IvanB's Profile

IvanB's Posts

Basic Data Points Ticker Last Price (native) Change (native) Change (%) Day Low Day High 52 Week Low 52 Week High Volume MC (M CAD$)

Compare

(Show all)Company Ticker Last Price (native) Change (native) Change (%) Day Low Day High 52 Week Low 52 Week High Volume MC (M CAD$)

Lithium X Energy Corp

Lithium X Energy Corp

LIX.V

1.85

0.00

0.00%

1.77

1.95

0.35

2.85

191,867

61.7

Albemarle Corporation

Albemarle Corporation

ALB

75.17

-1.00

-1.31%

75.07

76.67

41.37

78.40

190,113

8,440.0

FMC Corp.

FMC Corp.

FMC

45.12

-0.52

-1.14%

44.90

46.09

32.24

58.40

278,405

6,030.0

Sociedad Quimica y Minera

Sociedad Quimica y Minera

SQM

20.33

0.21

1.06%

19.91

20.71

12.32

23.03

240,728

5,350.0

Orocobre Limited

Orocobre Limited

ORL.TO

3.70

0.20

5.71%

3.58

3.70

1.25

3.70

11,200

475.0

Galaxy Resources Ltd.

Galaxy Resources Ltd.

GXY.AX

0.40

-0.02

-4.76%

0.40

0.42

0.02

0.49

8,701,028

364.1

Nemaska Lithium Inc.

Nemaska Lithium Inc.

NMX.V

1.40

0.09

6.87%

1.34

1.44

0.16

1.44

1,001,836

220.1

Lithium Americas Corp.

Lithium Americas Corp.

LAC.TO

0.82

0.04

5.13%

0.78

0.84

0.44

1.00

3,828,903

181.6

Altura Mining Limited

Altura Mining Limited

AJM.AX

0.23

0.01

2.27%

0.21

0.23

0.01

0.28

7,039,129

144.6

Bacanora Minerals Ltd.

Bacanora Minerals Ltd.

BCN.V

1.58

0.03

1.94%

1.51

1.60

1.16

2.05

10,150

116.9

Pure Energy Minerals

Pure Energy Minerals

PE.V

0.48

-0.02

-3.06%

0.47

0.49

0.21

1.15

327,998

23.4

Dajin Resources Corp.

Dajin Resources Corp.

DJI.V

0.23

-0.02

-6.25%

0.23

0.23

0.06

0.30

4,215

22.3

Sirios Resources Inc.

Sirios Resources Inc.

SOI.V

0.41

-0.02

-4.71%

0.41

0.43

0.07

0.51

101,025

20.7

Red River Resources Ltd.

Red River Resources Ltd.

RVR.AX

0.13

-0.01

-3.70%

0.12

0.14

0.08

0.23

2,354,677

20.3

International Lithium Corp.

International Lithium Corp.

ILC.V

0.26

-0.01

-3.70%

0.26

0.28

0.03

0.38

21,470

15.3

New World Resources PLC

New World Resources PLC

NWR.L

0.15

0.00

0.00%

0.05

0.32

0.05

0.80

1,190,889

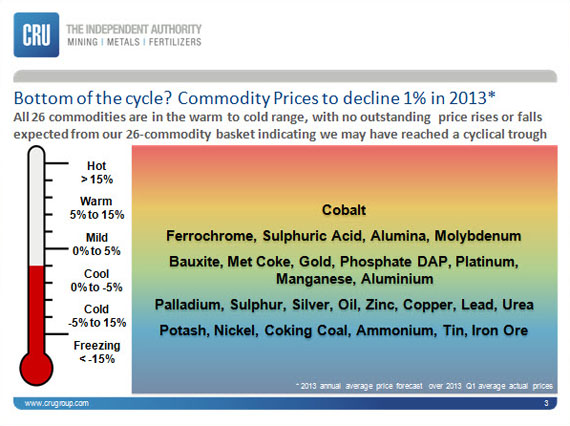

The Metals Report: Lisa, CRU recently published a report, "CRU Commodity Heat," which measures the near- and medium-term outlook for 26 different commodities, most of which are mined. How does CRU measure the market heat of these commodities?

Lisa Morrison: We start with the average for each commodity price in the first quarter of 2013 and then we compile CRU's view of the change in price between the first quarter and the annual average for 2013 and then each year through 2017. We do this analysis every quarter.

We categorize commodities according to their anticipated price movements. A hot commodity has an anticipated price increase of 15% or greater, warm is 5% to 15%; mild is 0% to 5%, cool is 0% to -5%, cold is -5% to -15% and freezing is greater than -15%.

TMR: Are there any hot commodities right now?

LM: Looking at the 2013 annual average, we don't see any hot commodities. That's because most commodities have come off of some very high points. The end of last year saw a bit of a crash. The strongest increase that we see between Q1/13 and the 2013 annual average is cobalt.

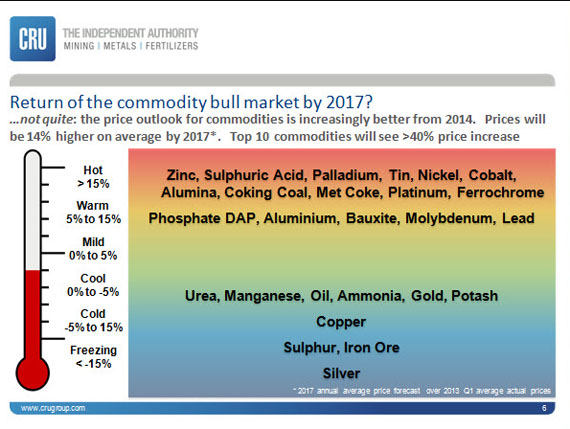

But looking further out into the forecast to 2017, we see some commodities that could move into the very hot region.

TMR: With so many commodities in the mild, cool, cold and freezing zones currently and in the future, does that mean we could see mines being shut down?

LM: A steep drop in the commodity price certainly could indicate that we have a period coming where strong oversupply means that producers may need to shut down, especially the higher cost ones. If a commodity has been very expensive in the past, meaning its price has been much higher than its cost of production, a steep drop in price doesn't necessarily mean output would be curtailed. It just means that the market is returning to some sense of normalcy. Copper is a good example of that.

Gold is a case where prices have come down quite a bit too, but because of lack of investor interest rather than needing to shut down gold mines. Aluminum is a case where the market is much oversupplied and the commodity is under some cost pressure. We've seen prices come off quite a bit in aluminum, but our heat chart doesn't show prices are going to decrease much further, simply because prices can't fall much more. They've gotten to the point where producers have to start shutting down because of overcapacity.

TMR: Has the lack of heat in your forecast led you to conclude that the market for these metals has hit a cyclical trough?

LM: That is our view on 2013, but by 2017, we're looking at markets that are sending a signal to producers to cut back or maybe not ramp up capacity quite so quickly.

The macroeconomic environment is uncertain. Is China going to pick up? Is the U.S. going to pick up? Is Europe ever going to come out of recession? With so many questions on the demand side, producers are being very, very cautious.

We're probably in the cyclical trough now and I would point to October 2012 as an inflection point. At least in exchange-traded commodities, investors were selling off because they realized that Chinese economic growth was not going to be 9% anymore. It was going to be something more like 7% or 7.5%. There also was a recognition that the U.S. wasn't going to be picking up and that Europe wasn't going to do very well in the coming year. Then, of course, we had another selloff in the spring, in March–April, because, again, the economic growth prospects weren't very good. We're probably in the low period right now. It's hard to say how long cyclical troughs last because they vary by commodity.

Depending on the commodity it takes a longer time or a shorter time to shut a mine or shut an operation. A lot of commodities are sold on contract basis, on a one-year contract or six-month, nine-month, etc. Production happens and continues to happen because an agreed-upon arrangement exists. It takes more than six months for commodities to really respond to lower prices. As for the 2017 outlook, today's lower prices are causing producers to ramp up much more slowly or even cancel new projects. But by the time we get through 2014 and into 2015, we may be back in the situation where we really need more capacity in these commodities.

TMR: What's CRU's outlook on China?

"With so many questions on the demand side, producers are being very, very cautious."

LM: It's easy to feel depressed about China because we've been accustomed to such a fast growing economy, with double-digit industrial production growth. You can't sustain that kind of growth for long. The economy now is going through a transition. If you think about Korea in 2000 versus where it was in 1980, it's a similar situation, but China is a much, much bigger economy. Our view is that China will still achieve strong GDP growth in the 7–8% range over the next couple of years. Industrial production growth won't probably be double-digits except in a very good month or a quarter here and there, but something in the 7–9% range. China still has a lot of infrastructure to build. People will get wealthier and will need and want more and better food. They are going to need more oil and more cars; they are going to want homes and washing machines. Even though the super fast growing commodity story in China may be over, it isn't as if we're getting to a point where China is not going to need commodities anymore.

TMR: Does your view of China lead you to conclude that the commodity supercyle is over?

LM: The commodity supercycle is probably over, but I don't think it's the death of commodities. The supercycle was after all driven by the unexpected strong growth in China and expected weakness of the U.S. dollar. At the same time, the metals and mining industries had gone through a period cost cutting, so there had been no investment in capacity or exploration. As a result, the mining industry was completely unprepared for the large surge in demand from China starting in 1995 and picking up again after the Asian financial crisis, in 1997, 1998, 1999 and the end of 2000, which was a peak period for commodities in general. That was very attractive for investors and that is what promoted the supercycle. Now we are going to see that back off. China's commodity growth isn't going to be 10% year-on-year; it's going to be much smaller. But don't forget that economies with large populations in Asia and in Africa are eventually going to be transitioning as well.

TMR: Do precious metals prices tend to be a leading indicator of a cyclical trough or are they more likely to be some of the last commodities to fall?

LM: Precious metals often function as a safe haven in times of high uncertainty. After the financial crash we didn't know if the economy was going to survive or how we were going to get economic growth. We saw investors very interested in gold and silver at those times. Of course, prices remain very elevated compared to prior to the crash. Precious metals prices certainly seem to be countercyclical and have high demand, both financial and physical, during periods of high uncertainty.

"Although the demand for steel and iron ore may go down and those prices may fall, that shift to something consumer oriented is going to support nickel prices going forward."

We have witnessed a certain amount of selling in gold and silver since the middle of last year. That's because the worst-case scenarios, such as a Eurozone breakup or China sliding into recession, didn't come about. Even President Obama and Congress managed to get past the fiscal cliff. Investors began telling themselves that because the worst didn't happen, they didn't need to be invested in safe havens anymore. That caused a selloff in gold and silver that turned out to be a precursor to selloffs in the rest of the metals space. In that respect they were a lead indicator that the worst of the uncertainty had passed. I don't think you could look at precious metals demand as necessarily a lead indicator for an economic cycle per se. I think they definitely have a role to play during a cycle and may play a leading role again with consumers when things are looking better.

The U.S. economy is on a much stronger footing than it has been since 2006. The U.S. economy has been a nonentity in the story for the last seven years. Our view is that this year we're likely to get 2.5–3% GDP growth, moving to the 3–3.5% range for the next two years. That is even slightly above trend compared to what demographics would give you. The U.S. economy is really looking in much, much better shape than it has been for quite some time.

Don't forget that Japan is going to emerge as well. It's also been an absent actor on the global economic stage. It's a big economy and it's going to emerge from this sleepwalking stage in the next year or so. I think that's very exciting. It's hard for me to be very negative about what I see over the next two years. Maybe the next six months aren't that great for commodities, but over the medium to longer term the outlook is very positive.

TMR: What is your outlook for gold, silver, platinum and palladium?

LM: Our forecast is that the gold price peaked in 2012 and that the good times for gold are pretty much over. We expect prices to come down through 2017. In silver that is also the case. If the interest in gold has peaked, the interest in silver is gone and that price is going to come down a lot faster. I certainly would not want to be holding either one of those for any length of time.

Platinum and palladium are a bit different because they are much more industrial type metals. They are produced in very small quantities in markets with supply constraints. Particularly in palladium, we also have had inventories that were coming out of the former Soviet Union and those Russian stockpiles and shipments are ending. There's no more left there, so we are coming back to the actual private market.

This means producers of palladium now have to increase capacity to meet demand. We're looking for pretty strong price increases—extremely strong in palladium. That's one of the super hot commodities. Going out through 2017, platinum would also fall into that super hot period because it's expected to increase well over 15% over the next five years. We've got lower prices now, but new capacity is going to be needed, so prices will pick-up after 2015.

TMR: What other commodities do you expect will move from neutral into the hot category over the next few years?

LM: We're looking at cobalt, which has had the strongest price increase this year. The best of the price increases are going to be in the very near term and things will slide off after about 2015–2016. Tin also has had some supply constraint problems, so that's going to move into the hot category next year.

Zinc, which is much oversupplied at the moment, is quite likely to move into the hottest commodity category five years from now because the new mines that we are going to need can't be financed at today's prices. With financing as tight as it is, those zinc mines are not going to be started for the next couple of years. It takes quite a few years to bring a zinc mine into production, so we could be looking at a late decade squeeze in zinc.

TMR: What about copper?

LM: Copper prices have been well over $7,000/tonne and have found it quite difficult to break below $6,800/tonne. Copper is likely to be better supplied than it has been for 10 years, so a major shortage going forward is unlikely. Of course, that assumes that the mine supply comes on the way it is supposed to. The mines are coming on in places that traditionally have had some difficulties such as Peru and Africa.

We will probably still see relatively high copper prices, meaning something in the $6,500–7,500/tonne range, to bring on these new mines needed in the next five to seven years to meet demand. Everything in copper hinges on whether or not mine supply comes on as expected.

TMR: Nickel prices have been very weak over the past four or five years; why are you predicting a 41% increase between now and 2017?

LM: Nickel has been punished because it's in oversupply. Supply came on at the wrong time, just when demand was coming off. Demand hasn't really picked up terribly well. In China nickel pig iron is used as a cheaper alternative to pure nickel. This was how China dealt with its shortage of nickel resources and its need for more nickel for stainless steel. Stainless steel is a higher-end commodity. China is shifting from heavy industrial or heavy infrastructure to something that's more consumer oriented and more high-value added. Although the demand for steel and iron ore may go down and those prices may fall, that shift to something consumer oriented is going to support nickel prices going forward. It's really a China story in nickel again.

TMR: How are gold and silver likely to react to the unwinding of quantitative easing in the U.S., Japan and Europe?

LM: If we get a lot of inflation because of the unwinding of quantitative easing, we may not see the drop off in prices that we've forecasted. Our view is that quantitative easing in the U.S. isn't going to start to get unwound probably until the end of next year to any significant extent. It will be done in a relatively gradual way. Unwinding in Japan probably won't happen until well after that because its central bank has institutionalized yet another round of it. It's going to be a gradual process. The winding down will be difficult to time because we can't even get that information out of the Federal Reserve Board at the moment.

As those uncertainties are reduced and things become clearer, then what we do at CRU is look at sentiment in the next year or two and try to figure out how that affects the price forecast. Then, as we move away from year two, we really should revert to the fundamentals of supply and demand in those markets.

We can't really see how the current price of silver is justified given that the lack of massive investor influx to support the price. That's why we expect the price to come down. Gold is a little a bit different, but similar. We look at supply and demand. We look at what investors are doing. Investors have really sold off. The question that you need to ask with gold is what's going to make investors buy again? Or will they keep unwinding at opportunistic times?

TMR: Do you have an answer to your own question?

LM: The only thing I think that would cause people to buy more gold again and to go through another cycle of this massive investor buying would be if it became a commonly held perception that quantitative easing was going to be unwound in a way that was going to cause very high levels of inflation. In that case, all commodity prices would go up, but certainly with gold and silver as safe havens, the demand for them would be even stronger.

TMR: Where should investors be long with mined commodities?

LM: The best prospects for being long over the next year in exchange-traded type commodities are probably tin and palladium. Looking at 2017, economic growth picks up after 2015. We hope that market conditions are more normalized. We should be getting finished with quantitative easing. We should have better market signals. In those cases probably the really good prospects there for exchange-traded commodities are zinc and nickel.

TMR: Thanks, Lisa, for your insights.

We believe stocks are making a final rally to a major top, a top for the centuries, and a Grand Supercycle degree Bear Market will start upon this rally's completion. There is a Jaws of Death pattern in stocks that has been forming for two decades. It is very close to completion, needing one more rally, a strong rally, that takes prices to the top of the pattern's upper boundary. Then, after reaching that height, a Bear Market for the ages will begin, something that will be greater than the Bear Market of 2007 to 2009, and greater than the Great Depression of the 1930's. Below we show this Jaws of Death stock market pattern.

Next we want to show you our Primary Trend Indicator as of November 30th. This Indicator is a long-term buy/sell indicator. It is telling us that stocks can rally further from here, but that a top could be coming in 2013.

The above chart updates our Primary Trend Indicator for the month of November, 2012, the long-term view, which the short-term trends operate within. We cover the short-term trends in our daily market reports at www.technicalindicatorindex.com. The Primary Trend Indicator generated a new long-term trend "sell" signal four years ago, on September 30th, 2008, just as the autumn stock market crash started, when the DJIA closed at 10,850.66, the first change from the buy signal October 31st, 2003, five years earlier, and the first sell signal since 2000. We saw a 4,400 point drop after this sell signal was triggered. On May 31st, 2010 the PTI generated a new buy signal, and it remains on a buy signal as of October 31st, 2012. Since that buy signal, the Industrials have risen 3,117 points (30.7 %). This indicator was weakening for months, but is now strengthening. However, it must be noted that this indicator does not change until several months after a new primary trend turn has started. The next Sell signal should identify when stocks have completed a Jaws of Death Grand Supercycle degree wave {III} top and {IV} down is starting.

Here is how the Primary Trend Indicator works: One of the tools we have in our arsenal to identify the status of a Primary Degree trend is a simple analysis of the 14 month moving average versus a Slower moving average calculation, the 5 month MA of the 14 month. It has been terrific at identifying multi-year trends, both up and down. It triggered a "sell" near the start of Primary degree wave (4) down, in mid 2000. What followed was a two and a half year, 39 percent drop into the wave (4) bottom on October 10th, 2002. It took a while for this indicator to confirm that the rally that started on October 11th, 2002 would in fact be a multi-year primary degree wave up, wave (5) up. But in October 2003, this analytical tool did in fact trigger a Primary Degree "buy" signal, which led to a four year further rally to new all-time nominal highs on October 11th, 2007 at 14,198.10. We got a near "sell" signal in mid-2005, but the rally rejuvenated itself, continuing on its "buy."

As of November 30th, 2012, our PTI remains on a "buy." The spread between the Fast and the Slow went positive in January 2010 for the first time in 20 months. It improved to positive + 417 in May, 2010, has fallen to + 228 as of November 30th, 2012, but has risen each month since July 2012's + 44 reading, so the trend is up over the past several months. Still, November's reading of 228 is far short of the 1,744 positive spread in December 2003, so a reversal could come fast. We require a 5 month moving average of the Spread between the Fast and Slow to reverse in a new direction for 3 consecutive months in order to declare that a new primary trend, a new multi-year trend, is underway. March 2010 generated the first of the three required consecutive positive readings in the 5 month moving average for a buy, April 2010 generated the second, and May 2010 generated the third, triggering the current signal, a buy signal. When Convergence occurs, it is an early warning that a new signal is coming.

There had only been three signals since 1997 before the current buy signal in May 2010, so this tool is useful for long-term investors, as it filters out the noise of up and down short term trends, keeping us focused on the significance of the primary trend. September 2008 was the third signal (a sell), and May 2010's was the fourth (a buy).

While I am not giving out trading advice, here is an idea to make money from an educational perspective using the Primary Trend Indicator: Investors or Traders can consider adjusting stock portfolios to add more cash (sell stocks) or play long term shorting instruments (such as DXD or SDOW or some other ETF that increases in value if the market is expected to decline after a new Sell signal occurs). Or, Investors and Traders could move back into stocks when a new Buy signal occurs, or if aggressive, could purchase leveraged ETFs that rise in value when the stock market rises, such as UDOW. We do these kinds of trades in our Platinum Trading program at www.technicalindicatorindex.com.

This Primary Trend Indicator is also useful for our Conservative Balanced Investment Portfolio we present to Standard subscribers at www.technicalindicatorindex.com since once we get a new signal, in the past we have been able to rely upon that signal for years. Further, it tells us which direction surprises are likely to occur, so when playing speculative options or futures, we will know the direction where a surprise trend turn is most likely. Knowledge of the primary trend is also useful for trading. In this case, we can be more aggressive when entering a position in the same direction as the primary trend, and less aggressive when entering a short-term trend play against the primary trend. Again, we find this helpful in our Platinum Trading subscription program.

Next, we look at the above chart as a confirming indicator of the Primary Trend Indicator shown on the previous page. It is a comparison of the position of the 20 Month Moving average versus the 40 month. A little history: On February 28th, 2009, the 20 Month/40 Month Spread went negative, which was the first time that happened since August 2004. In February 2009 the 20 Month fell 145 points below the 40 month, down from May 2008's peak positive 1,026 spread. It worsened to negative -345 March 31st, 2009, to negative -751 in May 2009, and worsened to negative -1,723 in March 2010. It moved to a positive reading February 2011, at + 26, confirming the May 2010 Bull Market Signal and remains positive at + 963 in November 2012, however has declined the past four months, which could be an early sign of a coming primary trend reversal. What is helpful about this indicator, is that once we get this indicator's confirming "buy" or "sell," we can look forward with high confidence to a large chunk of the primary trend's move still being ahead of us.

For example, the 20 month MA crossed below the 40 month MA in February 2002, with the Dow Industrials at 10,106. From that "sell" signal point, the DJIA dropped 2,909 points, or 28.8 percent. That suggested a great spot to purchase Leaps Put options.

Then, going the other way, the 20 month MA rose above the 40 month MA in August 2004, at DJIA 10,174. The Dow Industrials then rose 4,106 points, or 40.35 percent. Here, your strategy could have been to either play long-term leaps call options, or buy a leveraged stock ETF such as UDOW, to simply go long in the cash stock market and stay there, in other words, increase the percentage and amount of your long stock investment position.

After the February 2011 Bull Market confirmation, the Industrials have risen 1,070 points.

There were no false crossovers or cross-unders with this confirming 20 Month/40 Month MA measure. Once it turned negative, the trend was down. Once it went positive, the trend was up. Short-term countertrend moves can occur within the primary trend.

We will be giving our subscribers a Conservative Portfolio model to deal with this coming mega-Bear Market the first of the year 2013. We will show where Gold fits in defense against this coming economic disaster

We don’t hear much about gold and silver anymore on the news. This time last year you could not go 5 minutes without a TV or radio station talking about them. Why is this? Simple really, precious metals have been building a Stage 1 Basing Pattern for the last 12 months. This boring sideways trading range is how the market gets most of those long holders out of an investment before it starts another move up. The saying is “If the market doesn’t shake you out, it will wait you out”.

We all know time in money so the above statement makes a lot of sense doesn’t it? Instead of having your money sitting in an investment that has clearly displayed a large sideways range with month and possibly years before any significant breakout will occur, why would you want their money in it doing nothing? There are other opportunities which you could be putting your money into that could generate more gains until the precious metals sector sets up with a high probability trading pattern.

The good news is that gold, silver and precious metal miner stocks are forming a very large Stage 1 Accumulation pattern on the weekly chart. This points to a multi month rally in prices if they breakout above our resistance levels.

Gold & Gold Miner Stocks Weekly Analysis:

The chart below shows a lot of analysis and to the untrained eye this may look messy and confusing, so take your time to review it. In short, what I am showing are sideways price patterns using the previous highs and lows for support and resistance levels. The analysis shows the shift in prices from bearish (down), to Neutral (sideways). The exciting part about this pattern is that a new bull market should emerge if my analysis is correct. Now, I’m not talking about 5 -10% move here, I’m talking about a multi month and possibly a yearlong rally in precious metals that could allow some individuals to retire early if played properly…

A break above our red dotted resistance lines should trigger aggressive buying in gold miners along with physical gold bullion.

In the past month I have been giving out some of my Stage 1 trading ideas which have generated some decent gains for those who follow along. All but one have generated gains with FSLR 12.5%, FB 12%, RIMM 54%, AAPL 5%, TLT 2.5%, XLU 1.5%, and KOL down -5.2%. Keep in mind that you can follow my trading charts live for free and get some of my stock and ETF trading ideas here:https://stockcharts.com/public/1992897

Silver & Silver Miner Stocks Weekly Analysis:

This chart of silver and silver miner stocks (SIL), shows a very similar pattern to that of its big shiny sister (Yellow Gold). Silver carries a lot more risk because of its industrial usage. Also this commodity is thinly traded and can move very quickly on a daily basis compared to gold. Because of these quick price movements it has attracted a lot of speculative money which also has increased the volatility. More often than not silver will move 2-3 times more on a percentage bases than that of yellow gold.

Battle of the Miner ETFs Weekly Performance:

This chart compares three precious metals miner ETFS (GDX – Gold Miners, SIL – Silver Miners, NUGT 3x Leveraged Gold Miners).

Silver miners have held up the best because the herd saw how big the move was a year ago and are front running the next potential rally. But, depending on how you read the charts and sentiment it may be pointing to the dormant gold miners for a bigger than expected rally. But debating which one will breakout and run the most is a conversation/debate of its own and even I can argue both sides. The safe play is that even if gold miners (GDX & GDXJ) underperform the silver miners (SIL), the NUGT which is 3x leveraged gold miners should be the same if not outperform silver miners.

Precious Metals & Miners Trading Conclusion:

In short, I favor trading the miners over physical bullion simply because the charts show much more profit potential than if one was to buy the bullion exchange traded funds GLD and SLV.

The market seems to be setting up for some very large moves in 2013 and members of my trading newsletter should do very well. Be sure to join and follow along at www.GoldAndOilGuy.com

Chris Vermeulen

Originally published October 28th, 2012.

The intermediate top in silver was called several weeks back in the last update. We had expected it to plunge, but instead into went into a more orderly steady decline, its measured rate of decline thus far being due to the fact that the dollar has not entered into a new uptrend - yet.

We can see how silver broke down from its uptrend, formed a Double Top beneath resistance, and then went into decline, in detail on its 6-month chart below. We shorted silver investments near to the top with a close overhead stop, a tactic which has worked out well, and the big question now is to determine whether the downtrend is set to continue, or maybe even accelerate, or whether this is just a correction that has about run its course so that a reversal to the upside is imminent, and the COTs, which we will look at lower down the page, have an important part to play in making these determinations.

Looking further at the 6-month chart we can see that the downtrend of the past few weeks has taken silver down through its rising 50-day moving average, to approach its 200-day moving average, which is also rising, and it is getting oversold at this point. While this won't necessarily stop it dropping further, it is enough to put us off entering any new short positions here - so if you missed doing so at or near the top, you'd best forget it as it's getting too risky. The fact that we now have a neat clearly defined downtrend puts existing shorts in a good position, as you can stay short for further downside, but take profits and stand aside if the price makes a clear breakout from this downtrend, which would be evidenced by a close 20 cents above the trendline boundary. Apart from some moving average support, the first serious support comes in at the level shown in the $28.30 - $29.10 zone, which is quite a long way down from where we are now, and if the downtrend isn't broken that is where it is headed.

There is one scenario that we should be aware as it may produce a whipsaw. The dollar may back off from the resistance it is now at briefly, before turning higher again and breaking out as expected. This could result in a breakout by silver (and perhaps gold) from its downtrend that is a false move which is followed by a severe decline. We will deal with this on the fly on the site if it should occur.

What does the longer-term 3-year chart reveal of the larger picture for silver? It tells us that silver is essentially rangebound between the nearest major support and resistance zones shown with an overall neutral trend, and this being so it could quite easily drop back to the major support level in the $26.50 - $28.00 area, and should a deflationary shock hit, it could obviously crash this support and plunge as in 2008.

The COT charts assisted us greatly in determining that silver was set for a drop in the last update, when it was pointed out that the seldom wrong Commercials were heavily short. It is therefore logical to look for a significant reduction in Commercial short positions on the latest COT charts, if we are to see a breakout and significant recovery in the price of silver soon. The bad news for silver longs is that, as we can see on the latest silver COT chart shown below, there has been little reduction in the Commercials' massive short positions. This implies that the downtrend is set to continue and possibly even accelerate, and this fits with the latest COTs for the dollar, which are strongly bullish and imply that the dollar is set to break out upside from its recent base pattern shortly, which will of course be bad news for both gold and silver.