Crystallex International

Gold Stocks Continue to Diverge From Gold

On Monday, specific gold stocks with assets in Peru saw some initial selling as a result of the leftist Ollante Humala winning Peru's election. Humala is reportedly a 'good friend of Hugo Chavez', which is like a huge red flag getting waved in front of investors. Chavez has expropriated countless mining companies in Venezuela without compensation by means of dirty tricks (such as e.g. not renewing licenses that had been in good standing for many years on 'environmental grounds'). Peru's debt immediately began trading like junk, and the Peru ETF EPU went into free-fall.

As Bloomberg reports:

The extra yield investors demand to hold Peru dollar debt instead of U.S. Treasuries rose to 215 basis points yesterday, 4 above Turkey, which is rated two levels below investment grade by Standard & Poor’s. Peru’s spread jumped 56 basis points, or 0.56 percentage point, since April 8, the last trading day before Humala won a first round of voting. Peruvian bonds, the currency and stocks tumbled yesterday after voters elected Humala following his pledges to stamp out corruption and extend an economic boom to the nation’s poor. Humala, who in the past has supported Venezuelan President Hugo Chavez, toned down his anti-business rhetoric in later weeks of his campaign and said he would emulate the pro-market policies of former Brazilian President Luiz Inacio Lula da Silva.

|

(our emphasis)

Why the population of one of the fastest growing South American economies voted for the man who is most likely to wreck the economy is a mystery. Even though Humala sounded a more conciliatory note of late by promising to become a second 'Lula' rather than a second Chavez, the markets evidently do not believe one word of it. Shoot first, ask questions later – often this is the only way to avoid even bigger losses down the road. We obviously don't yet know with certainty how Humala's policies will turn out – but like Chavez, he once attempted a military coup before trying to come to power by democratic means. Just because someone comes to power by democratic means does certainly not mean that he will respect democratic institutions or leave a well-functioning economy alone. Only time will tell where Humala really stands.

The selling in gold shares with Peruvian assets, such as Buenaventura, Newmont and Goldfields then spilled over into the rest of the gold tape and by the end of the trading day, precious metals shares with zero Peru exposure had been mauled just as badly as their brethren in what one might term an 'equal opportunity bloodbath.' As a result, the gap between gold and the value of gold shares has widened even further, as the metal itself closed once again slightly in positive territory.

The HUI index breaks back below its 200 day moving average, after having briefly touched the 50% fibonacci retracement level of the preceding decline, a resistance level we have previously flagged as one of the likely rebound targets. The gap between gold and gold stocks becomes ever wider. In the past, such gaps have often been a precursor to falling metal prices (but there is of course no guarantee that it will resolve in this manner) – (click charts to expand.)

Here is a recent example of how valuation gaps between metals and metals producer stocks are usually closed: first silver stocks began to underperform the metal during April and shortly thereafter, in early May, the silver price crashed.

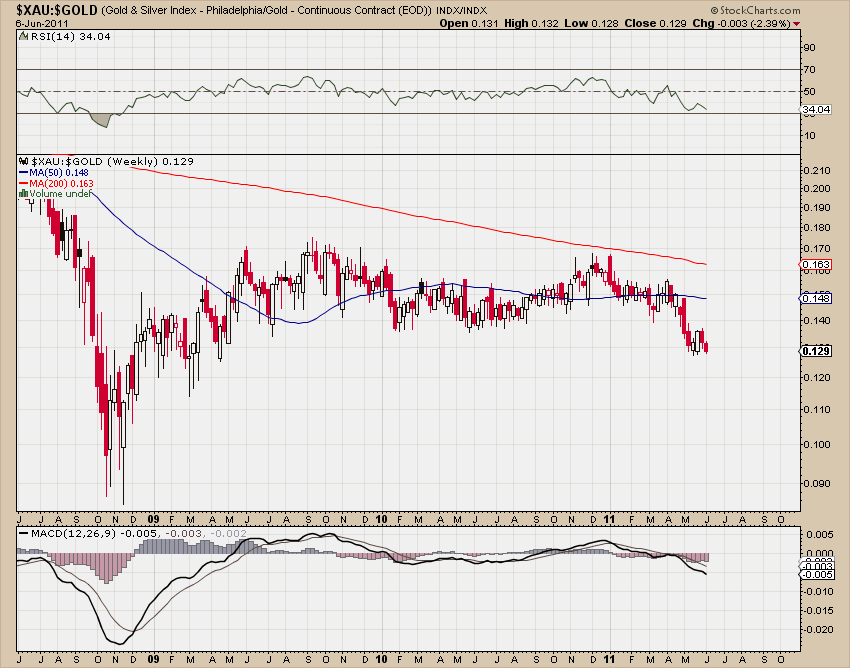

In the course of these recent developments, the HUI-gold ratio has broken below a line of weekly support, which we have also highlighted previously. There is another support line just beneath the one that has been broken, defined by the 2009 low in the ratio.

Gold stocks have been weakening vs. gold for many years, but recently their relative strength has broken slightly below an important support level.

As one indication of how extreme the weakness of gold stocks vs. gold has become, consider the XAU-gold ratio below:

At a mere 12.9, the XAU-gold ratio is breaking to a two year low, and trades a full 4.6 points below the low it reached at the depth of the gold bear market in the year 2000. In other words, relative to gold, gold stocks are now about one third cheaper than they were at the bottom of a 20 year long bear market!

Normally we would have to term these recent developments as rather short to intermediate term bearish for gold. Should a new liquidity crisis engulf the markets – which is well within the realm of the possible given the simmering crisis in euro land and the global economic slowdown that has been under way for most of this year – then this may well turn out to be the case.

However, gold's chart continues to look quite constructive:

Gold, daily – what's not to like?

Gold Sentiment

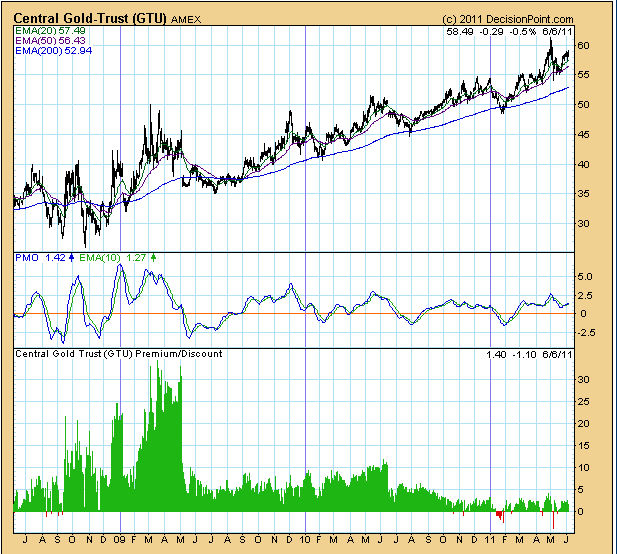

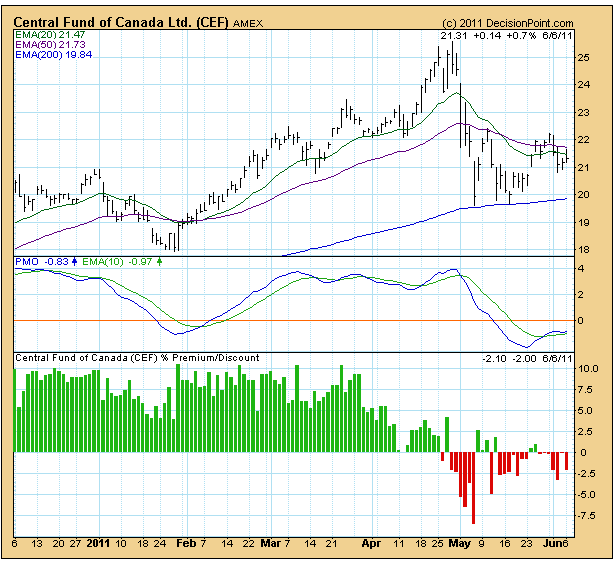

There is one reason one should perhaps refrain from getting too bearish – and that is the sentiment backdrop accompanying this recent activity. Closed end funds holding gold and silver bullion continue to trade at either tiny premiums to NAV (net asset value) or even discounts to their NAV - a historically very rare condition as can be seen below.

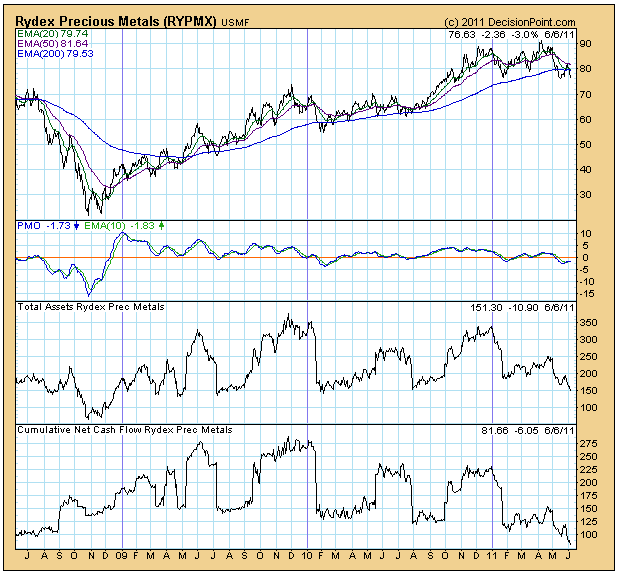

In addition, the cumulative cash flow ratio of the Rydex precious metals fund continues to plunge to multi-year lows. Evidently the public has become extremely bearish on gold equities. To some extent this bearish sentiment is of course a function of prices, but should prices begin to turn up again, it suggests that there will be a large pool of currently sidelined buyers that could drive prices higher.

This does not tell us anything about the near term performance of the sector, but we would note that the profit margins of gold miners are recently rising strongly and the fundamental backdrop – negative real interest rates and a slowing economy – is very conducive to further profit margin improvements.

The Central Gold Trust GTU – its premium to NAV has shrunk to a tiny 1.4% – historically this is one of the lowest premiums ever. This year even discounts to NAV could be observed on several occasions.

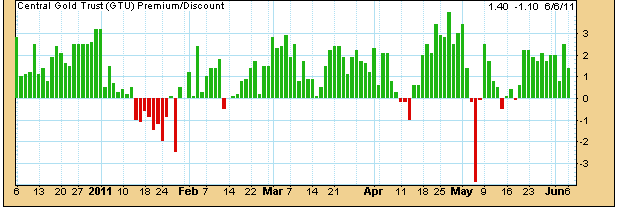

A close-up of the GTU premium/discount to NAV over recent months.

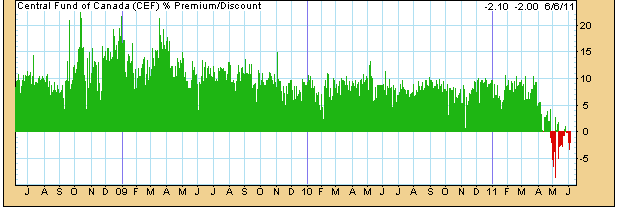

The Central Fund of Canada, CEF, trades at a very rare discount to its NAV.

A longer term view of CEF's premium-discount to NAV history. As can be seen, a discount to NAV hasn't been in place for quite some time.

The cumulative cash flow ratio of the Rydex precious metals fund has collapsed to a multi-year low. This is actually quite a contrast to the fund's performance, which in spite of the recent pullback is not too bad.

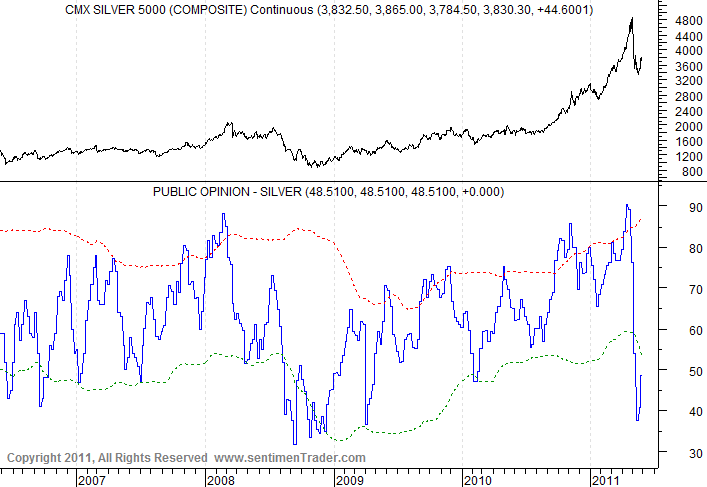

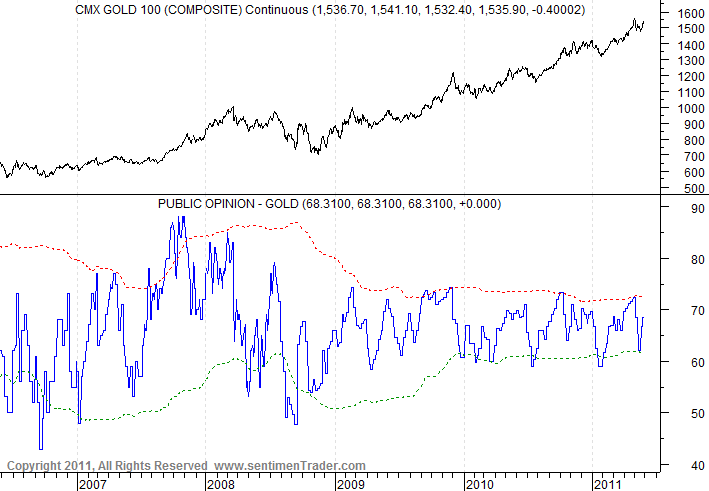

Lastly, the 'public opinion' charts on gold and silver published by sentimentrader.com suggest that there is currently little speculative froth in the metals themselves – in spite of gold's quite credible performance.

Public opinion on silver (an amalgamation of various quantitative sentiment indicators) is currently well into 'oversold' territory.

Public opinion on gold is obviously more bullish, but far from an extreme.

Precious metals related sentiment indicators would suggest that once a change in trend occurs, a new uptrend could be sustained for quite a while as the extremely negative sentiment unwinds