NotSoQuick's Profile

NotSoQuick's Posts

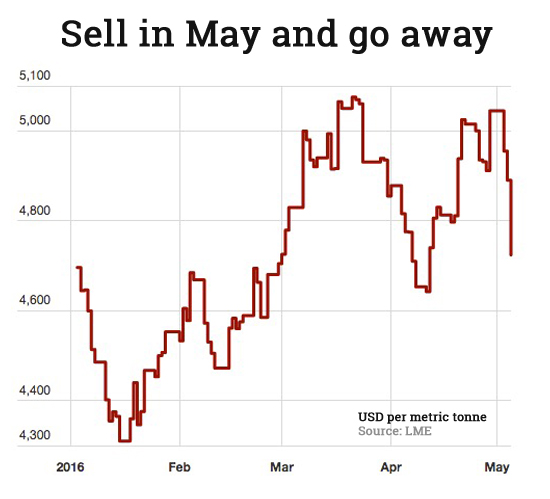

That is nice to see the copper pricee increases, it is also nice to see our stock hit 0.16 - the highest it has been for awhile.

Re: Copper is Flying!

In the article: http://www.mining.com/us-demand-growth-push-copper-market-deficit/

It states: Cochilco said it projected average copper prices of $2.40 per pound in 2017, up from its prior estimate of $2.20, citing expectations that proposed increased fiscal spending in the US will boost demand for the metal widely used in construction and manufacturing. Prices should improve further to average $2.50 per pound in 2018. The copper price averaged $2.21 in 2016.

I'm convinced that these guys (just the largest copper producer in world) have no idea what the copper price will be either. They are always adjusting their projections based on how the copper price has actually changed. I'm not saying that they will not be right but copper must be currently averaging around $2.55 per pound in 2017 which is quite a higer than the $2.40.

Re: "We will continue to review options for advancing the project as market conditions evolve. "

I understand why many/most people are frustrated with Elmer and the management. I do agree with much of the frustrations especially as I feel that have been stuck with a handicap BFS for over 3 years.

However, I feel that much of the frustration vented at Elmer is really a frustration of the market. There is nothing Elmer can do about low copper prices which is slowing down spending for pretty ALL mining companies. Thus the upswing in copper prices is so good to see - it gives intentive for Teck to look move forward. Yes, we have been tied to Teck as the operator but they are still spending money on the SC project - even the low $800,000 spending for this year is not that far off the amount that CUU raised by issuing more shares this year. Just a bit of prespective. I think there is good reason for optimism even if it isn't "soon".

I also like seeing the visible 2016 inventories numbers going down over the past few months. The total inventory is now down for the year.

http://mobile.reuters.com/article/idUSL8N1DA762?rpc=401&

(Repeats with no changes. The opinions expressed here are those of the author, a columnist for Reuters)

By Andy Home

LONDON, Nov 9 Copper has just burst into life after a year of choppy sideways trading.

On the London Metal Exchange (LME) benchmark three-month copper has exploded to the upside, hitting a 15-month high of $5,443 per tonne on Wednesday.

As is the way with markets, the move is feeding on itself as shorts buy back positions and momentum-chasing funds join the action.

Money managers were already lifting their exposure to copper even before this week. Funds were net long of the LME copper contract to the tune of 54,098 lots LME-CA-MNET as of last Friday. It's the largest collective bull position since the LME first started publishing its commitment of traders report in 2014. The long position has almost certainly grown further over the last couple of days.

It's tempting to dismiss this move as another tremor from the Trump election earthquake with a falling dollar the transmission mechanism. But copper began breaking upwards several days ago when markets were still pricing in a Hillary Clinton victory.

So what's going on? And what happened to that big supply surplus which has kept copper boxed in below $5,000 since the start of 2016?

BALANCED MARKET?

What trades on the LME and other exchanges such as CME and the Shanghai Futures Exchange (ShFE) is refined copper.

And the refined metal part of the copper supply chain is in essence balanced between supply and demand.

That, at any rate, is the view of both the International Copper Study Group (ICSG) and the International Wrought Copper Council (IWCC).

The ICSG assessment is that the global market will record an 8,000-tonne supply-demand shortfall this year before moving to a 163,000-tonne surplus next year.

The IWCC is forecasting a cumulative 180,000-tonne surplus over the same two-year period.

In the context of a 23 million-tonne global market, the difference between the two is no more than a rounding error.

The ICSG has tweaked its numbers since its last forecast in March. It has lifted its estimate of 2016 refined production growth from 0.5 percent to 2.2 percent, slightly higher than the IWCC's 2.0 percent assessment.

But, critically, the ICSG has also raised its usage forecast for this year from 0.5 percent to 1.5 percent, largely reflecting the pace of "apparent" usage growth in China.

"Apparent" usage is a statistical hall of mirrors, based as it is on what can be counted and not necessarily on what really counts in the world's largest user of the metal.

The Group concedes that "real" demand growth in China may be closer to 4.0 percent this year, chiming with the IWCC's forecast of 4.1 percent growth.

The higher figure also tallies with the broad consensus among analysts, who have collectively upgraded their own Chinese demand expectations after the early-year government stimulus, channelled as ever through construction and infrastructure spend.

Graphic on LME and ShFE copper stocks:

STATISTICAL NOISE

The "apparent" usage methodology is founded on "hard" figures such as China's imports and exports.

And these have fluctuated wildly over the last year.

Imports boomed over the November 2015-April 2016 period. The cumulative tally was 2.23 million tonnes.

To put that into perspective, they were running at an annualised pace of almost 4.5 million tonnes, which would have far exceeded even last calendar year's record 3.7 million tonnes.

Then exports surged over the May-August period. At a cumulative 260,000 tonnes they were running at an annualised pace of 780,000 tonnes. The previous high for any calendar year was 293,000 tonnes in 2013.

Stocks of copper registered with the LME and the ShFE have reflected this ebb and flow.

LME stocks fell to an 18-month low of 141,075 tonnes at the beginning of April. ShFE stocks, by contrast, soared to an all-time high of 394,777 tonnes in March.

As the import-export pendulum turned, LME stocks rebounded to 379,165 tonnes in late September. ShFE stocks have slumped to just 97,839 tonnes.

The pendulum appears to be swinging again with LME cancellations and outflows running at accelerated levels.

But it's increasingly clear that these apparently contradictory signals have reflected no more than a convoluted roundabout with physical traders arbitraging the two markets, playing with a mix of futures spreads, physical premiums and warehouse incentives.

Stock movements, so closely watched by the market for clues as to supply-demand balance, have generated only noise this year.

As of the end of October the net year-to-date movement in all global exchange copper stocks, LME, ShFE and the CME warehouse system, has been a rise of just 22,500 tonnes.

Which would seem to be another indication that this market has been and still is "broadly balanced", to quote the IWCC.

HIDDEN SURPLUS

Which doesn't mean there hasn't been a shift to surplus dynamics in the copper market.

It's just that it's taken place in a different part of the supply chain.

Mine supply of copper concentrates, excluding straight-to-metal operations using leach technology, is on course to grow by around 6 percent this year, according to the ICSG.

And that calculation includes an allowance for unexpected disruptions, which until the last month or so were running at an unexpectedly slow pace.

It's no secret where all that extra supply has been going.

China's imports of copper concentrates surged by 31 percent to 12.2 million tonnes (bulk weight) in the first nine months of this year. And the year-ago period itself represented a record pace of import.

The country is now the world's largest refined copper producer as well as its largest user and its smelters have been soaking up raw materials surplus.

Chinese refined production rose by 8.4 percent in the first nine months of the year, according to the National Bureau of Statistics.

The problem is no-one fully trusts these figures. Moreover, given the rate of increase in imports, the headline increase looks on the low side.

Have China's smelters been refilling stocks depleted by years of mine shortfall? Will they convert inventory into refined production next year?

Difficult questions to answer. Even by the shadowy standards of copper market statistics, what's going on at the concentrate stocks part of the supply chain is a very dark place indeed.

What is clear right now is that the market, or at least the fund part of it, has shifted its collective view about the size and impact of the much discussed wall of copper supply.

Because beyond the shadowy statistics and the misleading stock movements, the truest signal is the price.

(Editing by David Evans)

Just a fyi...

The SHFE inventory have dramatically dropped off since earlier this year. While the LME inventories have climbed dramatically. Overall we are about the same levels as at the start of the year.

Interesting how some of the major mining companies (previously Rio Tinto and now BHP) are beginning to spend money. It would be great if Teck also follow suit and get this SC project going. There doesn't seem to be much to otherwise hope for for our projects unless copper prices improve.

http://www.mining.com/bhp-resumes-expansion-plans-says-not-waiting-for-prices-to-recover/

BHP resumes expansion plans, says not waiting for prices to recover

Andrew Mackenzie says BHP won't wait for prices to recover, and insists the giant miner continues to drive down costs. (Image from archives)

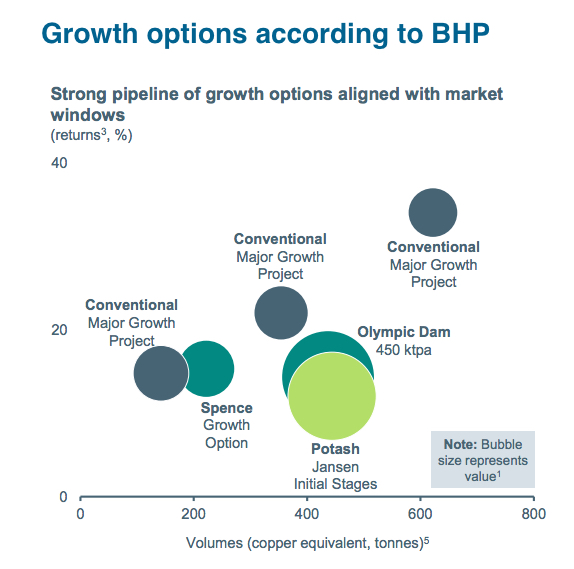

World’s largest mining company BHP Billiton (ASX, NYSE:BHP) (LON:BLT) has decided to resume investing in projects aimed to boost production capacity, particularly in copper and oil, even if commodity prices have not fully recovered yet.

Speaking at the Global Metals, Mining and Steel Conference in Miami, chief executive Andrew Mackenzie said the company will work towards making costs fall to half the level of five years ago and targeted a further $3.6 billion in productivity gains by the end of 2017.

The growth plan represents a major strategic shift from the miner’s austere approach of the last four years brought on by a sustained rout in commodity prices.

“Although we remain confident in the long term outlook for commodities, we are not waiting for prices to recover,’’ Mackenzie said in the presentation.

“We have everything we need in our portfolio right now to significantly increase the value of the company,” he added.

By investing in mining assets, Mackenzie said that BHP could add “over one million tonnes of copper equivalent capacity at a total capital cost of less than $1.5bn, or more that 10% of the company’s current output.”

BHP also plans to make an investment decision on its Mad Dog 2 and Spence oil and gas projects within 18 months.

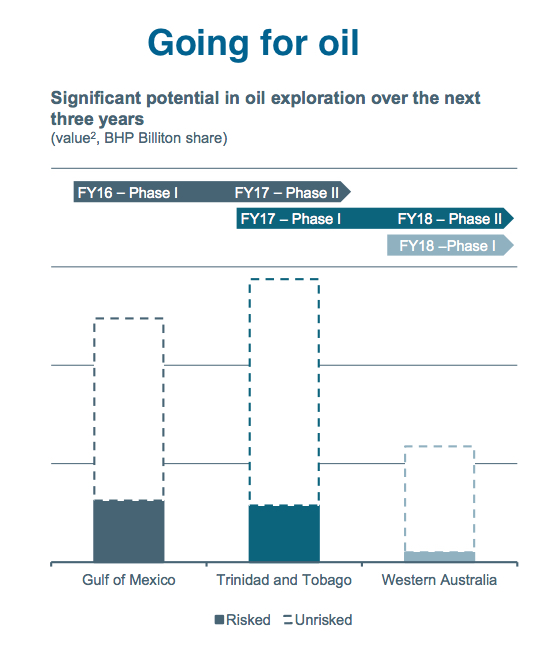

“We are increasing our exploration activity to take advantage of falling costs as others pull back,” Mackenzie noted, adding the firm has embarked upon one of its “most significant” oil exploration programs, accelerating activity in its three priority basins — Gulf of Mexico, Trinidad and Tobago, and Western Australia.

BHP’s market capitalization is down to $70bn, less than one-third of its level at the peak of the commodities boom. Its fresh commitment to growth seeks to gain back the confidence of investors, who had to deal with a 46% drop in the price of BHP’s London-listed shares over the past 12 months, while it also cut its dividend at its interim results in February, ending 15 years of steady or increasing payouts.

The strategic shift comes as rival Rio Tinto (LON:RIO) has also put expansions back on the agenda, recently committing to $7.2 billion in new projects.

http://www.mining.com/copper-price-breakout-point-coming-soon/

Copper price breakout point coming soon

The price of copper in New York fell on Thursday for the fourth straight day with July futures trading on the Comex market giving up 2% to $2.1430 a pound after optimism about demand from top consumer China began to fade. After a few brutal days of trading copper is down 6.7% this week alone, wiping out year-to-date gains entirely.

Growing demand from China – responsible for 46% of the global trade in the metal – is crucial for the copper market which is set to experience another year of oversupply albeit smaller than 2015's 350,000+ tonnes surplus which was the largest in several years. Primary mine supply grew more than 3% last year to just over 19 million tonnes.

A new report by London-based CRU, an independent mining, metals and fertilizer researcher, paints a brighter picture of industry fundamentals and the copper price for the rest of the decade.

Investment funds appear reluctant to fill the gap in funding for projects, meaning that M&A activity will remain centred on piecemeal acquisitions of unwanted operating assets

CRU points out that major copper producers in an effort to strengthen balance sheets laden with debt are focusing on their operating mines and most-advanced projects and cutting capital expenditure for developing projects and exploration budgets.

At the same time "the investment community has lost its appetite for funding exploration and development work, forcing many mid-tier and junior mining companies to halt work on projects, with pre-development projects in the probable and possible categories especially affected."

Investment funds appear reluctant to fill the gap in funding for projects, meaning that M&A activity will remain centred on piecemeal acquisitions of unwanted operating assets says CRU.

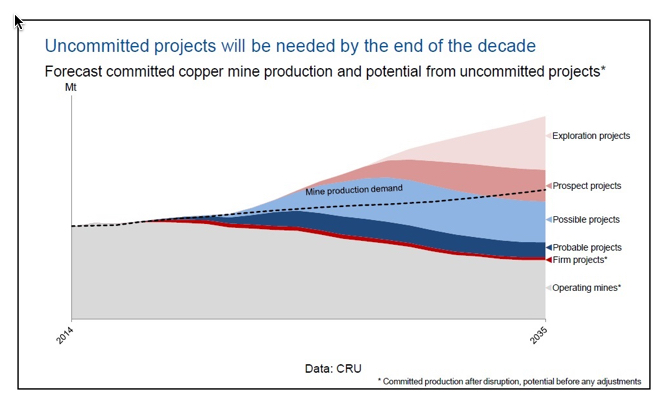

As a result, CRU’s long term market outlook finds that committed mine supply (operating mines and firmly-committed projects) will be insufficient to meet primary demand by 2018 and new projects needed before the end of the decade:

Even after allowing for additions to existing reserves, CRU expects that production from existing mines will peak in 2018 and decline thereafter due to falling ore grades and the exhaustion of reserves.

Increased output from firm projects will offset this decline until the end of this decade, but at that point, a marked downtrend in committed production will set in.

CRU tracks 238 projects that could come on stream within the next twenty year meaning there is no shortage of potential resources available to fill this gap.

However, CRU identifies several barriers, over and above low prices, that could see these plans collect dust. Those include increasing technical challenges associated with deeper resources, more complex ore bodies and difficulties with building mines in ever more remote regions. Other major factors are the potential for power and water shortages and continued opposition from local communities coupled with greater resource nationalism.

The challenge for exploration and development companies says the research house "is demonstrating that their assets are best-placed to come onto the market profitably."