Natasha's Profile

Natasha's Posts

For the life of me I can't understand why ORV is trading at this level? The float isn't outrageous. Cash in the kitty. A mystery for yours truly.

Good call SMF. The placement pretty much ensured a share price of $10.25. No one ever went broke booking profit.

Now if we could get some volume back, that would be a start. Me thinks the next jump in price could be when the deal with HI is closed. My two cents worth.

Mercifully that chapter is done. Now OSK get back to business as usual. The numbers out of this project continue to impress.

MARKET CONTINUES TO PURCHASE “ALL” ALLOCATED SILVER EAGLES FROM U.S. MINT

FEBRUARY 25, 2014

As sales of Gold Eagles remain subdued, the market continues to purchase every available Silver Eagle from the U.S. Mint. Since the beginning of the year, the U.S. Mint has sold its Silver Eagles on a weekly allocated basis.

in the past several weeks, 80-90% of the total allocated weekly Silver Eagle amount was sold on the first day of the week!

The U.S. Mint just updated its sales figures Monday, with an astonishing 744,500 Silver Eagles sold in one day:

From The SRSRocco Report:

The US Mint authorized dealers are limited to the amount of Silver Eagles they can purchase each week. Michael White, the Public Affairs person for the U.S. Mint, told me that in order for the Mint to build up inventory of Silver Eagles, it has to ration sales to its authorized dealers.

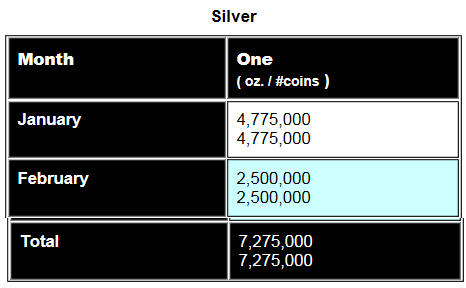

For the second week in February (10th – 14th), the U.S. Mint allocated 900,000 Silver Eagles. At the beginning of that week, total sales were 850,000. By Friday, the 14th, total sales reached 1,750,000.

The next week, Mr. White stated in an email that the allocated Silver Eagle amount for the third week (18th – 21st) were 750,000. I believe this lower figure was due to the Presidents Day Holiday making it a four-day work week.

The U.S. Mint updated its figures on Friday, the 21st:

Here we can see that the authorized dealers bought every available Silver Eagle for the week.

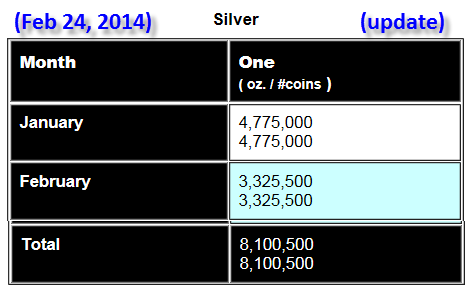

The U.S. Mint just updated its sales figures today (Feb 24th), with an astonishing 744,500 Silver Eagles sold in one day:

I noticed in the past several weeks, 80-90% of the total allocated weekly Silver Eagle amount was sold on the first day of the week. Just when I was getting ready to include my next chart into this article, I checked the U.S. Mint website to see if they updated their Gold Eagle sales.

I wanted to make that I had the most current Gold Eagle sales figures for my Silver/Gold Eagle ratio chart. When I updated the U.S. Mint’s Bullion figures, they sold an extra 81,000 Silver Eagles — within the hour.

Including the second update, the U.S. Mint sold 825,000 Silver Eagles today. I emailed Mr. White to see what the weekly allocation of Silver Eagles will be this week. He replied stating the total allocation figure for the week to be 1,250,000. I will provide an update on Friday to see if the authorized dealers consumed the total amount.

Furthermore, the current 3,325,500 February Silver Eagle sales figure, is only 43,000 less than last year’s February total of 3,368,500.

I have to say, this is the largest amount of Silver Eagles sold in one day if we exclude the first day sales in the beginning of 2014.

SILVER EAGLE MARKET: RED HOT

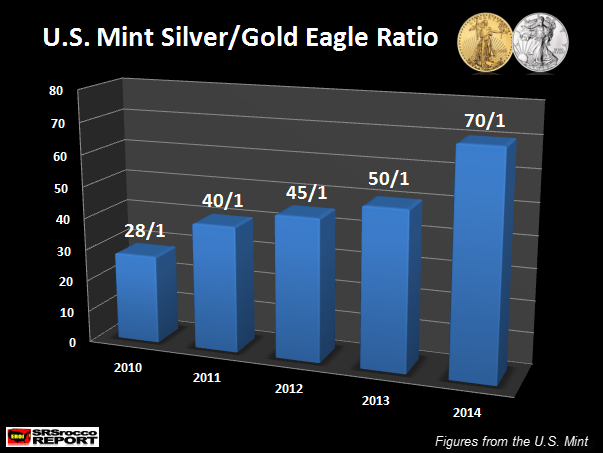

Even though the huge amount of Eastern gold buying continues to steal the show, retail investors are purchasing more Silver Eagles to Gold Eagles than ever. If we take a look at the chart below, we can see a definite trend:

In 2010, the U.S. Mint sold 34.6 million Silver Eagles and 1.22 million Gold Eagles for a ratio of 28 to 1. Each year, the ratio has increased. Last year, the U.S. Mint sold a record 42.6 million Silver Eagles compared to 856,500 oz of Gold Eagles.

Thus, the Silver to Gold Eagle ratio increased to 50 to 1 in 2013. So far this year, the U.S. Mint sold 8.1 Silver Eagles and 116,000 oz of Gold Eagles. Investors are currently buying 70 Silver Eagles to every Gold Eagle.

It will be interesting to see how 2014 unfolds. As the Chinese continue to consume nearly 100% of the annual world gold mine supply, the paper precious metal trading exchanges will come under severe stress.

Supplies of physical gold and silver will become tighter as the global financial system weakens. In the future, as one metal suffers a shortage, I would bet my bottom silver dollar, investors will soak up supply of the other.

Time is running out for investors to protect their wealth in gold and silver.