Rocket Man's Profile

Rocket Man's Posts

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Questerre Energy Corporation (OTCPK:QTEYF), an independent energy company, which engages in exploration and production of non-conventional oil & gas resources, has witnessed a 69% upside in 2013. The rally is not speculative and is backed by strong fundamental factors. This research discusses the factors for the upside in 2013 and the reasons for concluding that the stock can rally another 70% with a one-year time horizon.

More on Questerre Energy's Assets

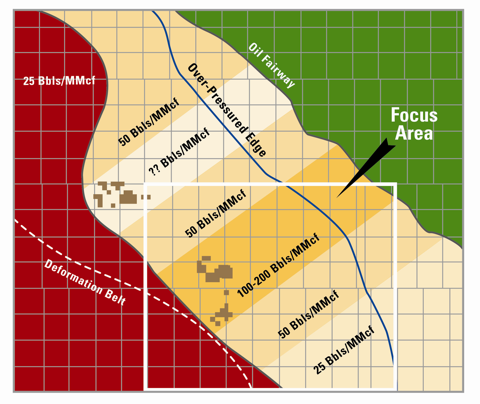

The assets of Questerre Energy are primarily non-conventional oil & gas resources. One of the primary assets of the company is located in the Kakwa-Resthaven area. The area is prospective for liquids-rich natural gas in the deep, over-pressured fairway of the Montney shale at a depth of approximately 3,100m to 3,600m. The company holds an average 76% working interest in 37,600 acres in this area. What is important to mention here (and will be discussed later in details) is that the company's activity has targeted a sweet spot where the natural gas liquids range as high as 195bbls/MMcf.

Through its equity investment in Red Leaf Resources (a private Utah-based oil shale and technology company), Questerre has acquired an interest in two oil shale projects in Utah and Wyoming. The 6% equity capital of Red Leaf has been acquired for a consideration of $41 million and it gives Questerre Energy licensing rights to the EcoShale In-Capsule process and a 20% working interest in oil shale acreage in Wyoming.

Questerre Energy and its partner Talisman Energy (TLM) also have interest in the St. Lawrence Lowlands between Montréal and Québec City. According to the company's presentation, the acreage has 18 Tcf prospective recoverable resources (4.4 Tcf net to Questerre Energy). The area is currently undergoing a strategic environmental assessment and I will not consider the asset in my valuation at this point of time. The reason being that monetisation of the asset will take time and it might be too early for the stock to discount the growth from the asset.

Questerre Energy also has 100% interest in approximately 39,000 high-graded acres at Pasquia Hills. The company drilled 16 wells in the interest in 2012 with good quality shale encountered in all the wells drilled. The company's production from Saskatchewan was 413 boepd as of 3Q13.

Valuing The Montney acreage - Taking cues from the recent Talisman deal

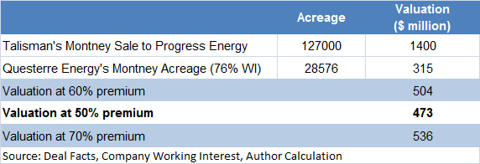

As mentioned earlier, the Montney acreage (76% working interest in 37,600 acres) is one of the primary assets of the company. Valuing the asset can give an important direction towards valuing Questerre Energy. My job is relatively simplified by a recent deal by Talisman Energy to sell Montney assets to Progress Energy Canada for $1.4 billion. The sale involves a total acreage of 127,000 with the company still retaining 48,000 acres of prospective Montney land.

Before I use this deal as an indicator to value Questerre Energy's assets, I must point out here that the valuation of the asset depends largely on the average liquid content in the acreage. Higher the liquid content, the better would be the valuations. According to Talisman Energy's third quarter news release:

In the Montney, Talisman initiated a 27-well completion program in Farrell Creek. The company is operating two drilling rigs targeting the liquids-rich area of the play. Recent completions have shown a 40 bbls/mmcf condensate-to-gas ratio on test.

In sharp contrast to this, Questerre Energy's acreage is in a sweet spot and exploration results over the past one year have shown that the liquid content in the acreage ranges between 100 bbls/mmcf to 200 bbls/mmcf.

Going back the timeline, which will also explain the company's 104% rise in share price in 2013, the first Montney well had an average condensate to natural gas rate of 100 bbls per mmcf. The second well, which wastested in January 2013, had an average condensate to natural gas ratio of 200 bbls per mmcf. Most recently, the company fifth liquid rich Montney well tested at 1,400 boepd and had an average condensate to natural gas rate of 195 bbls/mmcf.

These results point to a conclusion that Questerre Energy's Montney asset will command a significant premium compared to Talisman Energy's assets based on the condensate to natural gas rate. Below is the valuation of Questerre Energy's acreage considering the Talisman deal as a ball-park valuation estimate and assigning a premium for a higher liquid condensate.

Based on the stake sale by Talisman Energy, Questerre Energy's 28,576 acres of working interest area should be valued at approximately $315 million. The significant point here is the premium that needs to be assigned to the company's assets, which have a significantly higher condensate to natural gas ratio. The best idea is to consider a scenario analysis with different premiums assigned over the base valuation. I must also mention here that I have taken conservative premiums to stress test the valuation in case of lower oil prices. Even if I consider that the average condensate to natural gas ratio is 80 bbls per mmcf over the acreage and oil prices witness a 10-15% decline from current levels, I can still assign a 50% premium to the acreage over the Talisman deal. The valuations can be significantly higher and I would therefore look at a 60% premium and a 70% premium as well. The base case scenario would however be a 50% premium over the Talisman deal.

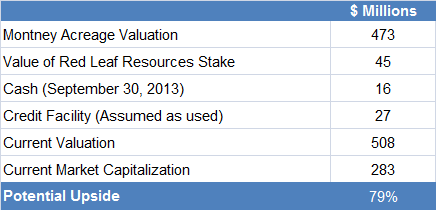

Based on the base deal and the premium assigned, Questerre Energy's Montney acreage has a rough valuation of $470 million.

The Red Lead Resources Stake Valuation

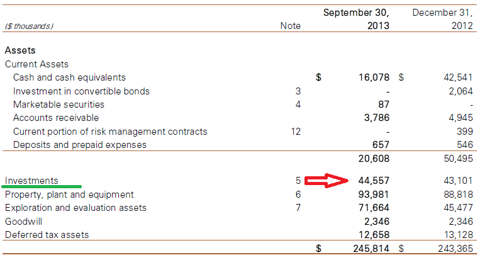

As mentioned earlier, Questerre Energy had bought a nearly 6% stake in Red leaf Resources for a consideration of $41 million. The stake is shown in the company's balance sheet as investments and has a current value of $44 million. To be as conservative as possible, the stake can just be valued at the same assuming that Questerre Energy puts up the stake for sale.

A deeper look into the stake and the participating players does lead to a conclusion that the valuation of the 6% stake in Red Leaf Resources will increase going forward. The confidence comes from the presence of oil major, Total S.A. (TOT) in the joint venture. I must remind readers that Total had acquired its stake in the Utica Shale from Chesapeake Energy (CHK) in 2012 for $2.3 billion. The company has been active in shale resources, which potentially contain more than ten times the resources of oil sands.

Coming to the current joint venture, the press release related to the JV states:

Red Leaf and Total intend to launch an advanced commercial scale project on approximately 11,000 acres of jointly owned oil shale leaseholds that are estimated to contain several hundred million barrels of recoverable hydrocarbons. Total will also fund an 80 percent share of the first $200 million of the commercial production phase of operations. As part of this agreement, Total has the right to license the EcoShale™ technology for use on other future oil shale projects worldwide and has become a shareholder in Red Leaf Resources, Inc.

The most important point here relates to the funding for development of the resource. With Total making a major contribution, the development will not face funding issues and should start creating value for stake holders in 2014 and beyond when the first commercial scale production is expected to be initiated. For now, I will assume that the stake has a value of $45 million.

I have not initiated any discussion for St. Lawrence Lowlands as the asset will take time for monetization and the value of the assets might not be discounted immediately in the stock. However, the Montney asset should provide a revenue bump-up in 2015 and 2016. For the same reason, I have considered a one-year time horizon for the valuation gap to be filled. On considering the current market capitalization and the valuation of two prime assets, the case for a 70% upside is established.

I must mention that the company has no debt on its books. I have considered the $26.5 million undrawn facility as used for my valuation assumption.

Risk Factors

Risk One - One of the primary concerns related to non-conventional energy resources is the impact on the environment. Change in regulations on this front can result in cost escalation or delay in projects and potentially impact the growth.

Risk Two - The Montney acreage will require more funding in the future for development. While Questerre has sufficient financial bandwidth, any dilution of equity can impact valuations on the downside.

Risk Three - The company's projects have a relatively high breakeven price. If oil prices ease due to a decline in tensions in the Middle East, growth can be impacted. I have however incorporated lower oil prices in my assumption and valuation of Montney assets.

Conclusion

Questerre Energy still has a lot of potential in terms of stock price upside as well as in terms of growth related to the company's assets. The 69% upside in 2013 is just the beginning of a long-term uptrend in the stock. In the immediate future, the stock has another 70% upside based on its asset valuation. This is a conservative view and hence the stock is a strong buy at these levels. As the Montney asset development continues, the stock will completely price in the potential. The investment in Red Leaf Resources can potentially trigger another wave of upside and the developments in that asset need to be monitored before a re-rating.

Well stated Foggy

Why the rest of Canada tolerates the existence of the PQ party when their underlying mandate is to seperate, especially when considering the amount of money they receive as a handout is beyond me.

That said and getting back to topic, l can't for the life of me believe that the PQ is not going to endorse the SEA recommendations if they are positive given the money at stake.

Politically speaking it is a win win scenario for them

Rocket

Nice find Canuck !

Nice to see that the industry is responding to the extremely misleading facts of Gasland.

Rocket

Rocco

Exactly!

Five yrs from now the taxes/royalties will be rolling into the QC coffers along with all the added liquidity from the thousands of new jobs and everybody will be wondering what all the fuss was about.

Rocket

Rocco

The appointment and timeline of the SEA committee was undoubtely decided on and controlled by the Charest government, unfortunately due to misinformation by the activists this became a hot political potato, therefore what better way to diffuse the issue, you both delay and control the timeline of the SEA decision to coinside with the timeline of the upcoming election, all the politicians do this, or at least try to.

IMHO the SEA will give the green light to this play, the scientific evidence can"t be denied

Rocket

Enclosed is a tidbit from the Financial Post

MONTREAL — A small regional college is quietly moving ahead with Quebec’s first oil and gas service industry training program in a bid to develop a local pool of expertise for the province’s nascent energy sector.

But its graduates may never get jobs at home.

Quebec has de-facto moratoriums in place on all oil and gas activity in a portion of the Gulf of St. Lawrence as well as on shale gas exploration and drilling while environmental evaluations run their course. And although the current Liberal government has made clear it wants to move ahead with commercialization as a way to generate much-needed public revenues, there is no guarantee the environmental panels will give their assent or that the next government (to be elected by late 2013 at the latest) will similarly back the industry.

For the time being at least, telling people you’re training to work in an oil and gas field in Quebec is like telling them you work in a bakery making maple leaf-shaped doughnuts loaded with transfats. It doesn’t come with a whole lot of societal respect.

That’s what makes the technical program offered by Cégep de Thetford in Thetford Mines all the more intriguing. This is a province where shale gas in particular has been vilified by critics and companies such as paper-maker Cascades Inc., which previously supported development, are re-evaluating their positions. Training local oil and gas service workers for a local industry that may never develop is either remarkably prescient or over-optimistic.

At stake is an estimated $3-billion per year worth of service contract revenue once the industry starts exploration and production in earnest. At stake also is developing a mass of local expertise that will help drive commercialization costs down and profits up.

“Right now, there are Western Canadian service companies that are interested in setting up offices here,” says Mario Lévesque, president of the seven-month-old Oil and Gas Services Association of Québec and owner of Séismotion Inc., a specialist in rights-of-way and well permits. “I don’t have a problem with that. But I’m convinced we can develop a basin of local workers.”

The services association is partnering with Cégep de Thetford on the training initiative. The college has an existing program in mineral technology that will be expanded. Of roughly 400 oil and gas service jobs identified, half of them require training of less than 12 weeks, Mr. Lévesque says.

“My vision is that we will have drill crews that stay in eastern Canada, fracturing crews that stay in eastern Canada and workers for a local industry,” he says. “I’m in favour of taking control of the oil and gas service industry in all of eastern Canada from here.”

The current lack of local labour and equipment in Quebec means service personnel and machines have to be transported from Alberta. That has driven up the cost of drilling and fracking for each pilot test well to about $15-million in the province, three times as much as similar wells in Western Canada, says Michael Binnion, CEO of Calgary-based Questerre Energy Corp., a key developer of Quebec’s Utica shale gas resource.

“It’s not for us to tell the government to move forward with oil and gas commercialization or not,” says Robert Rousseau, study director for Cégep de Thetford. “But if it chooses to go ahead, there will be thousands of workers that need to be trained. We’re trying to get ahead of that demand.”

Says Mr. Binnion: “Politically this is about local benefits. Economically it’s about us being able to drill wells at the same cost they can drill wells in Alberta or B.C. or Pennsylvania. We’re going to end up with head-to-head gas competition between Quebec and Pennsylvania. So [this is] economically critical.”

http://business.financialpost.com/2012/06/23/quebec-college-quietly-nurtures-provinces-energy-future/?__lsa=38f3f02d

Rocket