SILVER INVESTMENT DEMAND UP OVER 30% IN 2013

MARCH 5, 2013

Société Générale has issued a research note saying that investors looking to allocate funds to the precious metals may buy silver as a “cheaper alternative” to gold.

In a report e-mailed today and picked up by Bloomberg, the bank cites the “healthy” improvement in silver coin demand and exchange-traded product purchases recently. The bank says that measurable silver investment in 2013 is up by more than 30% and if sustained, this year’s surplus should be absorbed. This could lead to a silver deficit.

Silver eagle bullion coin sales soared to a record amount in February 2013 – totaling 3,368,500 ounces. February’s record sales followed record coin sales in January. Year-to-date silver sales for the U.S. Mint are 10.8 million ounces, which is over 10% higher than the next best period from 2011.

From Goldcore:

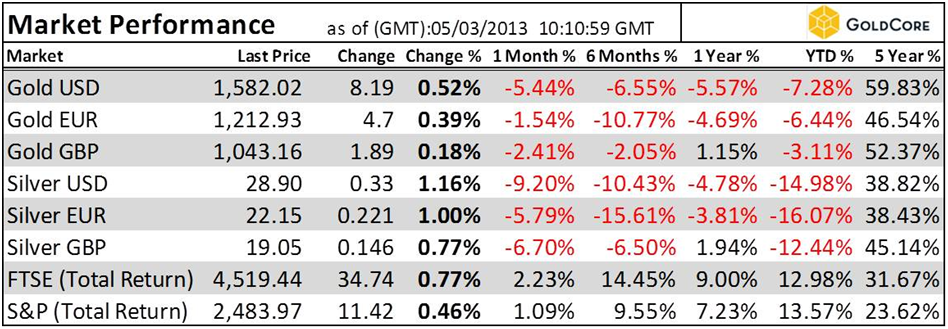

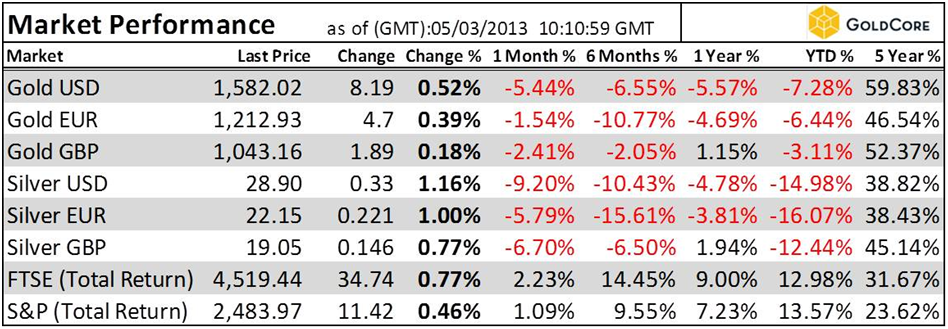

Today’s AM fix was USD 1,584.25, EUR 1,214.82 and GBP 1,044.33 per ounce.

Yesterday’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Silver is trading at $28.93/oz, €22.30/oz and £19.16/oz. Platinum is trading at $1,588.50/oz, palladium at $722.00/oz and rhodium at $1,200/oz.

Gold fell $1.80 or 0.11% yesterday in New York and closed at $1,573.80/oz. Silver slid to a low of $28.43 and finished with a loss of 0.07%.

Cross Currency Table – (Bloomberg)

Gold snapped four days of losses due to concerns that central banks from the U.S. to the UK, Europe and Japan will continue ultra loose monetary policies and currency debasement.

Silver Spot $/oz 05MAR2012-05MAR2013 – (Bloomberg)

Silver Spot $/oz 05MAR2012-05MAR2013 – (Bloomberg)

Silver, platinum and palladium also advanced after recent falls.

Société Générale has issued a research note saying that investors looking to allocate funds to the precious metals may buy silver as a “cheaper alternative” to gold.

In a report e-mailed today and picked up by Bloomberg, the bank cites the “healthy” improvement in silver coin demand and exchange-traded product purchases recently.

The bank says that measurable silver investment in 2013 is up by more than 30% and if sustained, this year’s surplus should be absorbed. This could lead to a silver deficit.

Silver eagle bullion coin sales soared to a record amount in February 2013 – totaling 3,368,500 ounces.

February’s record sales followed record coin sales in January. Year-to-date silver sales for the U.S. Mint are 10.8 million ounces, which is over 10% higher than the next best period from 2011. The record sales in that period may have contributed to silver’s surge to over $49/oz on the 28th of April 2011.

Silver support is at the $26/oz level and with silver’s supply demand fundamentals remaining even more compelling than gold, investors are diversifying their precious metal holding by going long on silver.

Gold remains nearly double its nominal high of $850/oz in January 1980. Silver is close to half of its nominal high in 1980 and its recent high in April 2011 – both close to $50/oz.