The 300 Club

By Shira Gonen

Merrill Lynch and Credit Suisse analysts provide their two cents on Marathon Oil Corporation (NYSE:MRO) following its acquisition of Payrock Energy’s oil well assets. While one analyst remains on the sidelines, claiming investors need more data regarding acreage, the other recommends buying shares, believing the acquisition increases the company’s overall value.

Merrill Lynch – Neutral

Merrill Lynch analyst Doug Leggate weighed in on Marathon Oil Corp following news that the company acquired Payrock Energy, a private oil company with assets in an area of counties in Oklahoma known as the STACK, for $888 million. As part of the deal, the company will acquire an additional 61,000 net surface acres in the STACK, which produce 9,000 net barrels of oil per day. The deal values each acre at around $11,800.

The analyst believes the acquisition is a step in the right direction for Marathon. He states, “Strategically, the deal fits with MRO’s existing footprint and provides depth to its US resource inventory.” Leggate notes that wells in the specific location of the acreage, mostly in the Kingfisher and Canadian County, have an oil cut of 50-90%.

The analyst compares the per acre value ($11,800), to similar deals by other companies. He believes the acquisition “compares favorably” to NFX’s $470 million acquisition of CHK, where NFK paid $10,000 per acre for a total of 42k stack acres. However, he believes MRO’s views of optimal wells will change with time. He explains, “Given the early development stage of the play, MRO’s comparison of PayRock wells compares well with all wells drilled to date; but with the industry seemingly moving to longer laterals, we suspect MRO’s view of optimal wells will evolve.”

The analyst believes this deal implies MRO’s view that oil prices will rebound. He states that since the “downturn” of oil prices, the company has been actively trying repair its balance sheet through asset sales in order to protect liquidity. However, in light of credit rating firm Moody’s recent increase of its 2018 price per barrel estimate from $43 to $50, the analyst believes that “immediate credit risk across the industry has eased”, implying the transaction is well-timed. He also notes that the company does not plan on issuing additional equity to fund the acquisition.

While the analyst believes that the “transaction is positive” for the company, he believes the market is waiting for more data on the Canadian county acreage before any meaningful long term upside to shares. He explains, “Going forward the increased operated STACK position provides options for MRO, although more data on Canadian county acreage that appears to dominate the acquired footprint is likely a pre-requisite before the market can fully assess the longer-term impact.”

The analyst maintains his Neutral rating on shares with a $20 price target. He states, “For now we continue to view MRO as a levered option on an improving oil price environment; but on the margin, we view this deal as a step forward in improving drilling options in a recovery.”

Credit Suisse – Buy

In addition, Credit Suisse analyst Edward Westlake provided his insights on Marathon Oil Corporation following its announcement that it would acquire PayRock for $888 million. PayRock’s assets will result in an additional 9,000 barrels of oil produced per day for MRO, a key positive according to Westlake.

The analyst reiterates an Outperform rating on the company and raises his price target slightly from $18 to $18.50.

He explains, “MRO’s shift of capital from Wyoming (sold earlier this year) to the STACK is accretive. The well results in the core of this PayRock acreage (which lies to the east of the more established play) do support decent IRR’s and a value uplift versus the price paid. Our EUR is more conservative than the type curve in today’s MRO presentation (decline rate). In general, there is room for type curves to improve versus our NAV models for the Permian and STACK (see our recent deep dive here). There are also well results required for MRO to de-risk the southeast part of the acquired acreage, a potential upside. The share price move today seems stronger than the initial risked value created from the deal, but reflects the fact that MRO shares were undervalued to start with, and perhaps reflects fears that MRO would overpay.”

Edward Westlake has a 54% success rate recommending stocks with a 7.6% average return per recommendation on TipRanks.

According to TipRanks, out of all the analysts who have rated the company in the past 3 months, 62% gave a Buy rating while 38% remain on the sidelines. The average 12-month price target for the stock is $17.56, marking a 19% upside from where shares last closed.

Thursday Morning’s Market Insights: Micron Technology, Inc. (MU), Seadrill Ltd (SDRL), BlackBerry Ltd (BBRY)

By Shira Gonen

Micron Technology, Inc. (NASDAQ:MU) is up over 7% following analyst upgrades. Analyst Mehdi Hosseini of Susquehanna upgraded the stock from Neutral to Positive, raising his price target to $18 from $10. The analyst credits his upgrade to improving PC & Server DRAM trends, as well as improving NAND fundamentals.

He states, “Our checks over the past week suggest that pricing trends for PC & Server DRAM …are improving and actually up into 2H. Although competitors are holding inventory of mobile DRAM, MU’s mobile share loss earlier in the year is actually playing to the company’s advantage. In fact… we now maintain a positive bias on the PC & Server segments into 2H [because of] new products (i.e. 2-in-1 NB) that are scheduled for introduction in 2H should provide catalysts for some upgrade activity…PC & Servers are viewed as MU’s sweet spot.” He continues, “Additionally, NAND fundamentals are continuing to improve, with increased prospects of a supply “shortage” by Sep Q. Although we don’t expect MU’s 3D NAND to be ready for HVM before 2017, improving fundamentals still bode well for MU’s planar NAND ASP, and thus are incremental to MU’s 2H earnings.”

Analyst Romit Shah of Nomura Securities also upgraded MU from Reduce to Buy, raising his price target to $18 from $8. The analyst credits an improvement in overall semiconductor fundamentals, such as SSDs and DRAM, as the reason for his upgrade, as well as competitors trading at higher levels.

He states, “We believe that semiconductor fundamentals are healthy or improving across several areas, including analog, SSDs, DRAM, and capital equipment. While end demand remains a mixed bag, we believe this strength could persist through the back-to-school season in Sep/Oct. Several franchise names, including AMAT, AVGO, NVDA, and TXN, are trading near highs and/or peak valuations. While we view several of these as core holdings, we believe investors should adopt a barbell strategy and own some beaten-down stocks into the second half.”

According to TipRanks’ statistics, out of the 26 analysts who have rated the company in the past 3 months, 19 gave a Buy rating, 3 gave a Sell rating, and 3 gave a Hold rating. The average 12-month price target for the stock is $15, marking an 18% upside from where shares last closed.

Seadrill Ltd (NYSE:SDRL) is up more than 2% this morning following a slight rise in oil prices resulting from the anticipated Brexit vote, set for later today. Many investors believe voters will keep the UK in the European Union due to recent poll results. As such, this will lead to a rise in “risky” assets such as oil. Many believe that if Britain votes to remain in the EU, a shift to fundamentals will occur, focusing more on supply disruptions which have so far increased prices. As of 9:00 GMT, Brent crude is up 31 cents to $50.19 a barrel while U.S futures are up 26 cents to $49.39. According to ANZ Research, “A positive one in the commodity markets continues to support prices. However, the gains remain limited as investors await the outcome of the EU vote in the U.K.”

According to TipRanks, out of the 4 analyst who have rated the company in the past 3 months, 3 gave a Sell rating while 1 remains on the sidelines. The average 12-month price target for the stock is $1.90, marking a 44% downside from where shares last closed.

BlackBerry Ltd (NASDAQ:BBRY) is up close to 2% in early trading Thursday, after the company reported Q1:17 earnings this morning. The company posted revenues of $424 million, lower than consensus estimates of $471 million, and break even earnings, compared to a consensus loss of ($0.08) per share. However, the company also posted a $670 million net loss for the quarter which includes an impairment charge of $501 million, a goodwill impairment charge of $57 million, and a $41 write-down of inventory charge.

CEO John Chen credited lower than expected sales of its first Android phone, Priv, as part of the reason why revenues came in lower than expected. However, investors also focused on better than expected guidance, as the company predicts a 30% growth in FY2017 software and services revenue as well as FY17 PS of ($0.15) compared to a consensus loss of ($0.33) per share for FY17.

The company stated, “Our current plan calls for continued investments to expand our addressable markets and drive sustainable profitability and revenue growth. For the full fiscal year, we are on track to deliver 30 percent revenue growth in software and services. Based on a more efficient operating model, we expect a non-GAAP EPS loss of around 15 cents, compared to the current consensus of a 33 cent loss. We also expect to generate positive free cash flow for the full year.”

According to TipRanks, out of the 9 analysts who have rated the company in the past 3 months, 2 gave a Sell rating while 7 remain neutral. The average 12-month price target for the stock is $7.49, marking an 11% upside from where shares last closed.

Wednesday’s Market Insights: Tesla Motors Inc (TSLA), SolarCity Corp (SCTY), Pluristem Therapeutics Inc. (PSTI), Adobe Systems Incorporated (ADBE)

By Shira Gonen

Tesla Motors Inc (NASDAQ:TSLA) is falling over 11% in pre-market trading following news that the electric car marker will purchase SolarCity Corp (NASDAQ:SCTY) for $2.8 billion. The company aims to access Solar City’s distribution networks and technology, all under the Tesla brand. This raises a conflict of interest as Musk is the chairman of SolarCity and the largest shareholder of the company. As a result, Musk, as well as his cousin and Solar CEO, Lyndon Rive, have recused themselves from voting on the deal.

Investors are worried that finances will shift away from Tesla, which needs capital to fund its various projects and delivery estimates. Related, Solar City has posted consistent quarterly losses, decreasing close to 60% YTD.

Following the announcement, Robert W. Baird analyst Ben Kallo reiterated an Outperform rating on the stock with a $338 price target. He states, “We believe TSLA shares could face pressure in the near term as the news is digested and due to potential arbitrage opportunities, although we continue to believe TSLA offers significant upside potential for long-term investors.”

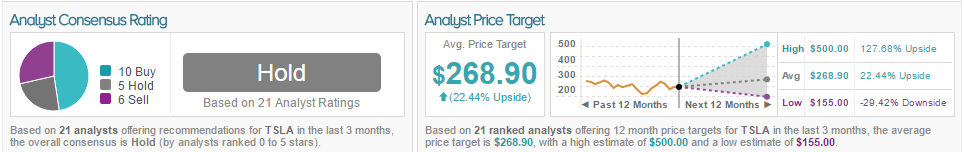

According to TipRanks’ statistics, out of the 21 analysts who have rated the company in the past 3 months, 10 gave a Buy rating, 6 gave a Sell rating, and 5 remain on the sidelines. The average 12-month price target for the stock is $268.90, marking a 22% upside from where shares last closed.

Pluristem Therapeutics Inc. (NASDAQ:PSTI) is up close to 11% in pre-market trading after the company presented positive data showing that preclinical studies of its PLX-PAD cells effectively treat Duchenne muscular dystrophy. The results demonstrated that in mice, PLX-PAD cells reduced CPK, a marker of muscle degeneration, by 50% compared to the placebo. CEO Zami Aberman stated, “Because PLX-PAD cells have already displayed efficacy in muscle regeneration in a Phase II muscle injury study, we believe our cell therapy may potentially be beneficial in Duchenne muscular dystrophy in human clinical trials.”

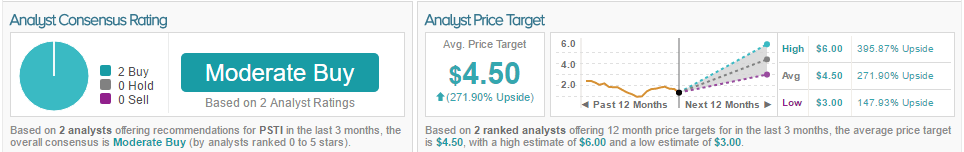

According to TipRanks, 2 analysts have rated the company in the past 3 months, both with a Buy rating. The average 12-month price target for the stock is $4.50, marking a 272% upside from where shares last closed.

Adobe Systems Incorporated (NASDAQ:ADBE) is down 4% in premarket trading after the company released Q2:16 earnings yesterday after market close. The company posted revenues of $1.4 billion, in line with consensus, and adjusted earnings per share of $0.71. However, investors were more focused on Q3 guidance, as the company expects revenues of between $1.42 bill and on $1.47 billion, with earnings ranging from 69 to 79 cents. This is slightly below consensus guidance estimates of $1.47 billion in revenue and in-line with earnings estimates of 71 cents per share. While the company expects to reach its 2016 targets, slightly weak Q3 guidance takes into account seasonality in cloud product sales.

Analyst Brent Thill of UBS weighed in on the stock following earnings, reiterating a Buy rating and price target of $122. He states, “Marketing Cloud has been choppy, and with CRM scooping up the top e-commerce asset, some investors are asking if ADBE needs another major Cloud to drive L-T growth.” He continued, “We still like ADBE’s prospects… but stock could trade sideways in the S-T after the Q1 euphoria was deflated by a more normal Q2, and investors look for excitement in the 2H.”

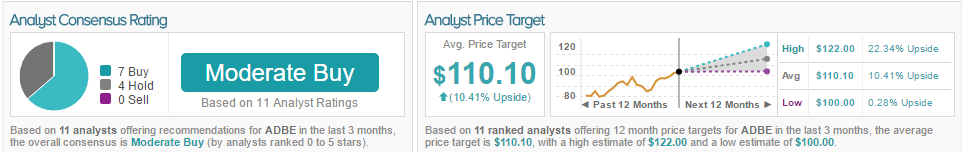

According to TipRanks, out of the 11 analysts who have rated the stock in the last 3 months, 7 gave a Buy rating and 4 remain on the sidelines. The average 12-month price target for the stock is $110.10, marking a 10% upside from where shares last closed.

Analysts Bullish on Apple Inc. (AAPL) and Nike Inc (NKE) Ahead of Upcoming Earnings

By Zachary Wohlberg

With quarterly reports being released soon, two of the most recognized brand name stocks Apple Inc. (NASDAQ:AAPL) and Nike Inc (NYSE:NKE) are facing pressing challenges. Below, analysts discuss the slowdown in sales of Apple products and the increased competition that Nike is experiencing.

Apple Inc.

Analyst Jeff Kvaal of Nomura Group expressed his long-term views on Apple in the midst of a fiscal year where Apple may not reach expectations. The analyst explains that the technology giant will face several challenges in the remainder of 2016 but will bounce back thereafter.

The analyst cites his opinion that expectations for F4Q sales are too optimistic and over the next two quarters demand for Apple products, outside of the iPhone SE, will slip. The analyst feels the iPhone SE has cannibalized Apple’s other products, especially the iPhone 6s, due to a record low upgrade rate and SE sales exceeding 2016 expectations by 10-20 million units. Kvaal stresses that SE sales will continue to show growth as it begins to reach “its intended first-time buyer market in China.” Apple is benefiting from a more efficient production process of iPhone SEs and has gotten lead times down to 4-8 days in the US and 3-5 days in China. The analyst expects “Apple to bring [SE] supply back into line with demand near the end of June.”

Kvaal anticipates a strong first quarter next year that will offset his expectations for low sales in F3Q and F4Q. He expects Apple to easily reach his sales estimate of 75 million phones in the first quarter with the replacement rate expected to recover to 8% and AT&T rolling out a new promotional schedule for the 4Q. Additionally, the analyst feels Apple will be able to hold its “90% retention rate, grow the iOS base, and ultimately restore unit growth” due to new features that are improving the user experience across devices.

In spite of the Kvaal’s expectation of a difficult end to Apple’s fiscal year, he has a positive view for 2017 and therefore maintains his Buy rating on Apple with a price target of $120, marking a 26% increase from current levels.

According to TipRanks, Jeff Kvaal has a success rate of 52% and an average return of 9.3% per recommendation.

Out of the 38 analysts on TipRanks, who have rated the company in the past 3 months, 84% gave a Buy rating, 13% gave a Hold rating and 3% gave a Sell rating. The average 12-month price target for the stock is $123.97, marking a 29.26% upside from current levels.

Nike Inc

Merrill Lynch analyst Robert Ohmes expressed his uncertainties regarding Nike prior to the release of its F4Q16 earnings next week, scheduled for June 28 after market close. The analyst points to increasing competition as Nike’s biggest risk for growth.

The analyst expects Nike to report F4Q16E EPS of $0.48, revenue growth of 6.0%, and a 30bps decline in EBIT margins thanks to strong momentum in casual footwear, increased distribution in department stores, and increased trends in Europe and China. However, he warns that this momentum may be partially outweighed by increasing competition in North America. The continuing rise of Under Armour and the reemergence of Adidas has caused Nike to lose footwear market share in North America for the first time in 6 years. Additionally, Nike now has to compete with Under Armour and Adidas for endorsements and key industry talent more than ever before. Looking forward, Ohmes predicts that Nike will maintain its F2017 outlook with “high-single digit revenue and low-teens EPS growth.”

Sell-through rates for Nike’s technical platforms of Free, Lunar, Air Max and basketball shoes have been decreasing as the market taste is turning to cheaper casual and retro styles. This shift comes with the risk of losing market share to non-technical styles from other brands. Ohmes feels that this slow down in sell-through rates is forcing Nike to accelerate “its inventory clearance through aggressive product returns from retailers” and thus pushing down futures and revenue growth.

The analyst expects international FX headwinds to decelerate after the Summer Olympics and EuroCup shipping windows as “comparisons turn tougher in key markets and Nike laps the implementation of category offense in Western Europe and an extremely successful market reset in China.”

Ohmes maintain his Neutral rating on Nike with a price objective of $60, marking an increase of 9.5% from current levels.

According to TipRanks, Robert Ohmes has a 48% success rate and an average return of 1.6% per recommendation.

Out of the 17 analysts on TipRanks, who have rated the company in the past 3 months, 71% gave a Buy rating and 29% gave a Neutral rating. The average 12-month price target for the stock is $68.25, marking a 24.61% upside from current levels.

Monday Morning’s Market Insights: LinkedIn Corp (LNKD), Eleven Biotherapeutics Inc (EBIO), MannKind Corporation (MNKD), Sunesis Pharmaceuticals, Inc. (SNSS)

By Shira Gonen

LinkedIn Corp (NYSE:LNKD) is up a whopping 48% after Microsoft agreed to buy the company for $26.2 billion in cash. Microsoft will pay LinkedIn $196 per share and issue new debt to finance the transaction. LinkedIn will continue to operate as an independent company, though CEO Jeff Weiner will report to MSFT CEO Satya Nadella. The deal has been approved by the boards of directors of both companies and is expected to close later this year, subject to LinkedIn shareholder approval. The deal is expected to leverage the strengths of both companies. Weiner stated, “Just as we have changed the way the world connects to opportunity, this relationship with Microsoft, and the combination of their cloud and LinkedIn’s network, now gives us a chance to also change the way the world works.”

According to TipRanks statistics, out of the 25 analysts who have rated the company in the past 3 months, 13 gave a Buy rating while 12 remain on the sidelines. The average 12-month price target for the stock is $159.38, marking a 21% upside from where shares last closed.

Eleven Biotherapeutics Inc (NASDAQ:EBIO) is soaring 63% in pre-market trading after it announced an exclusive license agreement with F. Hoffmann-La Roche Ltd., granting it the rights to develop and commercialize EBI-031, as well as all other IL-6 antibody technology owned by Eleven. Eleven will receive a $7.5 million upfront payment with future milestone payments of up to $262.5 million. The first milestone payment of $22.5 million will be made pending the approval of the IND on or before September 15, 2016, reduced to $20 million if effective after. The company will also be entitled to royalties for net sales which contain EBI-031 or other Eleven IL-6 compounds. In addition, the company announced an investigational NDA (INDA) submission to the FDA to initiate a phase 1 clinical trial of its humanized monoclonal antibody EBI-031, intended to treat ocular diseases. The company also

According to TipRanks, only one analyst rated the company in the past 3 months with a Hold rating and a $0.40 12-month price target, marking a 71% downside from where shares last closed.

MannKind Corporation (NASDAQ:MNKD) is up close to 7% in pre-market trading after the company announced positive data regarding its inhalable insulin drug, Afrezza. The company presented the data at the American Diabetes Association’s 76th Scientific Session from a study comparing Afrezza to Lispro, a rapid acting insulin analog. The results indicated a faster onset of action for Afrezza of 16-21 minutes compared to 45-52 minutes for subcutaneous insulin. Furthermore, Afrezza’s duration of activity was consistently shorter by 2-3 hours for clinically relevant doses.

Mannkind Chief Medical Officer Raymond W. Urbanski stated, “These data show Afrezza begins to work in the body more rapidly and leaves the bloodstream more quickly than an injectable rapid-acting insulin analog, which could translate into more flexibility in the timing of administration and a lower potential for hypoglycemic episodes following meals.”

According to TipRanks, out of the 4 analysts who have rated the company in the past 3 months, 3 are bearish while 1 remains on the sidelines. The average 12-month price target for the stock is $0.17, marking an 83% downside from where shares last closed.

Sunesis Pharmaceuticals, Inc. (NASDAQ:SNSS) shares are up over 19% in pre-market trading after the company announced positive results from an ongoing phase 1b/2 trial of vosaroxin in combination with decitabine in older patients with untreated acute myeloid leukemia and high-risk myelodysplastic syndrome (MDS), a type of bone marrow cancer. The results indicated that at 70 mg, the combination of vosaroxin and decitabine results in a median overall survival or 16.1 months with a CR/CRp/Cri rate of 76%.

According to TipRanks, only 1 analyst rated the stock in the past 3 months with a Buy rating and no price target.

BMO Capital Weighs In On Healthcare Giants: Valeant Pharmaceuticals Intl Inc (VRX), Incyte Corporation (INCY) And Celgene Corporation (CELG)

By Sarah Roden

Analysts from sell-side firm BMO Capital weigh in on three healthcare giants. While one remains on the sidelines of Valeant Pharmaceuticals Intl Inc (NYSE:VRX) following a dismal earnings report, another is incrementally bullish on Incyte Corporation (NASDAQ:INCY) and Celgene Corporation (NASDAQ:CELG) thanks to pipeline updates.

Valeant Pharmaceuticals Intl Inc

Valeant released first quarter earnings earlier this week, posting disappointing figures that underscore the several obstacles the company has faced over the past months. The company lowered guidance, yet again, leaving Alex Arfaei of BMO to note that Valeant doesn’t have much room left to continue this trend of lowering guidance.

In its first quarter earnings report, Valeant slashed full-year 2016 revenue estimates from the range of $11B to $11.2B down to the range of $8.5B to $9.5B, and slashed full-year 2016 EPS between $6.60 and $7, down from the range of $8.50 to $9.50. Arfaei comments, “Although we expected Valeant to lower its guidance, the magnitude of the downward revision was greater than we and the market expected.” The analyst believes that Valeant will meet this lowered guidance, but acknowledges that visibility remains low.

Arfaei is primarily concerned with the company’s dermatology business, specifically regarding profitability. He comments, “This had been our biggest concern following Philidor and the Walgreens’ deal, and one of the key reasons we expected the guidance lowering.” Valeant still has severe debt to repay, though the analyst notes that it should be able to pay back about $1.7B this year. He also acknowledges the possibility of Valeant selling its “non-core assets (e.g., surgical, dentistry, neuro, and other) worth as much as $5.5Bn to further lower its debt and alleviate covenant breach concerns.”

Arfaei reiterates a Market Perform rating on Valeant but lowers his price target from $44 to $38.

According to TipRanks, Arfaei has a 68% success rate recommending stocks with a 5.6% average return per rating. Out of the analysts who have rated Valeant in the last 3 months, 33% are bullish, 19% are bearish, and 48% are neutral. The average 12-month price target is $42.75, marking a 79% upside.

Incyte Corporation

Following a meeting with management, Ian Somaiya of BMO weighs in the company’s development strategy. Focus remains on epacadostat, the company’s pipeline drug to treat specific forms of cancerous tumors.

Somaiya describes that epacadostat’s development strategy “balances data with need for speed.” New Phase 3 trial data will be released in 18 weeks. The analyst expects epacadostat and baricitinib, a drug to treat rheumatoid arthritis and psoriasis, to represent the biggest sources of upside for the company.

At last week’s ASCO meeting (American Society of Clinical Oncology), the company “shared its views on the key datasets from the 2016 ASCO, which highlight need for novel combos and role for chemo.” The analyst believes the company’s focus “on understanding changes in tumor biology combined with its data sharing agreement with key I/O players increases probability of success for epacadostat outside melanoma, with Phase II data from larger expansion cohorts expected by YE16.”

Following these company updates, Somaiya reiterates an Outperform rating on the company and raises his price target from $91 to $97.

According to TipRanks, Somaiya has a 61% success rate recommending stocks with a17.1% average annual return per rating. He is ranked in the top 4% of all analysts on Wall Street. All analysts covering INCY on TipRanks are bullish on the stock with and average 12-month price target of $90.14, marking a 9% upside.

Celgene Corporation

Ian Somaiya goes on to cover Celgene, which also presented data at ASCO. While Revlimid is already an FDA-approved drug to treat transfusion-dependent anemia, all eyes were on Phase 1 data of Keytruda + Revlimid to treat Revlimid-refractory myeloma.

Somaiya comments on this promising data that demonstrated “high efficacy,” with half of the patients achieving stringent complete response (CR) or partial response (PR). The analyst elaborates, “Notably, even Revlimid-refractory patients (75% of patients in the trial) had similar response rates, with 37% of patients achieving a CR/PR We believe this could point to longer duration of use than the six months we currently assume in the third-line plus setting and upside to our estimates.”

The analyst believes that this data, coupled with other ongoing combination trials, “reflect Celgene’s strategy of pursuing combination trials to ensure Revlimid and Pomalyst remain backbone therapies across the myeloma disease spectrum.” He continues, “We see additional evidence of this strategy in Celgene’s partnership with AstraZeneca for durvalumab.”

Somaiya reiterates an Outperform rating on the stock with a $132 price target, marking a 24% upside.

According to TipRanks, 80% of analysts are bullish on Celgene while 20% remain neutral. The average 12-month price target is $140, marking a 31% potential upside from current levels.

Analysts Maintain Mixed Ratings on Apple Inc. (AAPL) and Lululemon Athletica inc. (LULU) Following Sales Data and Earnings Results

By Kate George

Analysts weigh in on tech giant Apple Inc. (NASDAQ:AAPL) and yoga-wear chain Lululemon Athletica inc. (NASDAQ:LULU), as Apple wraps up May iPhone sales and Lululemon posts earnings. Let’s take a closer look:

Apple Inc.

With iPhone sales from May in the books, analyst Brian White from Drexel Hamilton weighs in on the tech giant and shares his thoughts on the late stages of the iPhone 6-series cycle. Despite newfound concern over Apple’s long-term longevity, White remains bullish on the company and its bright future.

White notes that May iPhone sales were “softer than historical averages.” The analyst elaborates, “May sales… fell by 1% MoM and weaker than the average 5% increase over the past eleven years. Last May, sales for our Apple Monitor rose by 2% MoM.” However, this does not come as a surprise during the “final months of the iPhone 6-series cycle before iPhone 7 ramp begins.”

The analyst estimates that iPhone sales will also be weak in June due to this logic. White explains, “If we assume an average MoM sales decline for…this June as experienced over the past 11 years, we estimate sales…will fall by 4% QoQ in the June quarter and weaker than the average rise of 13% for past June quarters and below the up 2% in 2Q:15.”

Moreover, the analyst is not caught up in the “‘gloom and doom’” sentiment that followed Apple as the company reached record highs. On the contrary, White believes the stock “represents an exceptional value.” Looking forward, the analyst will attend Apple’s World Wide Developer Conference next week and expects to hear more about its innovation pipeline.

White reiterates a Buy rating on Apple with a $185 price target, marking an 86% potential upside from current levels.

According to TipRanks, Brian White has a 57% success rate recommending stocks with an 8.5% average annual return per rating. He is ranked in the top 3% of all analysts on Wall Street.

Out of the analysts who have rated Apple in the last 3 months, 84% are bullish, 13% are neutral, and 2% are bearish. The average 12-month price target for the stock is $125, marking a 26% potential upside from current levels.

Lululemon Athletica inc.

Athletic apparel retailer Lululemon posted first quarter earnings this morning. Camilo Lyon of Canaccord dives into the numbers, discusses the company’s outlook, and explains why he continues to remain on the sidelines of the company.

Lululemon posted adjusted EPS of 30 cents, in-line with Lyon’s estimate. Overall, he notes, “Q1 turned out to be a solid comp/GM quarter, but the absence of a clean beat on all line items coupled with ‘maintained’ vs. ‘raised’ guidance, tough 2H compares, and a high valuation likely keep the stock in check.”

Looking forward, the company is guiding second quarter EPS between 36 cents and 38 cents, falling below Lyon’s estimate of 40 cents. The analyst questions if this guidance is a “function of conservatism or perhaps less robust gross margin expansion.” Lululemon left its 2016 adjusted EPS estimate range unchanged at $2.05 to $2.15.

Lyon reiterates a Hold rating on the stock with a $70 price target, marking relatively flat upside.

According to TipRanks, 64% of analysts are bullish on the athletic apparel retailer, 23% are neutral, and 13% are bearish. The average 12-month price target is $69, marking a slight downside from current levels.

Hold the Phone on Biotech: Valeant Pharmaceuticals Intl Inc (VRX) and Gilead Sciences, Inc. (GILD)

By Sarah Roden

While Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Gilead Sciences, Inc. (NASDAQ:GILD) remain biotech giants, they are no longer the fan-favorites they used to be. Analysts from brokerage firms Cancaccord and Maxim remain neutral on both companies as Valeant releases weak earnings and Gilead navigates a patent lawsuit.

Valeant Pharmaceuticals Intl Inc

Valeant can’t seem to catch a break as the embattled pharmaceutical company released weak first quarter earnings, adding insult to injury following months of litigation on multiple fronts and a swift CEO swap. In light of the earnings report, Neil Maruoka of Cancaccord weighs in on the company and the challenges that lie ahead.

On the earnings front, Maruoka explains that quarterly revenue was in-line with his expectations at $2.37 billion, though adjusted EPS of $1.27 fell below his expectations of $1.43. Valeant also lowered 2016 revenue guidance to the range of $9.9 billion to $10.1 billion, down from the previous range of $11.0 billion to $11.2 billion. The analyst views this as new CEO Pappa’s move to “hit the reset button on expectations at the beginning of his tenure.”

The analyst points out several challenges presented by the company’s partnership with Walgreens, explaining; “The transition to Walgreens has not come without some significant bumps, including much lower ASPs across this segment. However, the company believes that this issue is ‘fixable’ and that it can return the business to growth.” Maruoka continues that this “slower rebound from a weak Q1 has led to a much weaker outlook for the year.”

As Valeant struggles to regain its footing, Maruoka reiterates a Hold rating on Valeant with a $40 price target, marking a 60% potential increase from current levels.

According to TipRanks, 33% of analysts are bullish on Valeant, 48% are neutral, and 19% are bearish. The average 12-month price target is $42.79, marking a 74% potential upside.

Gilead Sciences, Inc.

Gilead received news yesterday that a judge has reversed the order for Gilead to pay Merck $200 million in a drug-patent case after concluding that Merck’s in-house lawyer was deceptive. Jason Kolbert of Maxim Group sheds light on the update and its implications for the company.

Gilead has long ruled the market for hepatitis C drugs with its flagship products, Harvoni and Sovaldi, which comprise more than half of its revenue. Recently, Merck entered the hep c market with Zepatier, which is a less-expensive alternative to Gilead’s offerings. The ensuing lawsuit, filed by Merck, claims that Gilead infringed on Merck’s patents to produce its own hepatitis C drugs.

Kolbert summarizes the impact of this latest development, explaining, “The jury originally awarded a 4% royalty rate on $5 billion in sales (vs. the $20 billion that was being sought). For conservatism we assumed a worst case scenario of a 10% royalty and a one-time payment of $2 billion (payable in 18 months).” The analyst is removing his price target pending further clarity, but notes that the reversal decision reduces IP risk.

Kolbert reiterates a Hold rating on Gilead and has removed his price target until there is more clarity on the future of this case.

According to TipRanks, 57% of analysts are bullish on the stock while 43% are neutral. The average 12-month price target is $114.42, marking a 30% potential upside.

Analysts Chime In On Two Volatile Biotechs: Valeant Pharmaceuticals Intl Inc (VRX), Sarepta Therapeutics Inc (SRPT)

By Sarah Roden

Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Sarepta Therapeutics Inc (NASDAQ:SRPT) are two of yesterday biggest gainers and losers. One top analyst continues to sound the alarm on Valeant after the company released a disappointing first quarter earnings report and slashed guidance, while another analyst remains cautious on Sarepta after the FDA asked for additional data on eteplirsen, or PROMOVI. Let’s take a closer look.

Valeant Pharmaceuticals Intl Inc

Valeant fell more than 17% in pre-market trading yesterday to $23.78 after the company released earnings yesterday morning and slashed guidance. Irina Rivkind Koffler of Mizuho weighs in on the company, explaining how this disappointing report underlines her reservations about the company.

Valeant has been in the headlines as it faces a fraud allegation and an investigation into its pricing practices. Koffler has been critical of the company and bearish since March.

For the first quarter, the company posted a net loss of $373.7 million, or a loss of (1.08) per diluted share. This is a massive year-over-year loss as the company posted a net income of $97.7 million and $0.28 per diluted share in the first quarter of 2015. Looking forward, management expects total revenue between $9.9 billion and $10.1 billion for 2016, lower than the previous revenue estimate of about $11.1 billion. The company also lowered 2016 non-GAAP EPS estimate range from $6.60 to $7.00 down from the range of $8.50 to $9.50.

Koffler reminds investors not to be so fast in assuming that the stock is bottoming out because “business is expected to shrink even further as the company divests assets, manages through prior generic erosion guidance and additional pricing pressure, and begins to quantify the potential financial impact of its ongoing litigation.” The analyst warns that legal expenses will continue to climb and “settlement accruals could delay de-levering.”

Due to the mess that Valeant finds itself in, Koffler reiterates an Underperform rating on the company with an unchanged price target of $18, marking a 25% downside from current pre-market levels.

According to TipRanks, Koffler is a top ranked analyst with a 59% success rate recommending stocks and a 26.4% average one-year return. She is ranked in the top 1% of all analysts on Wall Street.

Sarepta Therapeutics Inc

Shares of Sarepta soared more than 30% in pre-market yesterday up to $20.99 after the FDA requested additional information on eteplirsen, or PROMOVI, the company’s experimental drug for Duchenne’s muscular dystrophy, or DMD. Ritu Baral of Cowen & Co. weighs in on the company following this news.

Baral notes that this news comes on the heels of a negative Advisory Committee meeting. Although the FDA does not have to follow the recommendation of the AdComm, it often does. The FDA requested the additional data to complete the New Drug Application review for PROMOVI, which the analyst estimates will take about 4 weeks to submit.

The analyst explains that this development does demonstrate a potential route forward for the drug, but also entails some clinical risk. She explains the route forward, commenting, “The FDA request for additional dystrophin data and not 6 Minute Walk Time data (6MWT) or any other functional endpoint data suggests the agency is likely open to an eteplirsen approval on Subpart H accelerated approval.” A mutation in the gene for dystrophin is the underlying cause for DMD, and the analyst believes this benchmark will be more favorable for the drug. However, the risk remains that PROMOVI data is based on a small number of just 13 patients.

Looking forward, Baral expects the company to “issue a press release upon data submission to FDA, whether the data are negative or positive given the materiality of the dataset.” From there, the FDA should make a final decision on the drug within several weeks.

Following this news, Baral remains on the sidelines of the company, reiterating a Market Perform rating without a price target.

According to TipRanks, 36% of analysts are bullish on Sarepta, 36% are bearish, and 28% are natural. The average 12-month price target is $21 marking a 30% potential upside from where shares last closed.

Analysts Weigh In on Internet Giants: Netflix, Inc. (NFLX) and LinkedIn Corp (LNKD)

By Sarah Roden

Are internet giants here to stay? Analysts weigh in on Netflix, Inc. (NASDAQ:NFLX) and LinkedIn Corp (NYSE:LNKD) to address lingering concerns for both companies. While one analyst remains bullish on Netflix’s longevity and growth potential, another is beginning to worry about LinkedIn’s long-term prospects.

Netflix, Inc.

While video-streaming giant Netflix has fallen out of the headlines for some time, analyst Benjamin Swinburne of Morgan Stanley highlights the company’s international growth and long-term potential. He reiterates an Overweight rating on Netflix with a $125 price target, marking a 25% upside.

Swinburne is bullish on Netflix’s international growth opportunities. He believes that Netflix can build an international subscriber base of 100 million people, excluding China. While he acknowledges a “real concern” following the company’s 2Q16 subscriber additional guidance in which the company forecasted 500,00 new domestic subscribers and a 2 million new international subscribers gain, falling short of expectations of 586,000 and 3.5 million, respectively. This guidance is leading some to believe that Netflix has “hit a wall.” Swinburne debunks this concern, explaining that “in all markets three years or older, [Netflix] has reached well above double-digit penetration and is generating profits.” Second, he continues, “Netflix has accomplished this in markets that range widely in terms of pay-TV penetration, native language, and household income levels.”

Moving on to Netflix’s long-term viability, Swinburne points out that the company is re-investing price increases into “content spending to build long-term scale,” which is the “right strategy.” He explains, “2Q guidance for QoQ margin compression in the US has led to concerns that the operating leverage inherent in Netflix’s model is not as rosy as previously expected… However, with domestic ARPU growth poised to accelerate as more grandfathered pricing expires in 3Q16, we expect gross profit per sub growth and gross margin expansion to re-accelerate in 2H16 and beyond.”

According to TipRanks, Swinburne has a 63% success rate recommending stocks with an average annual return of +10.9%. He is ranked in the top 10% of all analysts on Wall Street. Out of the analysts who have covered Netflix in the last 3 months, 64% are bullish, 28% are neutral, and 8% are bearish. The average 12-month price target is $120.52, marking a 20% potential upside.

LinkedIn Corp

LinkedIn is facing falling job postings, leading Rob Sanderson of MKM Partners to sternly address the company’s viability. The analyst hashes out his concerns, which range from decreasing online job postings to accounting practices.

The analyst explains that after “73 consecutive months of y/y growth, online jobs postings have been in decline since February.” May in particular was the worst month “by far” since January 2009, with online job postings down by 285k from April and down 552k year-over-year. While online job postings is not a direct revenue driver for the company, “it is a reflection of overall hiring activity and should be considered a check on demand vibrancy.” Aside from online job postings, Sanderson remains concerned that further “deterioration” of the company’s Talent Solutions and Hiring segments could lead to a shortfall in revenue in the second half of the year.

Sanderson goes on to comment that LinkedIn’s growing focus on GAAP over non-GAAP will be negative for the company. He explains, “A growing focus for several months, this has likely weighed on LNKD shares to some degree… We prefer non-GAAP and factor dilution for stock awards into our share count in our long-term earnings analysis. While we are comfortable with the dilutive impact on EPS power, LNKD does not screen well in the GAAP vs. non-GAAP debate.”

Sanderson reiterates a Neutral rating on the stock with a $130 price target, noting that he likes the company’s “long-term prospects” but believes “sentiment on the company’s opportunity is overly negative.” He concludes, “We would wait for clarity on Hiring revenue exposure to macro/cyclical factors, or a break-out in either Learning or Sales before potentially recommending the stock.”

According to TipRanks, 48% of analysts are bullish on LinkedIn while 52% are neutral. The average 12-month price target is $160.85, marking an 18% potential upside from current levels.