 9 AUM selling for .75 and Bg selling for .19 I hope no one took this advice but I am sure there were some that did this should not have been allowed on this AUM board IMO