The 300 Club

Mid-size oil exploration and production stocks have shaken off overbought technical conditions and look ready to eject into follow-through rallies that could add many points into the fourth quarter. Energy players fixed on crude oil futures may need to hold their noses to participate in the upside because these securities may decouple from commodity prices during the advance.

Many E&P companies have struggled to add points since April, after a first-quarter rally lifted the energy sector off historic lows. Crude oil topped out near $50 and sold off through $40 during this period, shaking out weak hands while establishing the first low in a trading range that could limit price movement into 2017. Add the broad-based equity advance into this equation and ideal conditions are in place for these stocks to head higher, despite sideways action in the energy pits.

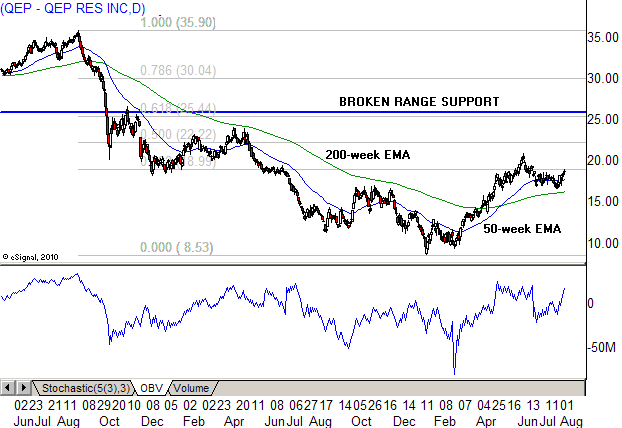

QEP Resources Inc (QEP) came public near 30 in July 2010 and entered a strong uptrend that ended at $45.20 one year later, at the same time that commodity futures were topping out after historic uptrends. It plunged into the mid-$20s a few months later, establishing a trading range with support at that level, and held above the low into an October 2014 breakdown that posted a series of new lows into January 2016.

The subsequent bounce mounted the broken 200-day EMA in April and traded up to a 13-month high in June. The stock then entered an orderly correction that tested new support at the moving average at the end of July. An upturn into August shows excellent accumulation, as interpreted by On Balance Volume (OBV), pointing to the start of a rally wave that could break June high and reach resistance in the mid-$20s (blue line).

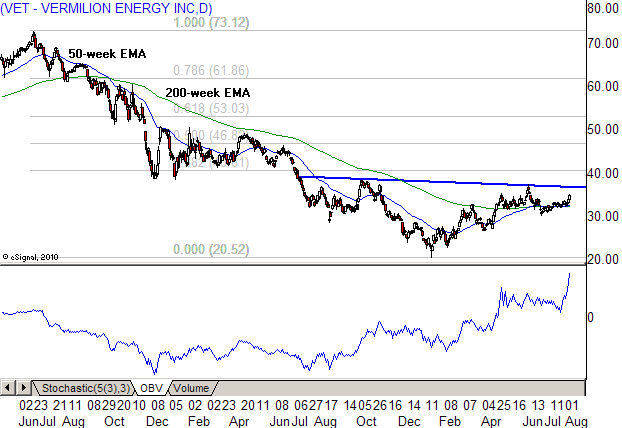

Vermilion Energy Inc (VET) came public in March 2013 near $50 and entered an immediate uptrend that posted an all-time high at $72.69 in June 2014. The subsequent downtrend accelerated to lower ground in the fourth quarter of that year, pounding out an intermediate bottom in the upper $30s. Support held into a July 205 breakdown that posted two selling waves into an all-time low at $20.31 in January 2016.

The stock bounced above the 200-day EMA in April, initiating a test that’s still in progress, nearly four months later. It spent the month of July building a basing pattern on the moving average and has now ejected into a rally that’s testing the June high at $37.33. That impulse may also complete an inverse head-and-shoulders breakout pattern, with a measured move target in the low $50s. OBV shows a strongly bullish pattern, supporting the breakout effort.

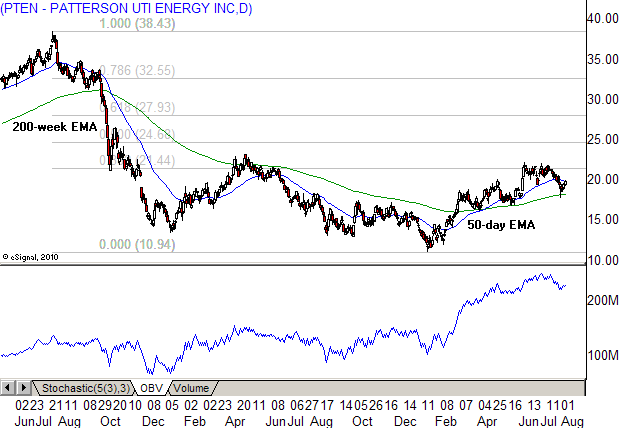

Patterson-Uti Energy Inc (PTEN) topped out in the upper $30s in 2006, plunged to an eight-year low in single digits in 2009 and failed tests at resistance in 2011 and 2014. The stock entered a new downtrend in October 2014, descending in two long selling waves into a five-year low at $11.28 in January 2016. It turned higher into March, mounting 200-day EMA resistance, and has spent the last five months testing that level within a rising channel pattern.

The stock bounced at new support on July 29th and has spent the last week lifting into resistance at the 50-day EMA near $20. A rally above that level should intensity the upside, yielding an assault on the June and July highs near $22, with a breakout clearing the way for an uptrend into the mid to upper $20s. OBV shows a strongly bullish pattern, supporting higher prices into the fourth quarter.

The Bottom Line

Oil exploration and production companies have been testing long-term support levels since the first quarter and now look ready to eject into rally waves that post new 2016 and 52-week highs. Timing conscious traders and investors should watch first-quarter swing highs closely for breakouts that could signal strong momentum into the fourth quarter.

Investopedia