As investors seek sources of consistent income, they are turning dividend-paying stocks and using a dividend-capture strategy to make their picks.

A dividend-capture approach involves buying a stock ahead of its dividend payment date, banking the dividend, then selling the stock to purchase another that is about to pay a dividend. Rinse, Repeat. With this practice, an investor can ensure a steady stream of income.

Typically, dividend-paying companies are mature and financially stable, with the steady cash flow required to reliably deliver dividends. Often lower risk, the stocks are frequently a portfolio choice for investors just ahead of or who are in retirement.

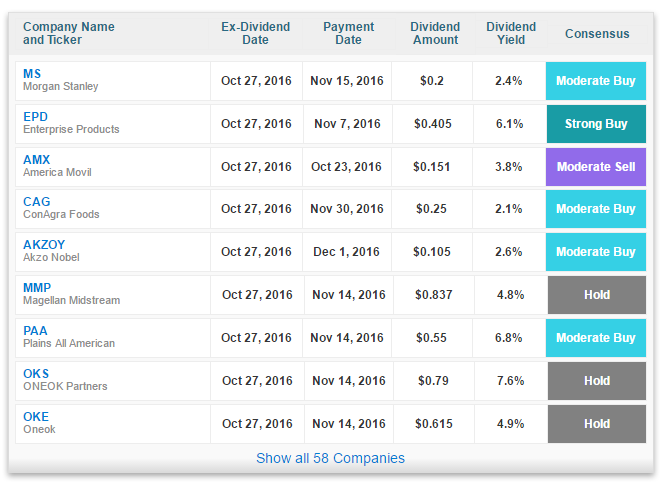

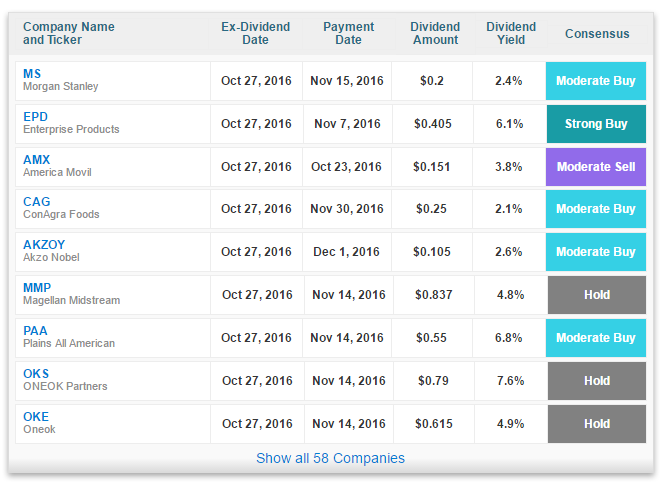

TipRanks enables investors to super-charge a dividend-capture strategy with the recommendations of Top Ranked Analysts. Using the Dividend Calendar, investors can not only see which stocks are soon to go ex-dividend, but also see the consensus rating of the Best Performing Analysts.

TipRanks enables investors to super-charge a dividend-capture strategy with the recommendations of Top Ranked Analysts. Using the Dividend Calendar, investors can not only see which stocks are soon to go ex-dividend, but also see the consensus rating of the Best Performing Analysts.

A number of stocks going ex-dividend this week are worth noting for their combination of high dividend yield and a Strong Buy rating. Genesis Energy L.P. (GEL) goes ex-dividend on October 26 (with a payment date of November 14) with 7.6% yield. The shares have a Strong Buy rating with an average price target of $44.70, a 20% upside from current price levels.

Enterprise Products (EPD) goes ex-dividend on October 27, with a $0.405 per share dividend to be paid on November 7. That is a 6% yield at current share price levels. EPD is also rated a Strong Buy according to an analyst consensus on TipRanks. The Best Performing Analysts have an average 12-month price target of $33.33, an upside of 23% from current price levels.

The strategy requires familiarity with the stock’s ex-dividend date, the day that new buyers are no longer eligible to receive the next dividend. To capture a dividend, investors must buy the stock before the ex-dividend date to ensure they are a shareholder of record when the dividend is paid.

Investors buying after the dividend announcement and before the ex-dividend date often pay a higher price because the stock price frequently increases prior to the ex-dividend date to factor in the payment. The price usually declines after the stock goes ex-dividend to reflect the value of the dividend payment since after the ex-dividend date, buyers of the stock or fund will not receive the upcoming dividend.